2023-12-15 09:50 |

Gary Gensler has said that the US Securities and Exchange Commission (SEC) is changing its approach towards spot Bitcoin exchange-traded funds (ETFs) after recent court rulings.

In an interview with CNBC, the SEC Chair noted that the regulator was evaluating “between eight and a dozen filings” for spot Bitcoin ETFs.

He noted that while the regulator had denied several of these applications in the past, the courts have weighed in on this. As such, the SEC was “taking a new look at this based upon those court rulings.

Gensler did not mention specifically mention Grayscale’s court ruling. The digital asset manager won a landmark victory against the SEC after a federal judge rescinded the regulator’s decision to deny the conversion of the Grayscale Bitcoin Trust into a spot Bitcoin ETF.

Gensler under Criticism over Bitcoin ETFsGrayscale’s victory over the SEC led to several US legislatures criticizing Gensler’s leadership. In August, the Chair of the House Financial Services Committee, Patrick McHenry, said Gensler’s stance against the crypto market was “falling apart under scrutiny from the courts.”

SEC Chair @GaryGensler's crusade against the digital asset ecosystem is falling apart under scrutiny from the courts.

This is yet another example of why a comprehensive regulatory framework, like the FIT for the 21st Century Act, must be made law.https://t.co/HI3wkFAsMm

US Congressman Bryan Steil also recently attacked Gensler for failing to clarify crypto regulations.

“Chair Gary Gensler obfuscates on crypto with the press like he does at committee hearings,” Steil said.

He does not want to explain his agency’s aggressive regulatory approach which is pushing crypto offshore.

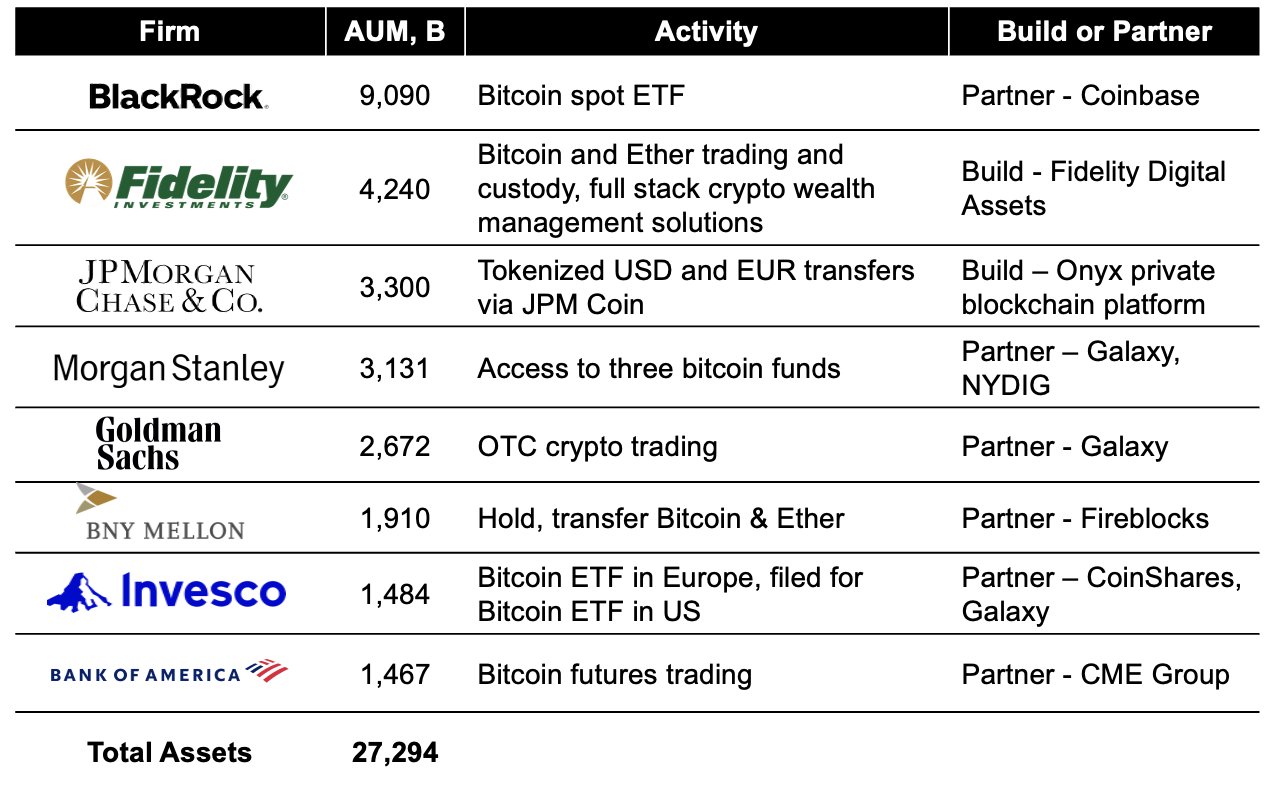

Race towards a Spot Bitcoin ETFLeading asset managers like BlackRock, VanEck, Fidelity, Valkyrie, Bitwise, and Invesco have filed for a spot Bitcoin ETF. So far, the SEC has delayed all applications, but analysts are optimistic that approval will come in early January.

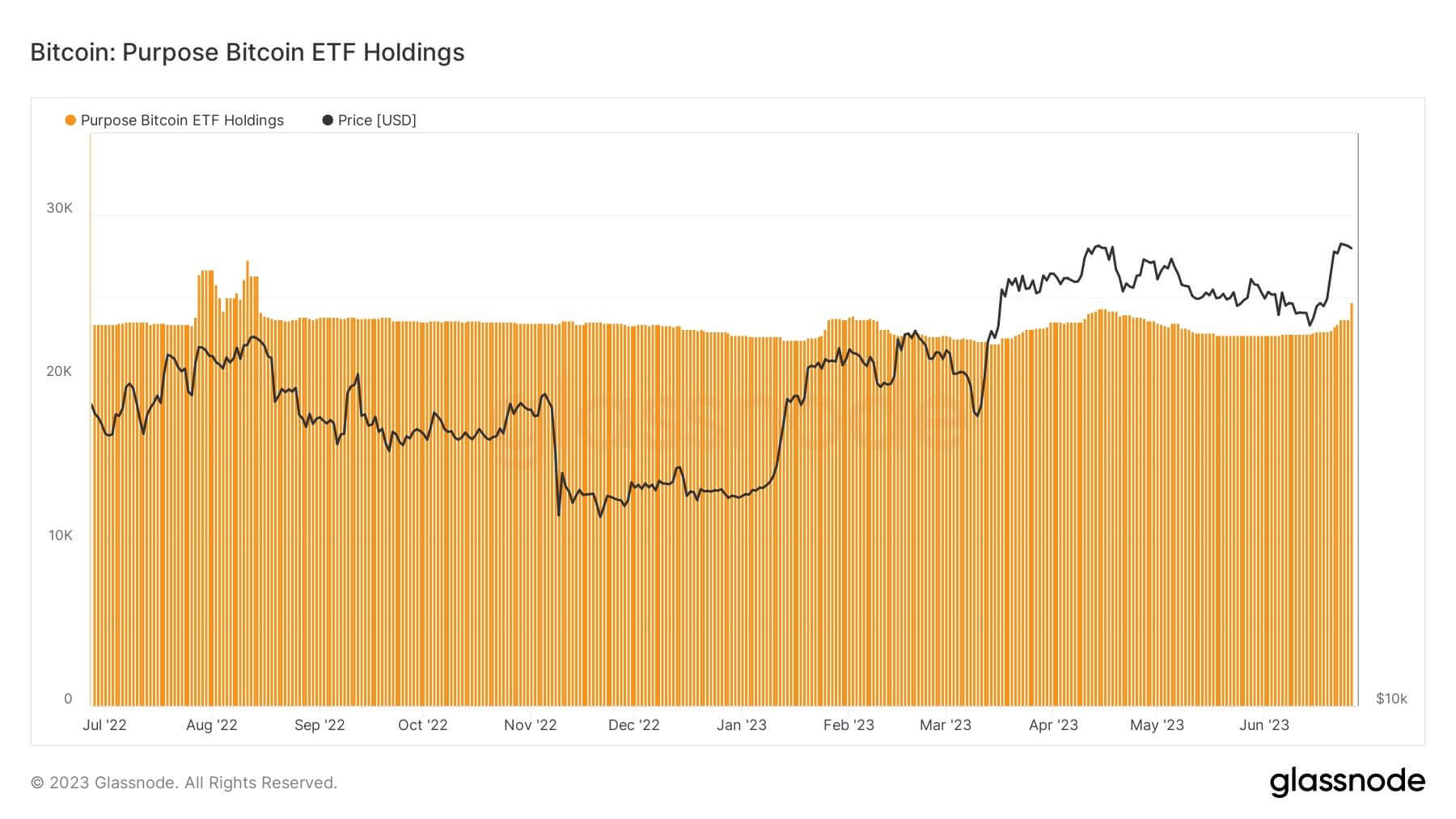

An analysis by VanEck for 2024 predicted that a spot Bitcoin ETF will raise around $1 billion during the first few days and $2.4 billion within the first quarter. VanEck estimates that this ETF will attain $40.4 billion inflows during the first two years of trading as adoption grows.

Bitwise is also bullish on the approval of Bitcoin ETFs, saying they will be “the most successful ETF launch of all time.” The investment manager also estimates that spot Bitcoin ETFs will account for 1% of the $7.2 trillion US ETF market.

Prediction #2: Spot bitcoin ETFs will be approved, and collectively they will be the most successful ETF launch of all time.

Within five years, we estimate spot bitcoin ETFs could capture 1% of the $7.2 trillion U.S. ETF market, or $72 billion in AUM. pic.twitter.com/iWX6n3I3qC

Since optimism around the approval of this product started to grow, Bitcoin has posted significant gains. BTC is up 140% this year alone. Analysts predict it will attain a new all-time high in 2024 once a spot Bitcoin ETF launches.

The post Gary Gensler says SEC taking a new approach to spot Bitcoin ETFs after Grayscale ruling appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|