2020-3-20 16:50 |

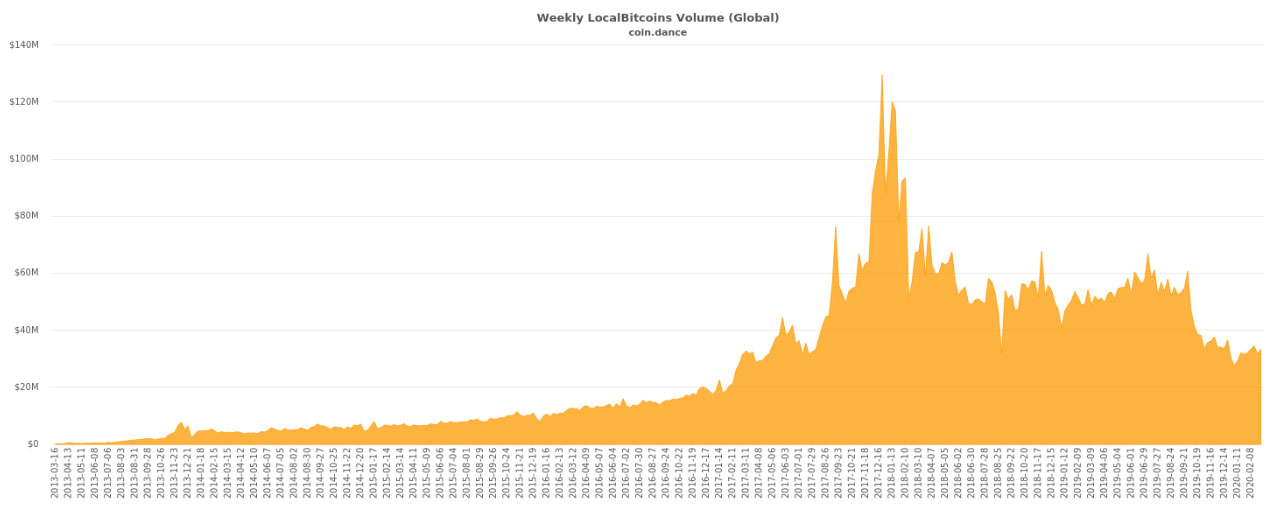

Bitcoin is having a great time, surging as high as $7,139, up 14% so far. What's even more interesting is the extremely high volume, crossing $3 billion for the first time on top ten exchanges with real volume, as per Messari.

The Dow Jones futures also rose 2.35% on Monday morning along with S&P 500 futures, up 1.9%, and Nasdaq 100 futures that climbed 3.5% after briefly hitting 5% “limit up” halt, suggesting a stock market rally.

Gold and BTC have been hinting at decoupling from the S&P 500 for the past few days, which Woo said could mean that gold is forming a double bottom while BTC forming an accumulation pattern.

However, this rally is nowhere near the percentage needed bitcoin to recover from last week's Black Thursday losses. Bitcoin might have started decoupling from traditional markets, but on-chain analyst Willy Woo says the next key event would be the confirmation of decoupling. Bitcoin’s unexpected move up is not agreed upon by everyone as Woo said,

“I don't expect a V-shaped bottom, I think there will be time, an accumulation range before moving up.”

So, it’s to be seen if the world’s leading cryptocurrency would keep the gains or drop back down. What’s positive is a bunch of charts which are bullish. BTC 0.73

To start with, the bitcoin miner energy ratio is making a “strong rebound,” meaning lots of energy is being pumped into the network which is bullish.

The difficulty ribbon is also expanding after a time of compression which the analyst said is generally seen as bullish. Although it is still too early, it definitely reinforces that the mining behind bitcoin is solid and the network is strong,” said Woo.

Spent Output Profit Ratio (SOPR) is also painting a bullish picture. The on-chain net position of investors is recovering and rekt investors are out.

SOPR has taken a nosedive below 1 which means the owners of the spent outputs are in profit at the time of the transactions.

Another one in this list of bullish charts is the on-chain RSI. The relative strength index is a momentum indicator that evaluates overbought or oversold conditions in the price of an asset.

About the current levels, the trader said, “Nobody went broke buying BTC at these levels of on-chain RSI. (If you are in it for the long game).”

Another non-technical indicator is the bitcoin ATMs, which have been continuing its upward ascent, reaching 7,242. In 2020, to date, the crypto ATMs have grown over 14%.

In the past two days, bitcoin has made a strong move, up more than 10% each day. The last time bitcoin had two straight daily closes over 10% was in early December 2017, during the bull run.

Now, bitcoin needs to maintain its gains before it could make its way to new highs.

Bitcoin (BTC) Live Price 1 BTC/USD =$6,224.5447 change ~ 0.73%Coin Market Cap

$113.78 Billion24 Hour Volume

$12.43 Billion24 Hour VWAP

$6.48 K24 Hour Change

$45.6192 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|