2024-10-1 18:11 |

Bitcoin and cryptocurrency stocks retreated on the final trading day of September, following a rally the previous week.

Despite the pullback, the crypto market remains on track to post a positive month, with Bitcoin leading the way.

This comes as investors brace for economic uncertainty, including potential strikes across key US ports and overbought conditions in the crypto market.

As September historically marks one of Bitcoin’s weakest months, the positive performance reflects changing dynamics in the market, fueled by factors like China’s policy reversal and growing institutional interest in crypto ETFs.

Bitcoin is down 3% but holds monthly gainsBitcoin was last down 3%, trading at $63,612.63, following a brief reclaiming of the $65,000 level earlier in the week, according to Coin Metrics.

The flagship cryptocurrency has experienced a volatile month but is on track to finish its strongest September in history, up 8%.

This is only the second positive September for Bitcoin in a row, marking a significant shift from its historically weak performance in this period.

Crypto-related stocks also faced declines. Coinbase, a major cryptocurrency exchange, dropped 3% in premarket trading, while MicroStrategy, which holds significant Bitcoin reserves, slid 5%.

Despite these losses, both companies had impressive performances earlier in the month, with Coinbase up 4% for September and MicroStrategy boasting a 33% gain over the same period.

The selloff comes as analysts warn of overbought conditions and possible market corrections heading into the final quarter of the year.

Source: CNBC

Bitcoin ETFs see inflows amid Chinese policy shiftNet inflows into global crypto exchange-traded products (ETPs) accelerated to their highest level since mid-July, driven by institutional interest and policy shifts in major economies.

The combined net buying volume of US Bitcoin ETFs last week totaled 16,774 BTC, surpassing the typical one-month supply of newly mined Bitcoin (13,500).

This surge was largely attributed to the policy reversal by the People’s Bank of China, which has spurred renewed interest in digital assets despite previous crackdowns.

September’s positive performance is setting the stage for what is expected to be a strong quarter for cryptocurrencies.

Historically, the fourth quarter has been favorable for risk assets, and many analysts anticipate that this trend will extend to Bitcoin and other cryptocurrencies.

Investors are looking for further clarity on market trends, including potential interest rate cuts and the results of the upcoming US presidential election, which could significantly impact investor behavior.

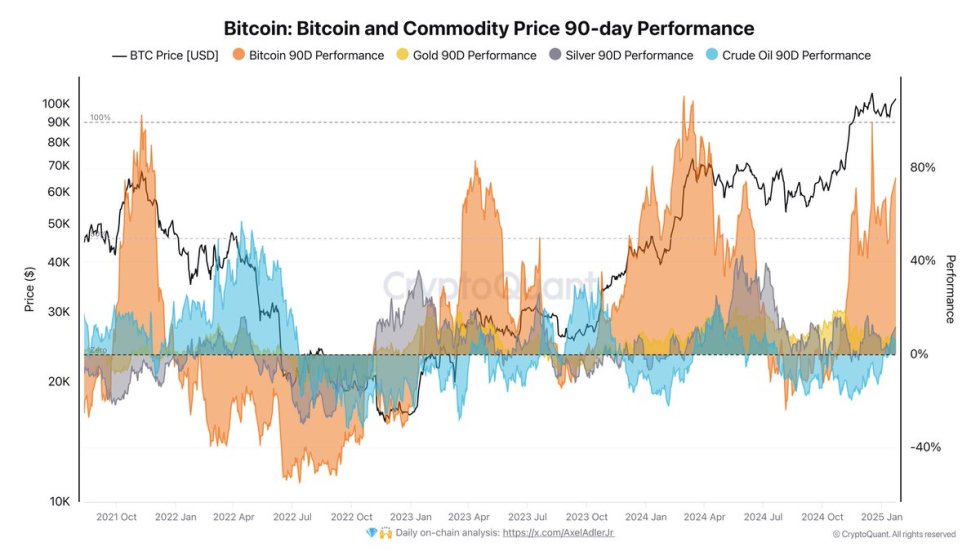

Bitcoin, a store of value or a risk asset?The narrative around Bitcoin’s role in the financial ecosystem remains debated.

While some investors see it as a store of value, others view it as a risky asset.

Currently, its correlation with the S&P 500 is higher than with gold, suggesting that Bitcoin is more aligned with traditional risk assets than with safe-haven commodities.

This could influence how investors approach Bitcoin, particularly in light of expected market shifts in the coming months.

As the crypto market heads into the fourth quarter, expectations remain positive despite the potential for economic headwinds, such as US port strikes and overbought conditions.

Analysts are closely watching how these factors may impact Bitcoin and crypto-related stocks, but the general sentiment is that the market is well-positioned to continue its growth in the coming months.

Investors are particularly focused on the potential for further institutional adoption of Bitcoin ETFs, which could drive significant inflows into the market.

The post Bitcoin, crypto stocks retreat following last week's surge, but September remains positive appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|