2019-10-9 02:18 |

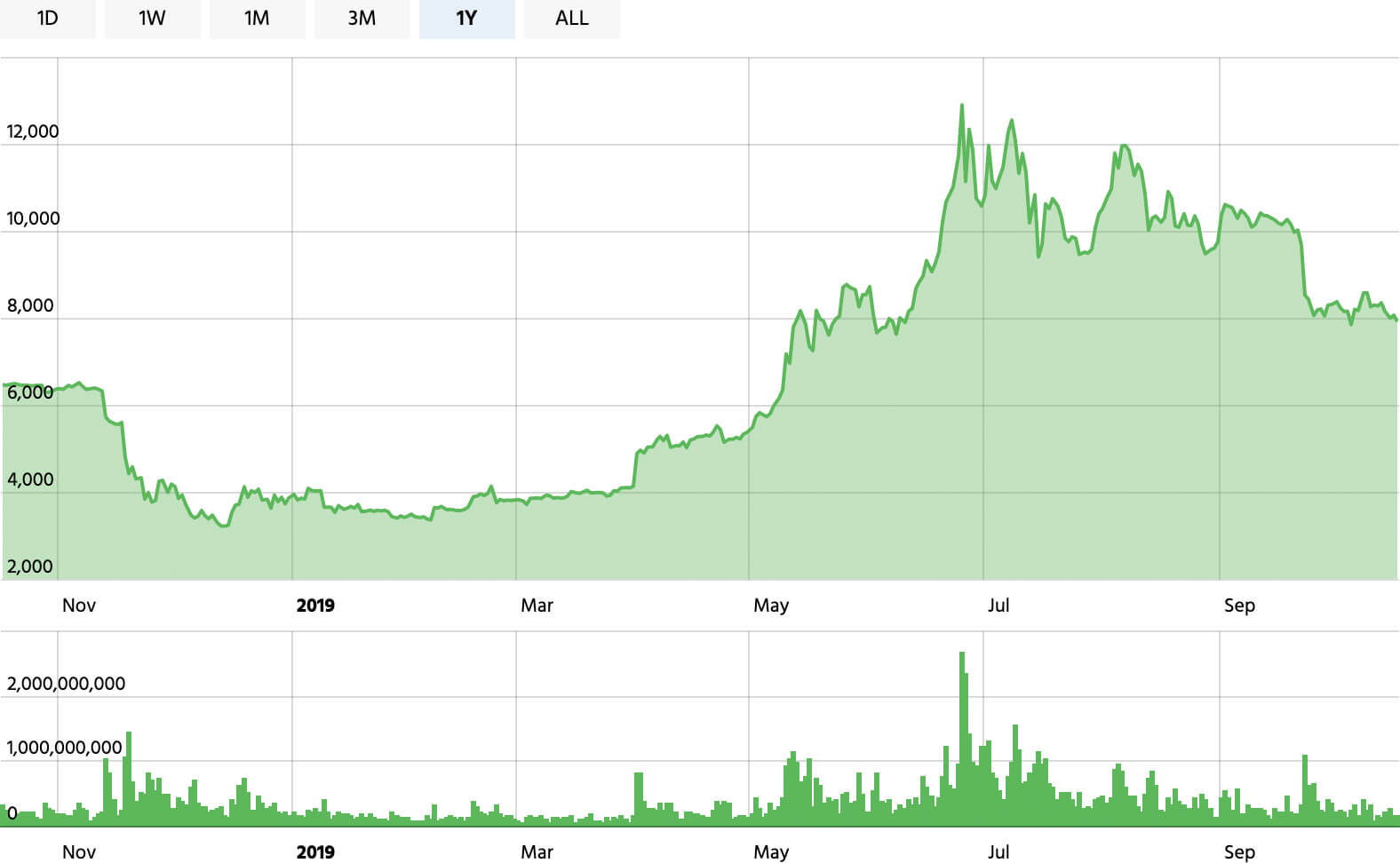

Many cryptocurrency maximalists are viewing signs of a possible economic recession as the potential foot in the door for a decentralized financial system, such as Bitcoin, to take root.

Across the world, there are more and more indications that a global economic recession may be looming, as BeInCrypto has reported on. For example, the European Central Bank has been doing all it can to try and prop up the ailing economy. In China, the value of the yuan is dropping rapidly as the US continues to spar in the midst of a trade war. The US has also seen its Federal Reserve cut interest rates with calls for negative rates persisting, as BeInCrypto has also reported. All of these factors and more have many institutional financial commentators concerned.

A former banker, Oswald Gruebel, who led both of Switzerland’s two biggest banks during his career, has now openly criticized negative interest rates and argues they’d lead to a further decline in the financial sector.

Money Is Making Less Sense by the DayIt may not be panic stations just yet in the global financial sector, but there is no doubting that central bankers and governments trying to implement policies that stimulate spending and growth in order to postpone any potential recession.

Negative interest rates, which essentially means that individuals will pay to keep fiat savings in a bank, rather than earning interest, is one method that is being bandied about currently. Donald Trump has even suggested it in a tweet, but the last time this policy was seen was following the 2008 banking collapse.

Gruebel said of this policy: “Negative interest rates are crazy. That means money is not worth anything any more,” in an interview with Swiss newspaper NZZ am Sonntag.

The real issue is the power and influence that governments and central bankers have over the financial system. That they can make policies that greatly affect the use and designation of fiat is problematic. As Gruebel states, these policies are so influential that the entire financial system can be turned on its head.

An Argument for BitcoinIt is interesting to see traditional financiers such as Gruebel making these bold claims about the current state of financial affairs, and how fiat money is so vulnerable to the centralized control of the likes of the G7 central banks.

This scenario paints a good picture for a decentralized system, such as Bitcoin, which cannot be directly affected by bankers and governments. There has been a growing call for the decentralization of power in a number of sectors, from social media – following a number of data scandals – to the general concerns around banking control following the 2008 crash.

There is still a long way to go before Bitcoin can usurp the power of the current financial system, we’re finally seeing a growing alternative to the former financial status quo.

Will we see cryptocurrencies become a preferred global financial system if a new recession hits? Is there enough potential in the likes of Bitcoin to offer up an alternative to the heavily controlled fiats currencies we see today? Let us know your thoughts in the comments below.

Images are courtesy of Shutterstock.

The post Bankers Start Turning on Fiat, Making Bitcoin a More Attractive Alternative appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|