2021-10-28 22:00 |

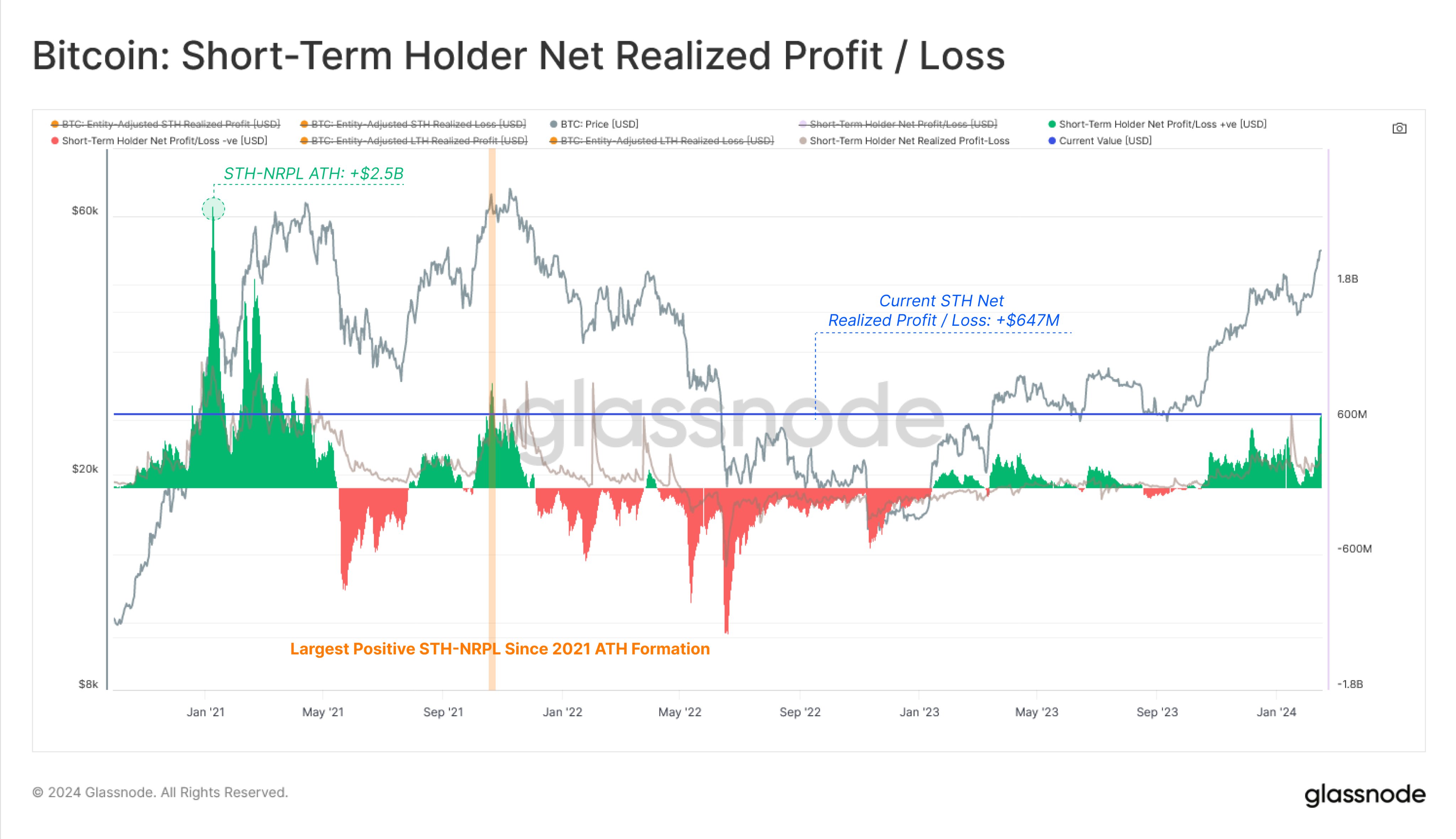

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event.

On-Chain Data Shows Bitcoin Short-Term Holders Are Taking ProfitsAs pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to be the cause of the crypto’s latest crash to $58k.

The relevant indicator here is the SOPR or the “Spent Output Profit Ratio” that shows the total amount of profits or losses that the overall Bitcoin market is reaping right now.

The metric judges so by taking the ratio between the price a coin was bought for and what it was sold at. Values higher than one suggest investors are selling, on average, at some profit.

For short-term holders, the indicator is modified to include only those coins that were held for less than 155 days before being sold. This new metric is called the short-term holder SOPR (or the STH-SOPR in short).

The below chart shows the trend in the value of the Bitcoin STH-SOPR over the past couple of weeks.

It looks like short-term holders have started realizing their profits recently | Source: CryptoQuantAs the above graph shows, the indicator has started showing many positive spikes recently. And today there were two large spikes, following which the price of Bitcoin crashed to $58k.

Related Reading | Breaking: U.S. Regulators Exploring How To Allow Banks To Hold Bitcoin

Here is another chart, this time for the spot exchange inflow, which shows the total amount of BTC flowing into spot exchange wallets:

The indicator's value shows a large spike in the last few hours | Source: CryptoQuantAs the above graph shows, the spot exchange inflow also observed a large spike before the crash, showing that some investors dumped a big amount of Bitcoin at that time.

Related Reading | This Bitcoin Meme Elon Musk Reposted Sold As An NFT For Almost $20k In WETH

The analyst in the post thinks that the short-term holders taking profits and this large inflow to spot exchanges (which may or may not be due to STH) could be a signal of the first major profit taking in the market in a long time. This may mean that this dip could turn out to be a good buying opportunity.

BTC PriceAt the time of writing, Bitcoin’s price floats around $58.9k, down 11% in the last seven days. Over the past month, the crypto has gained 36% in value.

The below chart shows the trend in the price of the coin over the last five days.

BTC's price crashes down to $58k, but has since rebounded back above a little | Source: BTCUSD on TradingView Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com origin »Bitcoin price in Telegram @btc_price_every_hour

Theresa May Coin (MAY) на Currencies.ru

|

|