2020-5-24 21:24 |

According to JP Morgan Chase & Co., if the idea of central bank digital currencies (CBDC) gains traction, the US can risk losing its geopolitical power.

“There is no country with more to lose from the disruptive potential of digital currency than the United States,” wrote analysts including Josh Younger, head of U.S. interest-rate derivatives strategy and Michael Feroli, chief U.S. economist in a report.

“This revolves primarily around U.S. dollar hegemony. Issuing the global reserve currency and the medium of exchange for international trade in commodities, goods, and services conveys immense advantages.”

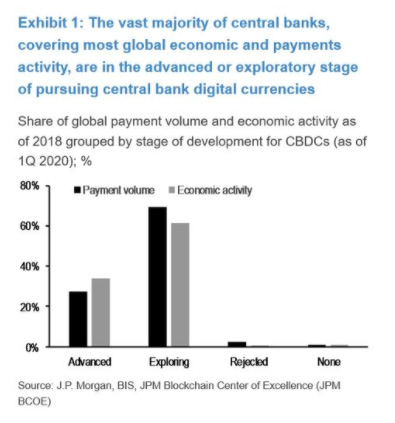

Source: Bloomberg The RisksOverall, the analysts found there to be reasonable reasons for central banks to introduce digital currencies. However, these CBDCs are unlikely to have the transformative impact that many have hoped.

Although JPMorgan doesn’t see the greenback getting toppled as the world's reserve currency anytime soon, the “more fragile” aspects of dollar dominance could be at risk. These aspects include trade settlement and the SWIFT messaging system.

According to the analysts, the EU might want to reduce US’s sway over global payment systems and pointed to SWIFT suspending access for some Iranian banks in 2018 after US sanctions took force, which may have been in violation of EU laws.

To bypass US sanctions and continue trading with Tehran, the EU even established a “SWIFT alternative” called Instex.

As for their progress on CBDC, on May 11, Yves Mersch, Member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB shared they have to be “ready.”

Mersch talked about embracing the financial technological innovation which has the “potential to transform payments and money faster, and in more disruptive ways, than ever before.”

As for the US, Fed Chairman Jerome Powell said earlier this year that they are looking at the issues with creating a digital dollar but not making any commitments.

An exercise in geopolitical risk managementIf like Europe, other countries are also able to circumvent the dollar’s domination, it would become all the more difficult for the US to carry out its goals through sanctions and terrorist-financing enforcement, analysts said. The report reads,

“Offering a cross-border payments solution built on top of a digital dollar would, particularly if designed to be minimally disruptive to the structure of the domestic financial system, be a very modest investment to protect a key means to project power in the global economy.”

“For high-income countries and the U.S. in particular, digital currency is an exercise in geopolitical risk management.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|