2023-7-29 23:11 |

Bitcoin (BTC) continues to display a robust bullish outlook, with long-term holders demonstrating a notable absence of selling pressure.

On July 26, Ki Young Ju, the CEO of crypto data analysis firm CryptoQuant, took to X to share insights on BTC’s current market behaviour, reaffirming the ongoing bullish sentiment.

According to Ki Young Ju, approximately 71% of the realized capitalization of Bitcoin remained unmoved for over six months. This data indicates that long-term holders are not rushing to sell their BTC holdings, contributing to the reduced selling pressure in the market. While low selling pressure doesn’t guarantee an immediate price increase, he noted that it does suggest that BTC is less likely to be at its cyclic top, providing a positive sign for investors and enthusiasts alike.

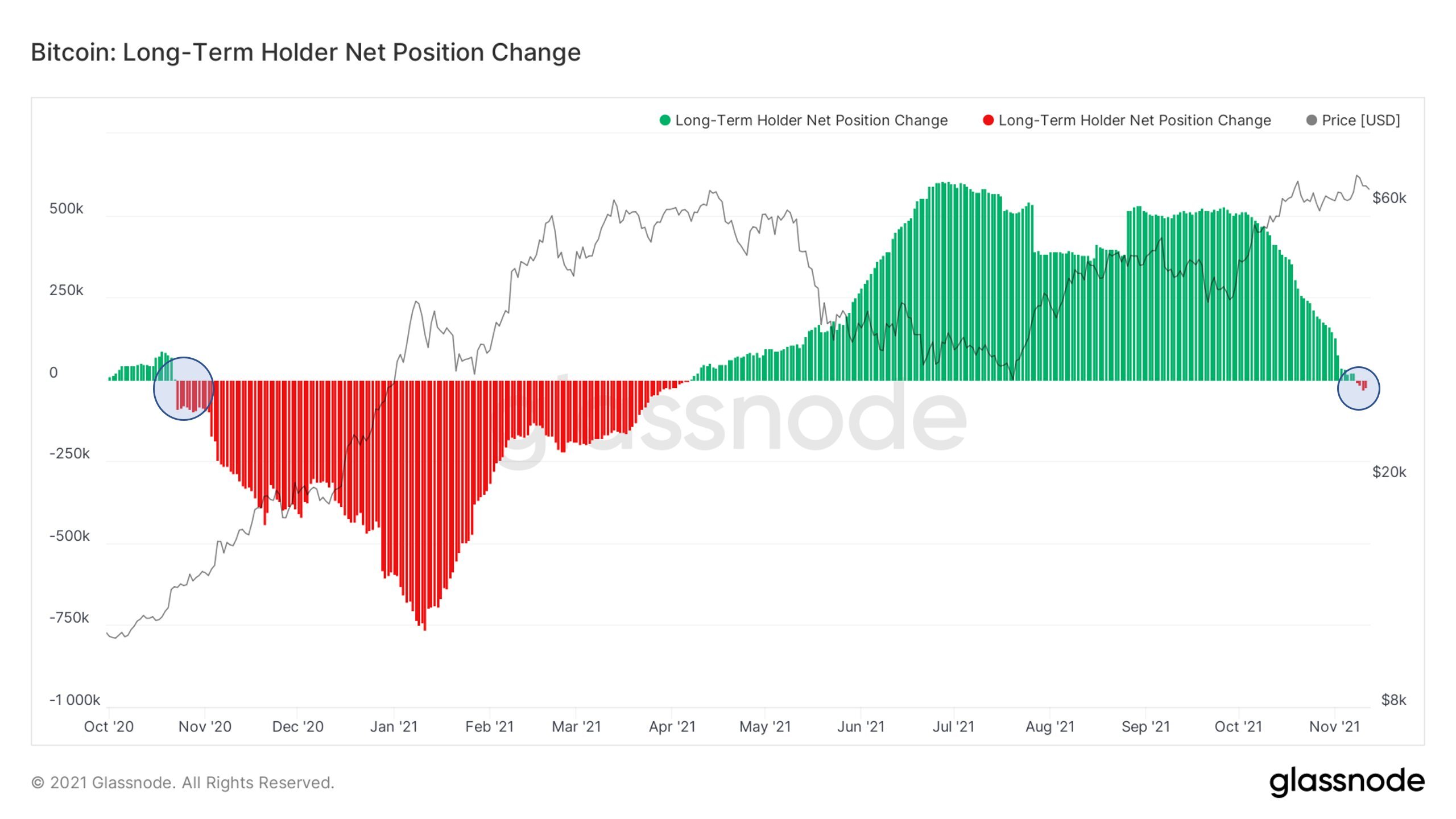

Young’s findings align with those of on-chain analysis firm Glassnode, which recently reported that the Bitcoin Long-Term Holder Supply had achieved a new all-time high of 14.52 million BTC, equivalent to 75% of the circulating supply. “This suggests HODLing is the preferred market dynamic amongst mature investors,” Glassnode wrote on July 24.

Notably, data by the firm shows that long-term holders, or addresses that hold coins for 155 days or more, currently control roughly three-quarters of the total bitcoin in circulation (19.43BTC).

Elsewhere, another analyst at Cryptoquant, “IT Tech”, has recently offered valuable input on BTC’s behaviour during bull and bear markets. On Monday, the pundit highlighted the Long Term Holder SOPR (SMA 30) metric, emphasizing the significance of “level 1” as a key indicator in distinguishing between the two market phases. According to him, in a bear market, level 1 (Circled in yellow) acts as resistance, while in a bull market, it transforms into solid support.

Historic data from 2016 and 2020 showed that after crossing and holding level 1, Bitcoin entered the early bull market phase. The one exception was the period between 2019 and 2020, marred by the black swan event. The 30 SMA has since moved above the level, signalling the early phases of a bull market.

Despite positive indicators, Bitcoin’s price remains just below $30,000, with the U.S. Federal Reserve’s upcoming decision on a 25-basis point rate increase creating market uncertainty. Last month the price attempted to push higher following numerous ETF applications led by BlackRock fueling hopes of institutional investments before falling back into the current range. Nevertheless, experts remain confident that the ongoing weakness will be shortlived, with analyst Plan B predicting massive institutional buying, which will further prop up Bitcoin’s price.

Bitcoin was trading at $29,358 at press time, reflecting a 0.26% growth in the past 24 hours.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|