2024-12-12 19:30 |

It has been a whirlwind. Bitcoin surpassing $100,000 may have been the champagne moment, but the digital asset class has had much to cheer about and digest since the Fed’s easing cycle began on September 18, and even more since the U.S. election.

New incoming leadership at the SEC and other regulatory agencies, blockchain-savvy cabinet appointees, a new “AI and Crypto Czar,” and frequent mentions of bitcoin and crypto by the President-elect all point towards more support for the industry from the U.S. government.

You're reading<a href="https://www.coindesk.com/newsletters/crypto-long-short/" target="_blank"> Crypto Long & Short</a>, our weekly newsletter featuring insights, news and analysis for the professional investor. <a href="https://www.coindesk.com/newsletters/crypto-long-short/" target="_blank">Sign up here</a> to get it in your inbox every Wednesday.

The availability and early success of bitcoin ETF and ETF index options offer risk management tools that individuals and institutions can access through brokerage accounts. This not only invites investors with more sophisticated risk management needs, but also provides another venue for bitcoin liquidity.

Record spot and derivatives volumes on digital asset exchanges, topping $10 trillion in November, remind us that it’s not all about U.S. ETF inflows and outflows — there are giant crypto global markets out there and they like what they see.

Medium- and long-term optimism may be well-placed here, given the tailwinds of regulatory expectations (better, stronger, easier to navigate), the macroeconomic state (an easing cycle, but with the possibility of inflation), industry health (oceans of talent, global competition, a hiccup-free 2024), and green shoots of institutional adoption (over $100 billion in bitcoin and ether ETFs, MSTR’s balance sheet).

While timing — whether in markets, regulation or macro — is never easy, here are a few predictions for the months and quarters ahead in digital assets.

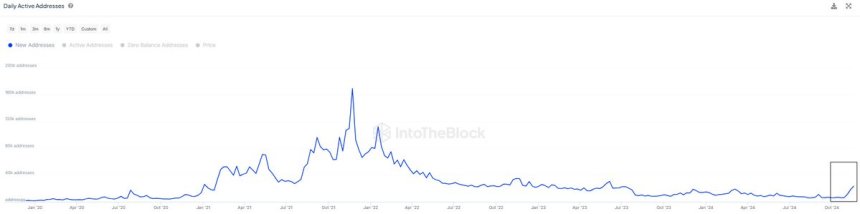

Prediction 1: bitcoin adoption momentum will persistAmong digital assets, bitcoin's regulatory support is the most "complete" today. In the United States, you can get exposure to bitcoin natively or via futures, ETFs, asset management products, or options. Bitcoin stands to gain the least from more prescriptive digital asset regulation in the U.S. However, bitcoin's adoption momentum is strong, with plenty of room to run. With a fixed ultimate supply of 21 million bitcoins, a known and hard-coded "monetary policy," and a better-understood narrative and context for investment allocation, we expect more integration of bitcoin into individual, advised, and institutional portfolios. Adoption momentum will be bitcoin’s long-term price driver, with macro factors affecting short- and medium-term fluctuations. Every time we see a bitcoin-skeptical article, we know that adoption momentum will persist.

Prediction 2: lower bitcoin volatility lies aheadThe growing population of bitcoin holders and the broader array of financial instruments to provide exposure to bitcoin's price will continue to dampen bitcoin's volatility, bringing it closer, on average, to equities (or, at least some equities). Options on bitcoin ETFs in the U.S. will permit more sophisticated and accessible risk management strategies. This has two implications. First, investors with institutional-grade risk management requirements — and steadier hands — may be able to own bitcoin given the availability of options. Second, investors may use the protection properties of options to avoid selling positions in a weak market, which would otherwise exacerbate drawdowns. We also believe retail investors will sell bitcoin call options against long ETF positions, a yield strategy permitted in retirement accounts, which will depress options prices and volatility.

Prediction 3: greater sustained breadth will spotlight the “5%-er conundrum”In the month since the U.S. election, the broad-based CoinDesk 20 Index nearly doubled, outpacing bitcoin's strong performance. The CD20/bitcoin ratio also rose sharply, reversing Ethereum and other blockchain assets sprang to life on the promise of more dedicated and usable digital asset regulation in the U.S. with the incoming administration in 2025. We expect this to continue, with CD20's exposure to top digital assets reflecting the growth-side of crypto alongside that of bitcoin’s “store of value” appeal.

This presents a conundrum for “5%-ers,” those investors who want to allocate to digital assets (beyond bitcoin) but won’t have the time to become experts in sectors, pick names, or think about timing. In traditional asset classes, this is a classic application of indexing to provide access, diversification, and automatic rebalancing. We predict (and hope!) that regulatory authorities will permit investors to avail themselves of these benefits in easy-to-access wrappers.

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralize Currency Assets (DCA) на Currencies.ru

|

|