2020-7-1 20:54 |

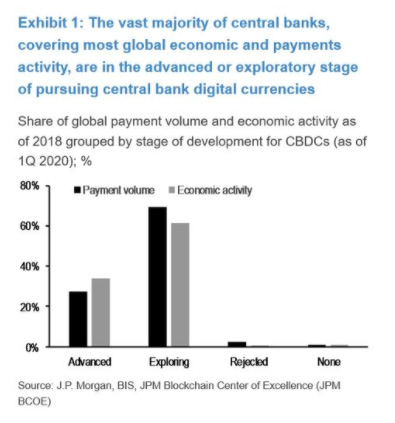

A recent analytical staff note by the Bank of Canada on CBDC's has highlighted that higher privacy levels may come at a cost. The bank summarized possible privacy CBDC frameworks as it looks to advance research and development in this space.

Known privacy innovations such as Zero-knowledge proofs (ZKPs) have yet to prove their value when it comes to practical privacy solutions on a countrywide-scale, as per the Canadian financial watchdog.

The analytical staff note highlights that a CBDC ecosystem would fundamentally comply with KYC and AML protocols. Therefore, developing such a network for Canada's population would inevitably dictate the levels of privacy participants enjoy. Going by the value proposition of upcoming virtual ecosystems, finding balance becomes pretty hard leaving hybrid options as the go-to infrastructure:

“A designer, however, could build a system with hybrid privacy levels. In this, unregulated holdings and transactions (offering maximum privacy to users) would be allowed within limits (e.g., a maximum amount) alongside regulated ones without limits.”

Tradeoffs for Higher PrivacyWhile Canada's Central Bank has been working on CBDC research for some time, the regulator is reluctant to unlock its sunrise phase as China did with the digital Yuan. According to its note, this position may have been influenced by the underlying risk of integrating a privacy-focused CBDC.

The banknotes that have higher privacy levels come at a cost and may prevent scalability in the long-run. This is because of the enhanced control protocols that need to be integrated for data encapsulation:

“This adds complexity, which raises operational costs. It also adds computational overhead, so scaling to a population size can be challenging or impractical—whether a DLT or non-DLT platform.”

Other than resource intensity, privacy in CBDC networks is still a relatively new concept, given it has yet to prove itself even in systems like ZCash, which leverages Zero-Knowledge proof. At the moment, this tech has not been implemented on a national level. This paints a picture of an immature infrastructure that could expose deep vulnerabilities if tested as monetary policy function:

“The risk here is that their technical complexity, combined with their immaturity, could mask vulnerabilities. Further, no known deployments have scaled up to a national population.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|