2024-11-4 02:00 |

Bitcoin (BTC) crashed below $69,000 on Sunday resulting in significant levels of market liquidations. Interestingly, analysts have also noted a correlation of this decline with a decrease in the winning odds of US Republican presidential candidate Donald Trump ahead of the general elections on November 5.

Bitcoin Price Fall Induces $232.6 Million In LiquidationsIn the last few days, Bitcoin has witnessed some significant price re-correction following a prolonged price rally in October during which it gained by 20%. The price of the premier cryptocurrency initially dropped from above $73,000 on Friday finding support around the $69,000 region.

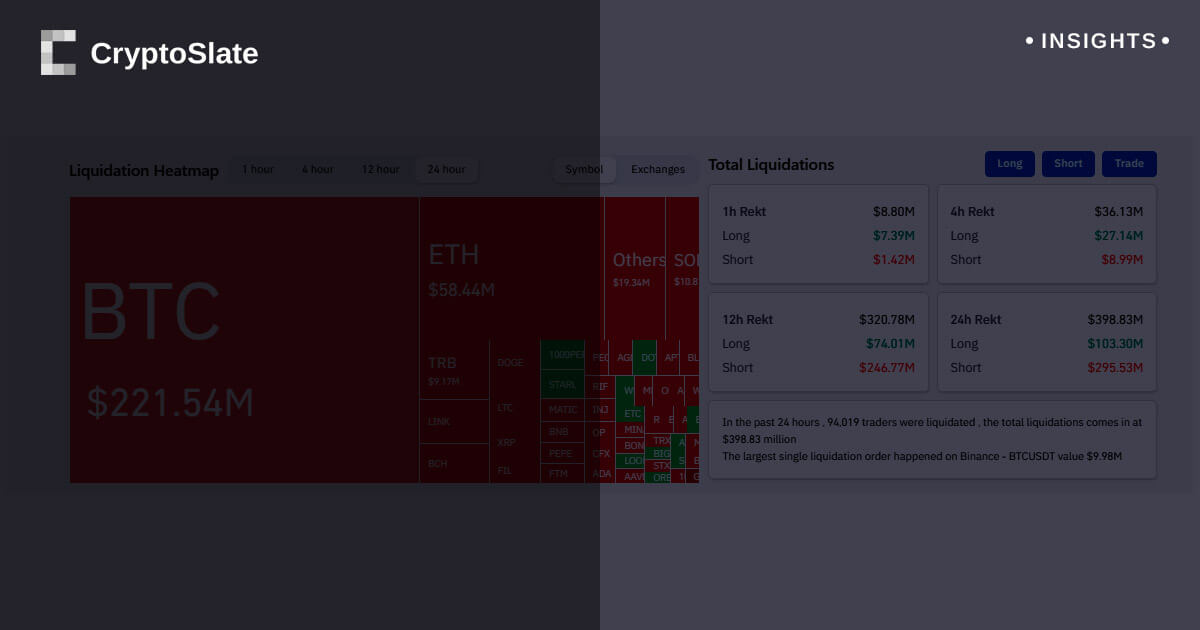

Following a a brief period of sideways movement, BTC experienced another significant decline on Sunday reaching a local bottom of $67,960. Amidst this price drop, crypto analyst Ali Martinez noted that the 104,787 trading positions were liquidated resulting in a loss of $232.6 million.

Data shared by Martinez showed that long traders accounted for majority of these figures with $198.6 million in liquidations while only $34 million in short positions were closed. This development means that more traders had anticipated a rebound by the crypto market leader following its initial price pullback on Friday.

At the time of writing, Bitcoin has retraced to above $68,000 with little indication of its next price movement. If its current downtrend persists, the premier cryptocurrency could fall as low as $55,000 in line with a range-bound movement that has lasted over the past eight months.

Alternatively, Bitcoin could undergo a price recovery returning to levels within its all-time high at $73,750 value as bullish sentiments remain on the high amidst heightened ETF inflows, a fast-approaching US election, and an anticipated Fed rate cut of 25 basis points.

Is A Potential Trump Loss A Threat To Bitcoin?So far, Bitcoin’s decline on Sunday has found a correlation with a decrease in the winning probability of US presidential candidate and crypto activist Donald Trump. According to data from Polymarket, Trump’s chances of emerging victorious in the presidential elections on November 5 dropped by 4.3% after his opponent Democrat candidate and US Vice President Kamala Harris became the favorite to win in Pennsylvania.

Although the pro-crypto Donald Trump remains the forerunner to emerge president with a 53.8% to Harris’s 46.1%, recent price reactions by Bitcoin have shown a potential loss by the Republican could exert a significant price decline for the crypto market leader. Albeit, historical price data indicates that such a downturn would likely be temporary as Bitcoin has consistently embarked on a bullish trajectory following the US elections regardless of the result.

At the time of writing, BTC now trades at $68,471 reflecting a price loss of 1.38% in the past 24 hours. Meanwhile, the asset’s daily trading volume is down by 40.54% and valued at $24.40 billion.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|