2024-3-29 17:31 |

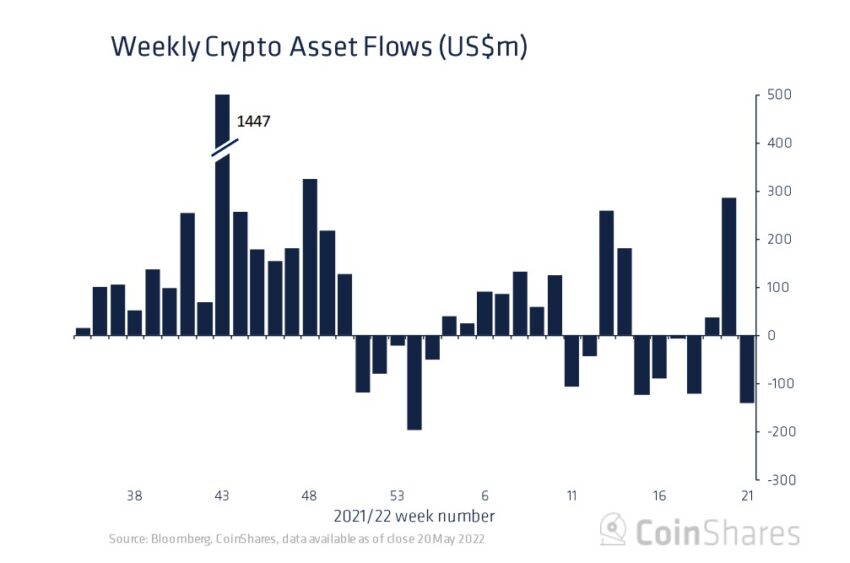

Bitcoin ETFs saw a remarkable $418 million net inflow this week, reversing last week's outflows and signaling renewed institutional confidence after Fidelity led the charge. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|