2018-6-15 17:16 |

Yet further concerns surrounding the impact of Tether (USDT) and Bitcoin (BTC) futures on the leading cryptocurrency’s fortunes were raised on CNBC, Wednesday June 13th.

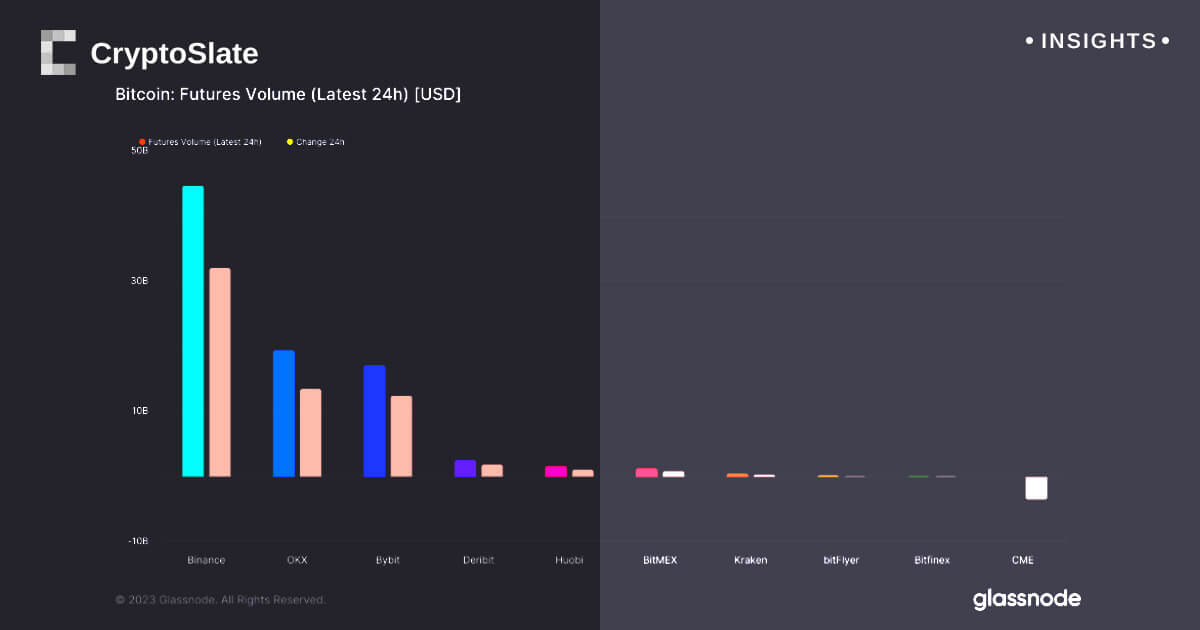

As CNBC notes, Bitcoin futures have sunk 55 percent this year, reaching their lowest levels since February.

Stutland proposed a different explanation for Bitcoin’s declining fortunes in 2018, saying that low volatility in the stock markets the coming quarter mean that “people would rather be invested in the stock markets” than Bitcoin.

If Tether is the only reason that Bitcoin is at $6,000, then I think we’ll see it down much more than the 3 percent it’s down right now.

3 percent would be a victory, I’d expect it to be down [by] 10.” Just yesterday, Fundstrat’s Tom Lee, similarly attributed the recent “gut wrenching” price weakness of Bitcoin to futures contract expirations.

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|