2024-1-11 11:02 |

The Securities and Exchange Commission (SEC) finally approved eleven spot Bitcoin ETFs after months of consultations. This decision was in line with what most analysts were expecting since the sponsors had made all the recommendations that the agency wanted. For example, all these funds had a surveillance clause aimed at preventing manipulation.

SEC approved a spot Bitcoin ETFWith the spot Bitcoin ETFs expected to start trading on Thursday, the question is on the next crypto ETFs that the SEC will approve. Blackrock, the biggest asset manager in the world, has already filed for a spot Ethereum ETF. Grayscale could also file to transition its Ethereum Trust (ETHE) into a spot ETF. The company won a major lawsuit against the SEC about these conversions in 2023.

Ethereum makes sense as an ETF now that the SEC has provided precedence by allowing a spot BTC ETF. However, there is a huge difference between Bitcoin and Ethereum. The SEC has long-argued that Bitcoin was not a security. Ethereum, following the merge in 2022, moved from being a Proof-of-Work (PoW) crypto to a proof-of-stake (PoS) one

Therefore, SEC’s Gary Gensler has long warned that he sees Ethereum a security because of the staking element. He believes that Ethereum stakers should be protected by the agency. For example, who determines the staking reward?

Other potential crypto ETF candidatesIn addition to Ethereum, other cryptocurrencies that could see ETF filings are Cardano (ADA), Avalanche (AVAX), Ripple (XRP), Tron (TRX), and Solana (SOL). These are the other biggest cryptocurrencies in the world with a combined market cap of over $120 billion.

Each of these coins face huge challenges in getting ETF approval. In Tron’s case, the SEC is battling with Justin Sun and his companies. In a lawsuit, the SEC alleged that Sun and his companies manipulated the TRX and BitTorrent tokens through “excessive wash trading.” Therefore, because of this reputation, I doubt any company will want to apply a spot ETF.

Avalanche, Solana, and Cardano also face the challenge that Ethereum faces ahead. They all have staking features, which the SEC believes that should be regulated. In the case of Solana, the SEC still remembers its close association with FTX and Sam Bankman-Fried.

Ripple’s XRP has a clearer path toward acceptance since a judge has already ruled that it is not a security. This was a huge blow to the SEC, which launched a major lawsuit in 2020. Ripple is also a big player in the crypto industry with a market cap of over $32 billion.

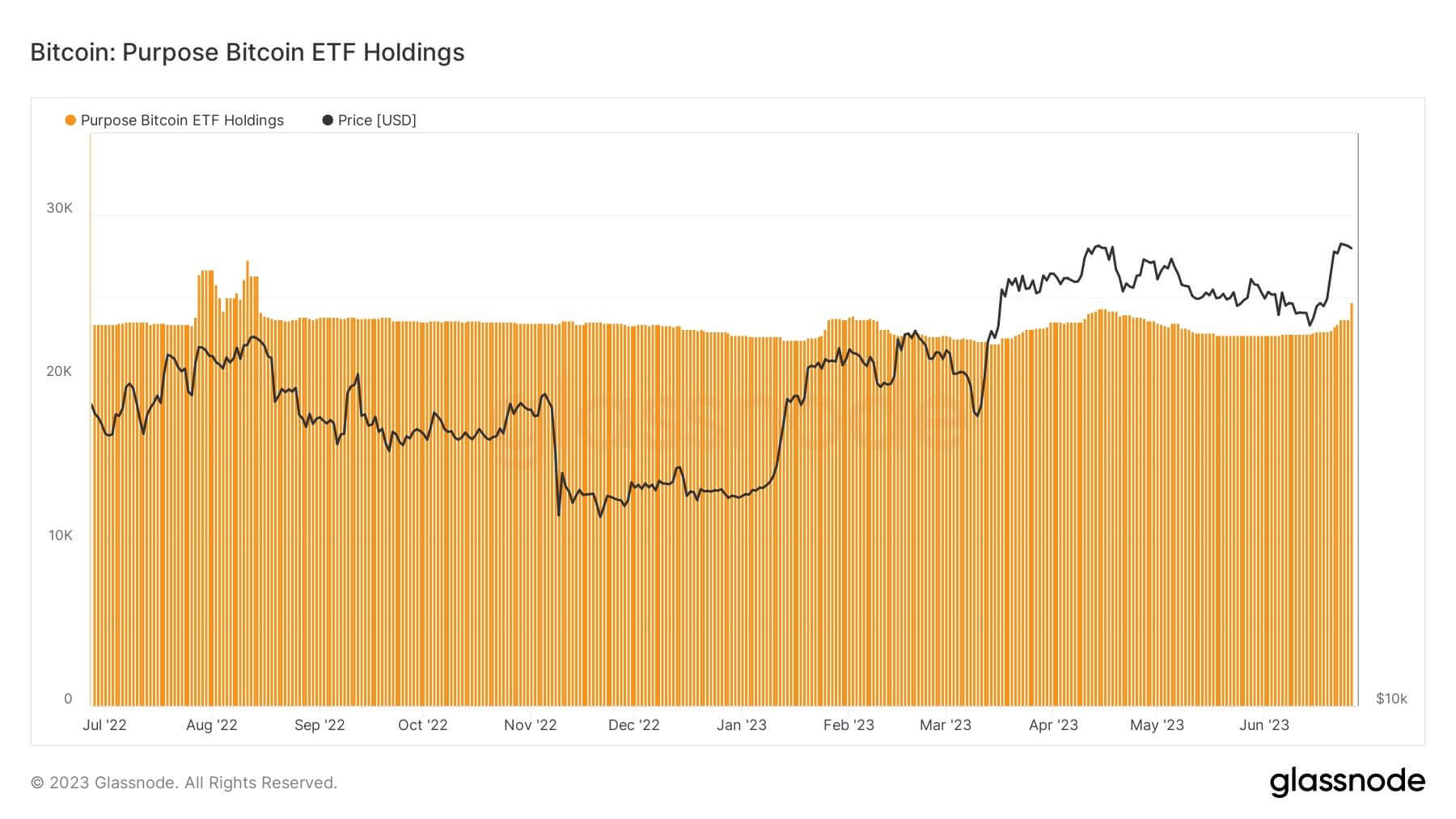

Still, the next ETF applications will depend on the success of the eleven Bitcoin ETFs that were allowed by the SEC. If inflows are strong, it means that these companies will attempt to make these filings.

The post Are Cardano, Avalanche, Tron, XRP, and Solana spot ETFs coming? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|