2018-7-24 10:07 |

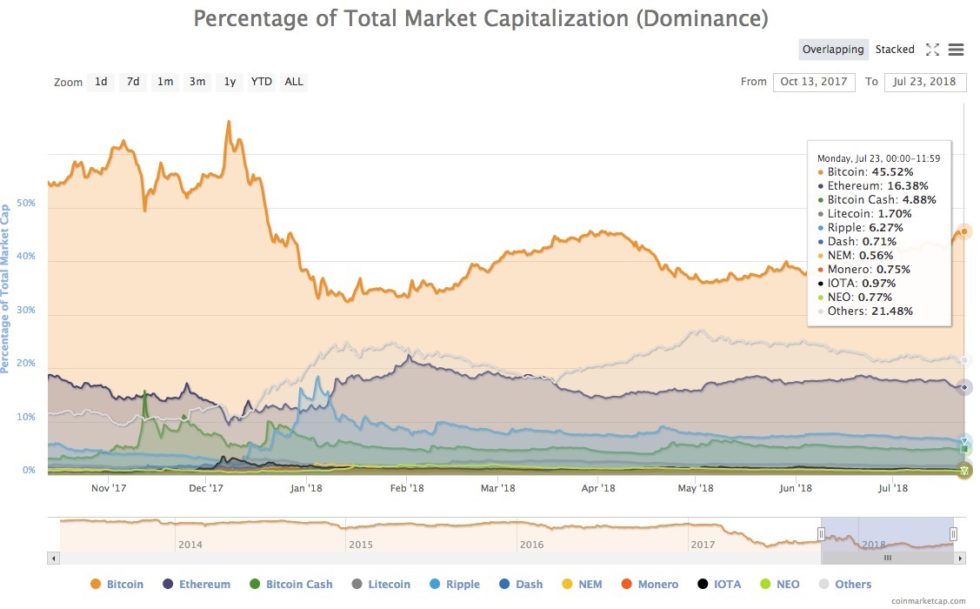

Bitcoin (BTC) Price breaks $8,000 for the first time in over 60 days as well as boasting a crypto market dominance share of over 47% according to CoinMarketCap.

The last time we saw Bitcoin's price above the $8,000 USD mark was back on May 21, 2018 in which it dropped all the way down to $5,904 on June 28, 2018. The (BTC) dominance has hit a 47% mark for the first time since December 2017.

This sudden spike is boosting investors’ confidence while Bitcoin’s recent bull run seems to be more than an ordinary fluke as many opinions and viewpoints are starting to echo the bigger picture – its real and more and more ‘sidelined money' is about to enter the mix as bitcoin's value and gateways are increasing by the day. Let's cover a few of the trending news stories and stats that might foretell the big bull run moment crypto enthuasists have been waiting for almost all year long.

Bitcoin's price has risen up over $1,205 in the past week, in which $300+ of that has come in the past day as many headlines continue to pour in from all over the world about advancements and innovation happening within the space. Of course, much of the focus is around the two big keywords of “Bitcoin ETF” and “Institutional Crypto Investors” coming into the fold despite many barriers for both of them still yet to be met and checkmarked.

While $8,000 price point is exciting, many might wonder about the Bitcoin dominance as it measures Bitcoin’s percentage of the total cryptocurrency market share by market capitalization. The controversial index has been trending upward for most of the year and is up over 10 percent since the beginning of the year. Of course, market cap is not everything, just ask popular Crypto twitter personality what they think on the matter:

Stop using #Bitcoin dominance as an indicator. As soon as people started with premines/tokens and (BTC) airdrops it became irrelevant. I can create a WP-token, create $1 trillion, sell 1 token for $1 on an exchange and I'm a trillionaire with WP being the dominant coin.

— WhalePanda (@WhalePanda) July 20, 2018

What is intriguing about Bitcoin's $8000 price increase and 47% market share is the fact of altcoins moving in the opposite direction which usually is not the case more often than not. This time around we have saw BTC value increase in the green while nearly all altcoins are in the red. Many crypto investors are speculating as to why this could be but most of them are saying to ditch the alt bags and buy up more bitcoin as the market cap for bitcoin has the most potential to rise the fastest compared to the digital tulip ICO bubble the market has experienced in 2018. The $292 Billion dollar market cap is a nice increase $45 billion dollar increase from just 10 days ago, giving the entire crypto evaluation higher than Visa.

The second most prevalent crypto, Ethereum is at a 16.10% market dominance, more than 30% lower than Bitcoin’s. The XRP token comes in third place for market dominance, with a further reduction in percentage from Ethereum’s to a measly 6.1%. Currently, over 69% of the market is dominated by these 3 coins.

Most other popular cryptocurrencies see a trading pair with Bitcoin. For example, XRP/BTC is a popular pairing, with the price being the amount of XRP in the current price of Bitcoin.

This results in Bitcoin leading the market, especially during bull and bear runs. Which is why the market dominance of Bitcoin will always be there unless alternative trading pair comes up.

Bitcoin has proved to be one of the most stable digital assets amid a massive 70 percent market-wide correction with many altcoins still struggling despite Bitcoin now showing signs of recovery.

It is the oldest blockchain with first mover advantage and impressive 99.99 percent uptime — but it’s also the most battle-tested and most immutable (with the highest hash rate) blockchain with the biggest network effect. Hence, it is no surprise that it inspires the most confidence among cryptocurrency investors.

Furthermore, there are plenty of other factors that are linked to BTC’s recent success including the launch of Coinbase’s custodial service and BlackRock’s recent interest in cryptocurrencies. The possible introduction of a Bitcoin ETF in August has also undoubtedly given a push to the ongoing bullish trend.

It is worth noting that Bitcoin’s dominance does not necessarily represent the current state of the crypto market. It is a purely quantitative metric and one that doesn’t accurately depict a market that is obsessed with novelty.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|