2019-1-18 22:49 |

Bitcoin is currently trading around $3,650 and not seeing much price development. For now, it looks like, Bitcoin price is maintaining stability.

However, if we take a look at the Bitcoin futures, we might get some other ideas. The Bitcoin futures on the largest options exchange in the US, Chicago Board Options Exchange (Cboe), are in fact predicting further drops in the price.

Source: http://cfe.cboe.com/cfe-products/xbt-cboe-bitcoin-futures

Currently, these Bitcoin futures are in “backwardation”. According to Investopedia:

“Backwardation relates to the price of a futures contract and the contract's time to expire. As the contract approaches expiration, the futures contract trades at a higher price compared to when the contract was further away from expiration. This is because the spot price is above the futures price, and the contract and spot price must eventually converge, so the future's price rises toward the spot price.”

This in a way shows a lack of investors’ confidence in Bitcoin’s price in future. However, it is not likely to affect the prices as this is not the first time that Bitcoin has been in this position. “The bitcoin futures curve teetered between being effectively flat and in a backwardation state for most of Q1,” stated a trading report by Element group that further showed that there is no connection.

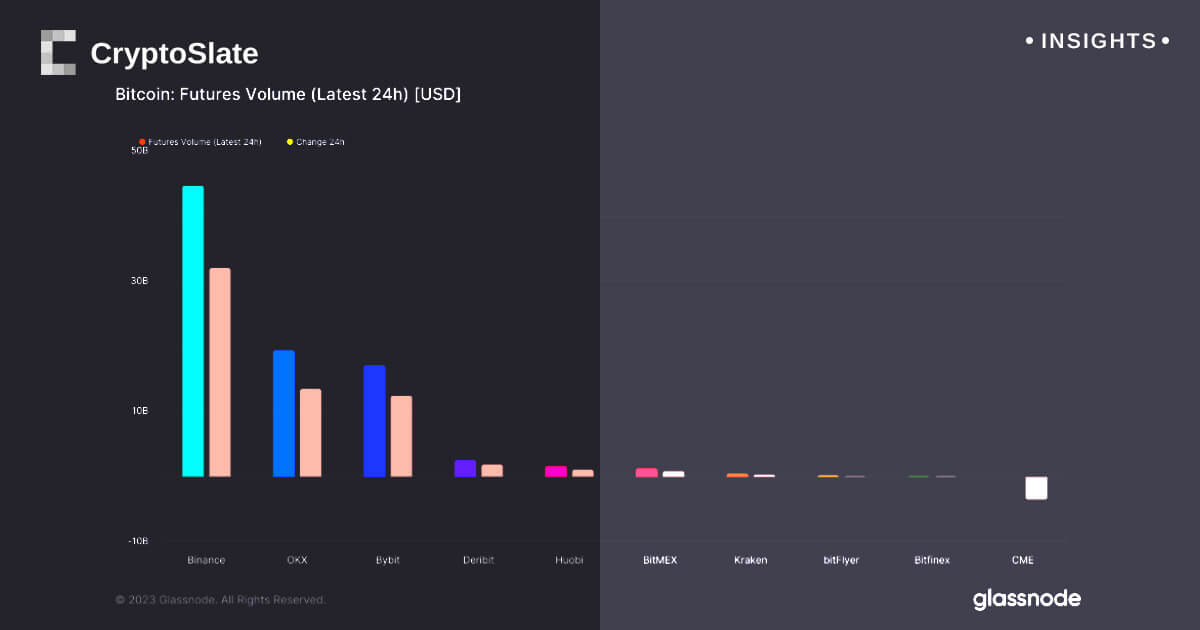

Moreover, the volume of these futures are low. The December report of CryptoCompare shared that Bitcoin futures are actually decreasing in volume,

“XBTUSD futures of CME and CBOE decreased 45.5% and 48.0% respectively since November. Regulated exchanges (CME and CBOE) represented only 2.88% of the total crypto futures market in December.”

These Bitcoin futures are also not physically delivered that could be the reason why the volume is so low. However, We might see the things changing when Bakkt by Nasdaq's parent come into the market with its physically delivered Bitcoin futures. Things will definitely get an interesting turn then.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|