2019-10-17 01:48 |

Bitcoin’s price has been showing significant bearish signs of late with the price of the coin struggling to make it very far above $8,000. However, on a more positive note, Binance’s recently-launched futures product has managed to have a record-breaking day this week.

Unfortunately, the dire situation in which the Bitcoin market finds itself is not as polar as a low price on one side, and institutional interest on the other. It has been pointed out that there are several negative metrics swirling around the major cryptocurrency.

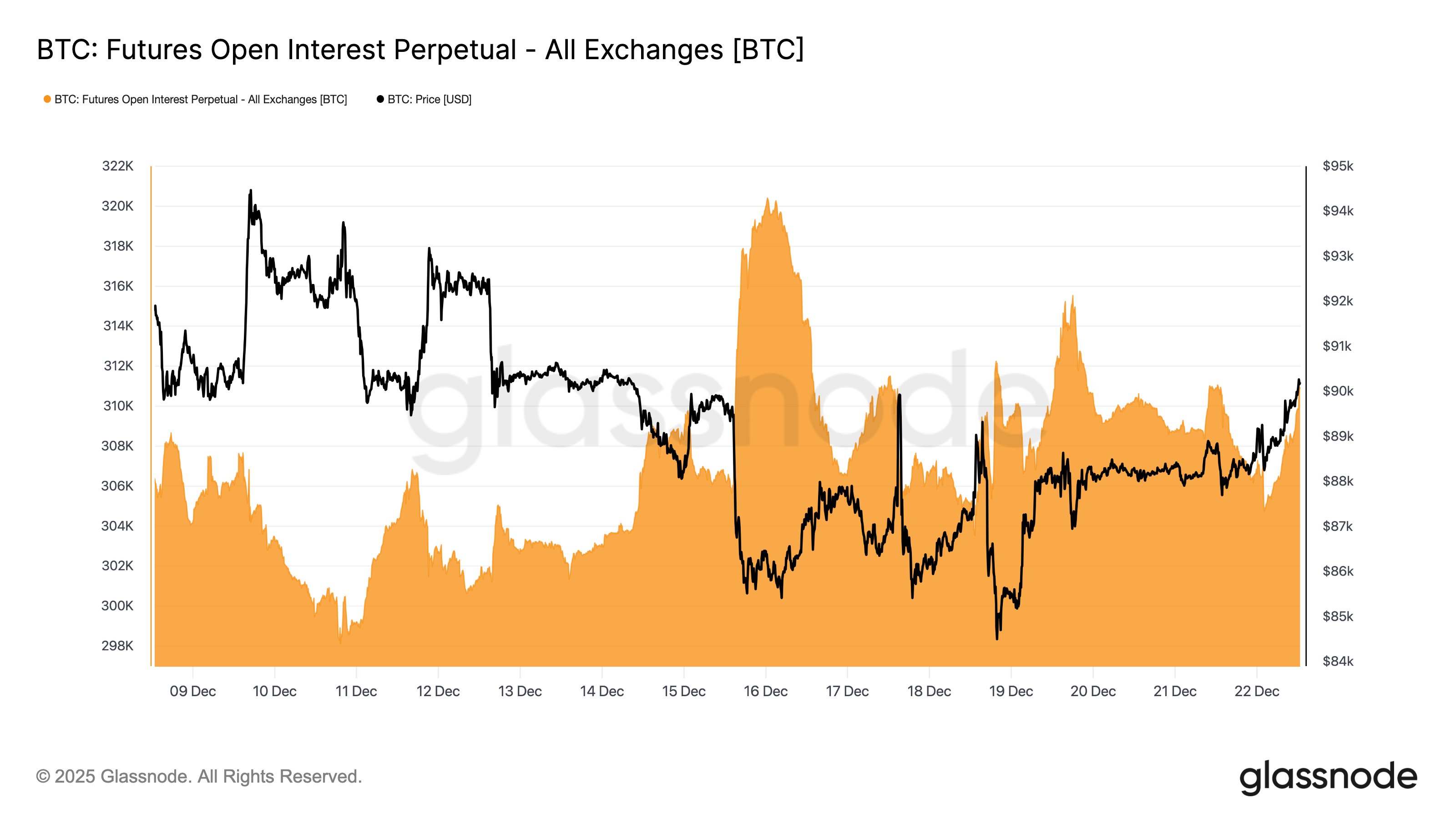

eToro senior market analyst Mati Greenspan, a well respected Bitcoin bull, took it upon himself to point out that the current lull in the Bitcoin price is being compounded by low trading volume on exchanges, poor institutional uptake through other futures contracts, as well as dipping peer-to-peer trades.

Looking on the Bright SideGreenspan, in his dire analysis of the current state of Bitcoin, also pointed out that its mining hash rate is on a year-long rally with the difficulty of the mining algorithm barely dipping through 2019 thus far.

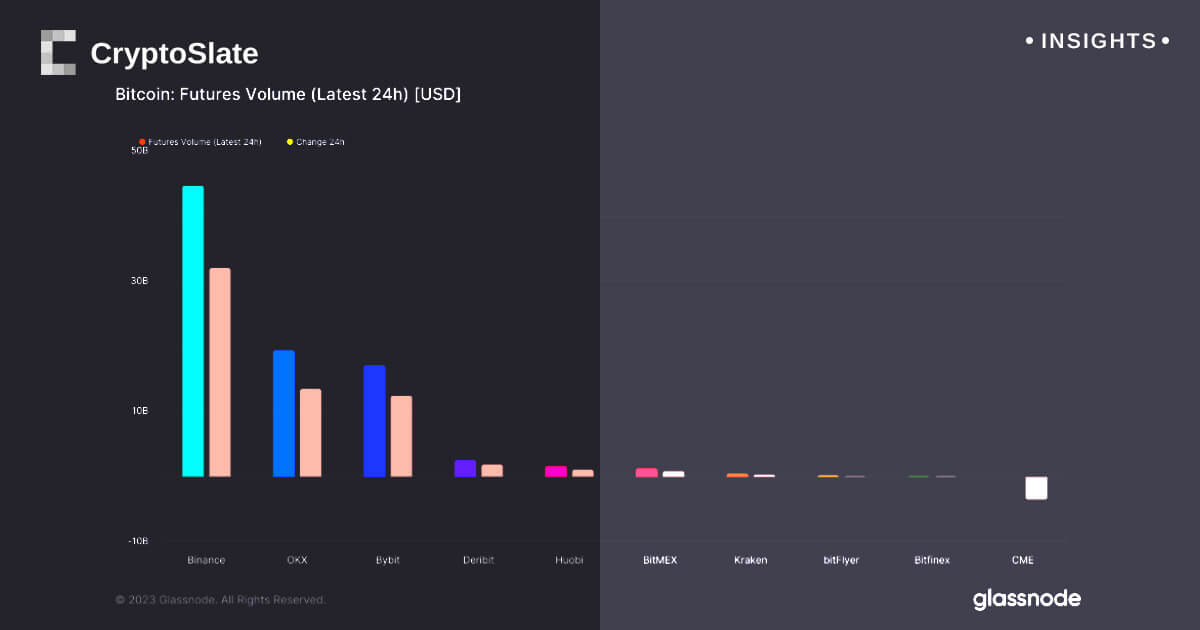

It has often been correlated that a high hash rate is one sign of a healthy network, but for the financial side of the market itself, it appears that it is not all doom and gloom. Greenspan looked into other futures platforms, and only found poor performances from Bakkt and CME, but Binance has been the exception — as pointed out by another cryptocurrency analyst, Skew.

Binance just had a record volume day for its newly launched BTCUSDT futures product : $700mln+ traded on the 15th pic.twitter.com/w0MX0csBEt

— skew (@skew_markets) October 16, 2019

On Tuesday, Binance’s futures platform traded $700+ million, setting a new daily trading volume record. The Binance futures platform is a relatively new one, having launched on Sept 12, yet its new daily record made it the third biggest platform for trading volume, behind Huobi and BitMEX’s offerings.

In comparison, another new futures trading platform, Bakkt, played into Greenspan’s analysis of a struggling Bitcoin as the physically settled contracts only achieved 10 BTC on the same day.

A Period of Stabilization?While the general situation around Bitcoin and its many facets are certainly on a downward trend, there are a few silver linings between the grey clouds. The hash rate of the blockchain constantly growing indicates that there is enormous mining interest, no doubt in the run-up to the reward halving.

More so, as Greenspan pointed out: “Bitcoin is not dead. It’s just resting.”

“Yes, this is a giant lull in crypto volumes across the board. Let’s not forget though that bitcoin is one of the best-performing assets this year. After all this action a period of stabilization is more than welcome.”

What do you make of the poor metrics surrounding Bitcoin? Is this just a period of stabilization, or are there bigger concerns? Can big interest in Binance Futures help boost the price of the coin?

Images courtesy of Shutterstock, Twitter.

The post Binance Futures Platform Breaks $700 Million Daily Volume, Despite Bitcoin Lull appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|