2024-3-24 10:25 |

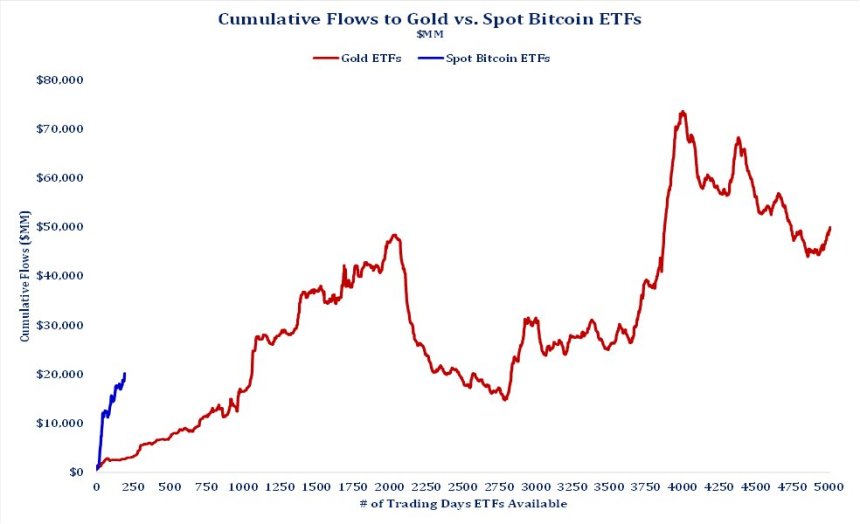

In line with the decline in Bitcoin’s price, the spot Bitcoin ETF market has appeared rather gloomy in recent days. According to data from analytics firm BitMEX Research, these BTC ETFs have recorded a negative netflow for the last four trading sessions.

This situation has been marked by large levels of Grayscale’s GBTC outflows and the record low inflows for the other ETFs, mainly the market leaders BlackRock’s IBIT and Fidelity’s FBTC. However, amidst these persistent declining netflows, Ki Young Ju, a prominent analyst and Chief Executive Officer at Cryptoquant, has predicted a possible resurgence in the spot Bitcoin ETF market.

Analyst Pinpoints $56,000 Level As Critical To Bitcoin ETF RecoveryIn a post on X on March 22, Ki Young Ju shared that a rise in spot Bitcoin ETFs netflows could occur even as the BTC price decline continues. Using data from the historical netflow trends, the analyst noted that demand for Bitcoin ETFs usually kicks in when the cryptocurrency traces to certain support levels.

Young Ju stated that, in particular, new BTC whales, especially ETF buyers, have shown to have a $56,000 on-chain cost basis. This suggests that the new significant holders of Bitcoin, particularly those invested in ETFs, usually purchased Bitcoin at an average price of $56,000. Following this trend, the crypto quant boss believes the spot Bitcoin ETF market could experience massive inflows if BTC reached the specified price level.

#Bitcoin spot ETF netflows are slowing.

Demand may rebound if the $BTC price approaches critical support levels.

New whales, mainly ETF buyers, have a $56K on-chain cost basis. Corrections typically entail a max drawdown of around 30% in bull markets, with a max pain of $51K. pic.twitter.com/vZCG4F0Gh5

— Ki Young Ju (@ki_young_ju) March 22, 2024

For now, Bitcoin’s price has oscillated between $62,000 and $68,000, as seen in the last week. However, Young Ju believes that such a descent is quite feasible as price corrections usually see a maximum decline of 30%. Using BTC’s most recent high of $73,750, the analyst predicts the asset price could still trade as low as $51,000.

BTC Price OverviewAt press time, Bitcoin continues to trade at $64,065.74, representing a decline of 3.73% and 7.17% in the last one and seven days. Meanwhile, the asset’s daily trading volume is down 3.53% and valued at $39.62 billion.

Following historical trends of the bull cycle, it is possible that BTC may have reached its price peak leading up to the halving event in April. If that is the case, Bitcoin may likely not return to previous high price levels soon and could experience further price drops in the coming weeks.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|