2018-10-12 18:29 |

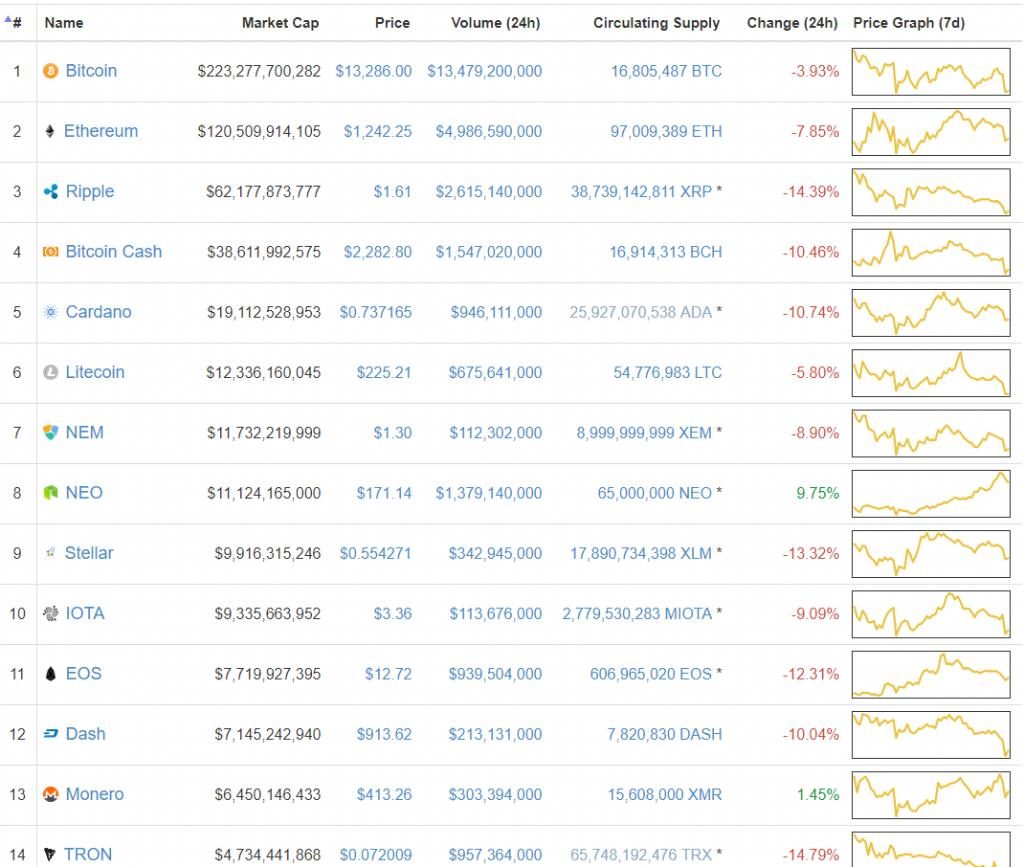

After the most recent drop we have seen in cryptocurrencies, the market capitalization is just about maintaining above $200 Billion. The market cap is currently at $201 Billion representing a 7% decline over the past seven days. This is around the same market cap as Mastercard.

This decline has brought the market capitalization of Bitcoin to a point where it represents 54% of the total market cap of all cryptocurrencies. With Bitcoin’s dominance increasing, the movements of altcoins are going to be even more dependent on the price action of Bitcoin.

Bitcoin Technical AnalysisThe key pattern which almost all traders have been monitoring has been the triangle pattern which has been forming since January. As price action approached the end of this pattern, there was a continuing consolidation for almost two weeks with Bitcoin’s price forming lower highs and higher lows, converging to the $6600 price.

RSI was trading and converging around 50 showing equal pressure from buyers and sellers. The MACD was trading flat showing no advantage in momentum to either buyers or sellers. The Average True Range (ATR), a measure of volatility recorded new 2018 lows almost every day for two weeks.

The price action looked as if it was about to trade outside of the triangle to the upside but a sharp drop kept it inside the triangle and even moved it below the bottom trendline. The drop was on significant volume, more than double the 20-period average daily volume. Volatility also spiked bringing an end to the consecutive lows.

$6250 has been a level of support for some while and may continue to act like one. However, if the price does not trade back inside the triangle, the bottom trendline may act as significant resistance and be the catalyst for an increase in sellers coming into the market.

Bitcoin Drops after Long Consolidation. Bitcoin Daily Chart – Source: Tradingview.com Ethereum Technical AnalysisEthereum mirrored the performance of Bitcoin while it was consolidating and also dropped sharply when the decline occurred. Ethereum continued to form lower highs and higher lows while the RSI traded close to 50 showing equal pressure from buyers and sellers in the lead up to the drop.

Ethereum underperformed when the drop occurred. While Bitcoin dropped from around $6660 to $6250, a 6% decline, Ethereum depreciated around 17% from $226 to $187. The drop marked the return of Ethereum to sub-$200 levels. The $200 level may act as a resistance point if Ethereum appreciates from here.

Ethereum Mirrors Bitcoin & Drops Sharply. Ethereum Daily Chart – Source: Tradingview.com XRP Technical AnalysisXRP had a huge spike in the build-up to the launch of the xRapid project. Since the spike, a bearish divergence has occurred between price and RSI providing an opportunity for traders to take short positions. The bearish divergence occurred when the price was around $0.58 and has been a profitable position to take with price reaching lows of near $0.38 in this weeks decline.

Price has since started to move back up and is currently trading around $0.43. However, it seems to be experiencing some resistance at the 50 EMA. The arrows on the below chart represent the lower lows which have been formed since the initial drop. A breaking of one of these may represent a fundamental shift in the market structure and be a good point for short positions to close. The MACD continues to converge to the centerline showing that for the moment, momentum remains with the sellers.

XRP Continues to Depreciate After Bearish Divergence. Ripple Daily Chart – Source: Tradingview.com EOS Technical AnalysisWhile most of the market was consolidating along with Bitcoin, EOS was slightly increasing forming small higher highs and higher lows. The RSI was also slowly increasing showing a gradual rise in buying pressure.

However, the decline also resulted in EOS recording a sharp decline. The dubbed Ethereum Killer underperformed Bitcoin along with the actual Ethereum. EOS declined around 14% from $5.9 to $5.05, an over 14% depreciation. It has since started to rise and is currently trading at $5.22. With this rise being on little volume showing small strength behind it, EOS remains strongly linked to the price action performance of Bitcoin. The MACD is diverging to the downside showing increasing seller momentum for the moment.

EOS Drops With Bitcoin Despite Steady Increase. EOS Daily Chart – Source: Tradingview.com ZRX Technical AnalysisThe major bullish news for an altcoin came in the form of a new listing on Coinbase Pro. Coinbase Pro which is highly selective in the assets it decides to list has launched 0x Project’s digital currency ZRX on the platform. ZRX has continued to appreciate despite the declines occurring across the cryptocurrency market. The price increased from $0.65 to $0.79 over the past seven days, a 17% increase. Price reached a high of $0.9 during the week.

The price of ZRX began to increase early in the week with many traders speculating that ZRX was going to be listed on Coinbase. Many of the ZRX key team were former Coinbase employees. The speculation heated up when ZRX appeared on Coinbase’s tax calculation tool. Known as the Coinbase effect, cryptocurrencies have historically appreciated upon listing on Coinbase. Being one of the most popular exchanges and a starting point for most beginners, being listed on Coinbase opens up key new fiat currency routes for the coins that it lists.

ZRX Appreciates After Listing On Coinbase. ZRX Daily Chart – Source: Tradingview.com DISCLAIMER: Investing or trading in digital assets, such as those featured here, is extremely speculative and carries substantial risk. This analysis should not be considered investment advice, use it for informational purposes only. Historical performance of the assets discussed is not indicative of future performance. Statements, analysis, and information on blokt and associated or linked sites do not necessarily match the opinion of blokt. This analysis should not be interpreted as advice to buy, sell or hold and should not be taken as an endorsement or recommendation of a particular asset.Bitcoin [BTC], Ethereum [ETH], Ripple [XRP], EOS [EOS], & 0x Project [ZRX] Price Analysis – Bitcoin’s Bearish Break; Altcoins Follow was originally found on [blokt] - Blockchain, Bitcoin & Cryptocurrency News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|