2024-12-24 15:30 |

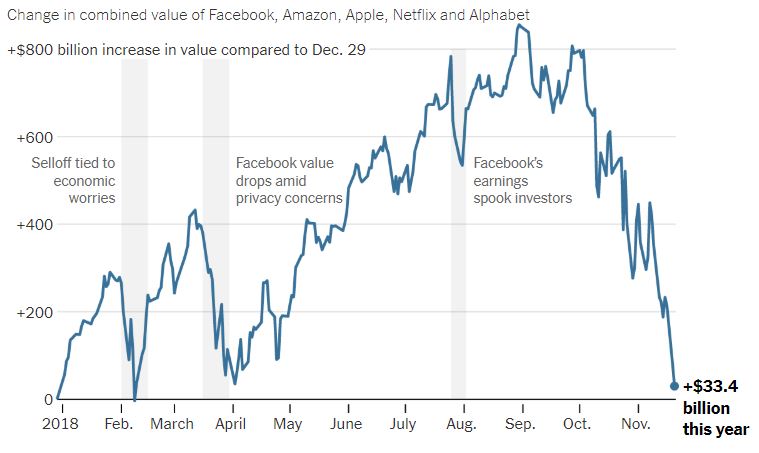

The crypto industry is buzzing with momentum, and 2025 promises seismic changes. After Bitcoin crossed $100,000 in 2024, digital assets surged to mainstream recognition. Major milestones like the debut of Bitcoin and Ethereum ETFs and global stablecoin adoption bolstered this evolution. Meanwhile, a victorious U.S. presidential campaign underscored its pro-Bitcoin stance, marking a new era for the sector.

Currently standing at a $200 billion supply, stablecoins could double by next year, surpassing $400 billion, according to DefiLlama.

Source: DefiLlama

Bitcoin’s rise as a financial cornerstone may soon extend to national reserves. The U.S. proposal for a Strategic Bitcoin Reserve sparked debates, hinting at a global domino effect. Countries eyeing Bitcoin’s finite supply and store-of-value capabilities could diversify their reserves to include digital gold, reshaping the international financial system.

Bitcoin ETFs Launch Draw $109B in YearIn 2024, the launch of Bitcoin ETFs made history. Drawing over $109 billion in assets within a year, according to SoSoValue. These funds opened the doors for institutional and retail investors alike. BlackRock, Fidelity, and Ark Invest championed these financial products, paving the way for broader crypto-focused ETFs. Following Bitcoin’s lead, Ethereum ETFs hit the market and are expected to integrate staking by 2025, offering users additional incentives through staking rewards.

Source: SoSoValue

Innovative ETFs featuring assets like Solana could soon emerge, showcasing crypto’s expanding reach. Diversified index ETFs may also take center stage, combining top-performing assets like Bitcoin, Ethereum, and newer players into balanced portfolios. These advancements promise to make crypto investing more accessible to the mainstream audience, driving the industry’s market cap beyond $8 trillion.

This expected surge mirrors 2024’s explosive growth, where crypto’s market cap reached $3.8 trillion. The continued influx of developer talent is predicted to foster transformative decentralized applications (dApps) in finance, artificial intelligence, and beyond. These innovations could revolutionize industries while onboarding millions of users into the crypto economy.

Bitcoin DeFi Ecosystem Set for 2025 BoomBitcoin is no longer confined to being a digital store of value. In 2024, advancements like the Nakamoto Upgrade on Stacks unlocked Bitcoin’s DeFi potential. Decentralized finance applications enabled trustless lending, staking, and other financial activities anchored to Bitcoin’s security. By 2025, the value locked in Bitcoin’s DeFi ecosystem may outstrip the $24 billion currently represented by wrapped Bitcoin derivatives TVL of 14.14 billion.

Source: Dune

Layer 2 networks are driving this evolution, mitigating risks tied to centralized custodians and allowing Bitcoin to integrate into DeFi natively. Such growth underscores Bitcoin’s pivotal role in the decentralized financial world, carving out new opportunities for adoption.

Additionally, one of the Magnificent Seven—the tech giants with over $600 billion in reserves—may soon include Bitcoin on its balance sheet. Tesla’s pioneering move set a precedent, but updated accounting rules effective from late 2024 make crypto holdings even more appealing. These rules allow real-time reporting of gains, aligning with corporate needs for accurate valuation.

Stablecoins Transforming Global PaymentsStablecoins are emerging as unsung heroes of the financial world. Their seamless integration into remittance systems and everyday transactions showcases their potential to revolutionize payments. By offering stability through U.S. dollar backing, stablecoins have become lifelines for users in economically unstable regions. Their trajectory points toward unprecedented growth with regulatory clarity likely on the horizon.

Simultaneously, discussions around Strategic Bitcoin Reserves are gaining traction. Countries are beginning to recognize Bitcoin’s value as a hedge against economic uncertainty. This could lead to nations diversifying reserves with Bitcoin alongside gold and foreign currencies, redefining global wealth management paradigms.

Regulatory clarity is ushering a crypto renaissance in the U.S. Gary Gensler’s contentious tenure as SEC Chairman concludes in January 2025, with Paul Atkins poised to take over. Atkins’ pro-crypto stance marks a stark departure, promoting innovation-friendly policies and restoring fairness for startups. The end of Operation Chokepoint 2.0, which stifled access to banking infrastructure, sets the stage for crypto startups to flourish once more.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|