2019-7-2 11:39 |

Binance to Launch Futures

In a recent keynote, Binance chief executive Changpeng “CZ” Zhao unveiled a surprising tidbit of news. Speaking to the crowd at the Asia Blockchain Summit in Taipei, which is soon expected to see a monumental debate between BitMEX’s Arthur Hayes and staunch Bitcoin critic Nouriel Roubini, the exchange head revealed that his firm would soon be launching cryptocurrency futures. A slide from Zhao’s keynote can be seen below.

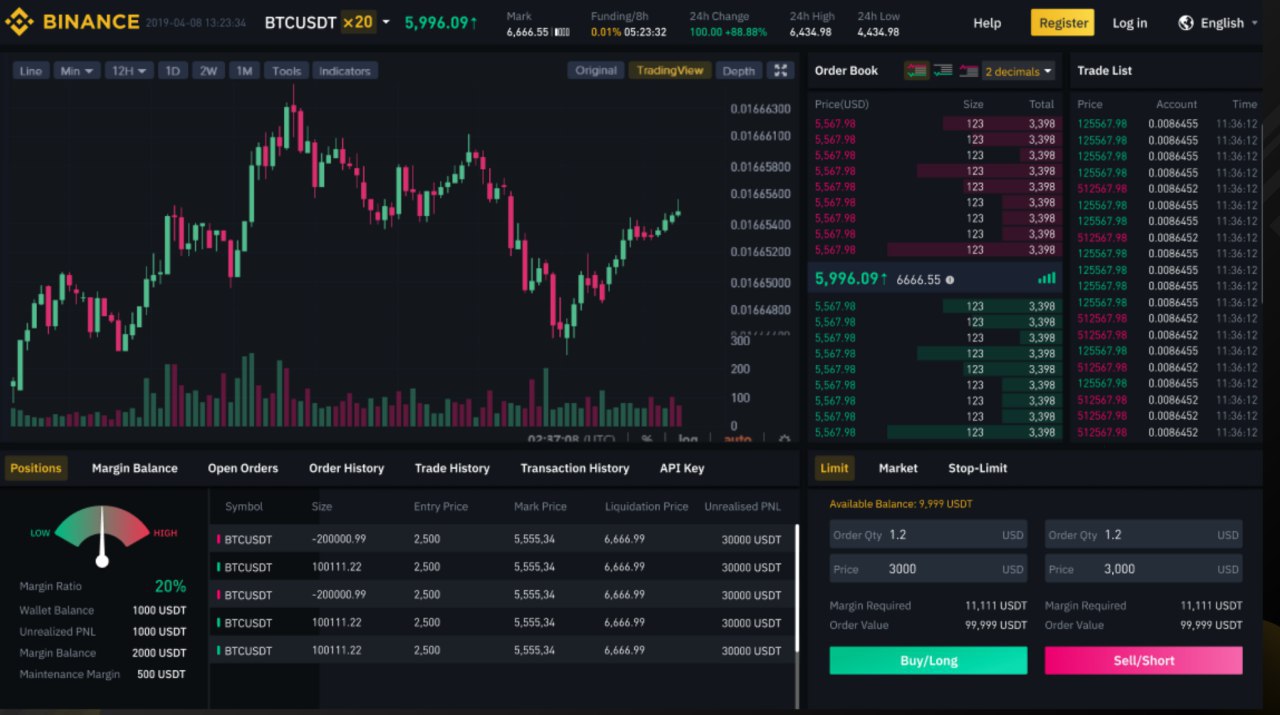

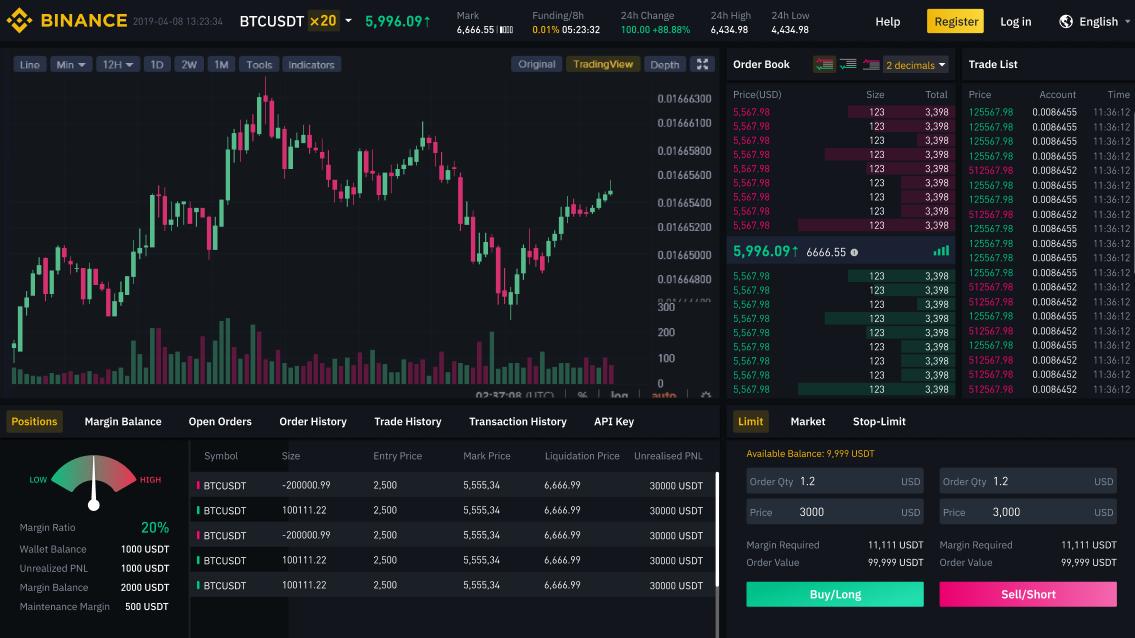

The slide shows a preliminary version of the trading platform, which may purportedly allow for up to 20 times leverage, and allow for investors to long and short key crypto asset markets: presumably Bitcoin, Ethereum, and Binance Coin at the minimum.

.@cz_binance just announced that #Binance will offer futures contracts in his keynote at the @aba_summit! #ABS2019 #Taipei #Futures pic.twitter.com/RXlui8YY0V

— Binance (@binance) July 2, 2019Per a report on the matter from CoinDesk, the platform will go live “very soon”, but there are no concrete dates just yet. What is confirmed is that a “simulation test version” will be launched in a few weeks, potentially in line with the launch of the more regulated Binance United States. A Binance spokesperson told CoinDesk that prior to the launch of futures, margin trading will go live first.

As analyst Luke Martin notes, Binance will be the first crypto exchange in history to foray into the four types of exchanges: derivatives, regulated spot, unregulated spot, and decentralized exchange. Interestingly though, Binance Coin is still hurting, losing 4.5% in the past 24 hours as a result of a collapse in the Bitcoin price.

Crypto exchange types:

1/Derivatives: margin, swaps, futures (Bitmex, Bybit, Deribit)

2/Regulated: BTC & major alt focus, fiat on-ramps (Coinbase, Gemini)

3/Unregulated: Alt focus (Binance, Kucoin)

4/DEX

Binance adding futures & becoming only exchange to be in every category. https://t.co/Ikp9pwOtyv

This news comes hot on the heels of pro-futures news made by other startups in the space. Announced Monday afternoon, ErisX, a Chicago-based cryptocurrency startup, has secured a “derivatives clearing organization” (DCO) license from the Commodity Futures Trading Commission (CFTC).

The Bitcoin exchange now has the authority to list “digital asset futures contracts” on a platform slated to “launch later this year”.

ErisX is expected to launch physically-backed vehicles for Bitcoin, Ethereum, and potentially other digital assets this year.

The firm has notably been backed by Bitmain, CME, CBOE, ConsenSys, Digital Currency Group, DRW, Nasdaq, Fidelity, and, most notably, TD Ameritrade. The retail brokerage and its main rival, E*Trade, are expected to soon open Bitcoin and digital asset trading for its millions of customers across the U.S., many of which will soon get their first taste of cryptocurrency via an ErisX product.

Title Image Courtesy of Marco Verch Via FlickrThe post Binance to Launch Bitcoin (BTC) Futures as LedgerX, ErisX Snag CFTC Licenses appeared first on Ethereum World News.

origin »Binance Coin (BNB) на Currencies.ru

|

|