2019-7-2 21:23 |

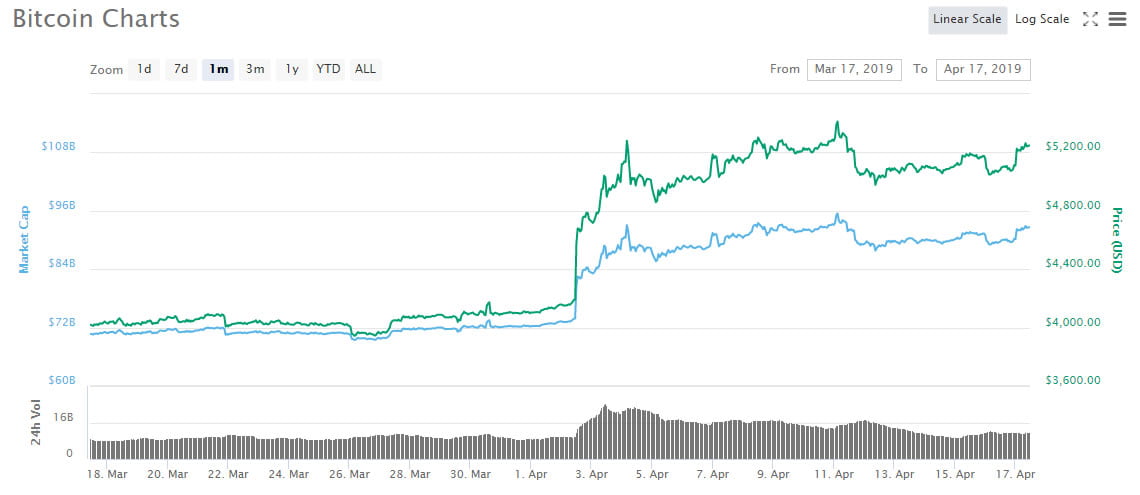

It’s been just under a week since Bitcoin (BTC) set a new high for the year, when it looked like the leading cryptocurrency was only a few days away from $20,000.

Even the Telegraph, not known for crypto advocacy, published an article on how to jump aboard the crypto bandwagon – although it was mostly a rehash of various warnings to avoid BTC like the plague.

But despite many crossed fingers, Bitcoin fell far shy of its all-time high. Since hitting $13,770 late on Wednesday, the cryptocurrency has shed more than a quarter of its value and is currently hovering just above the $10,000 mark, which some traders take to be a crucial support level.

A fall below $10,000 could trigger multiple ‘stops’, which could lead to a downward spiral as more investors sell.

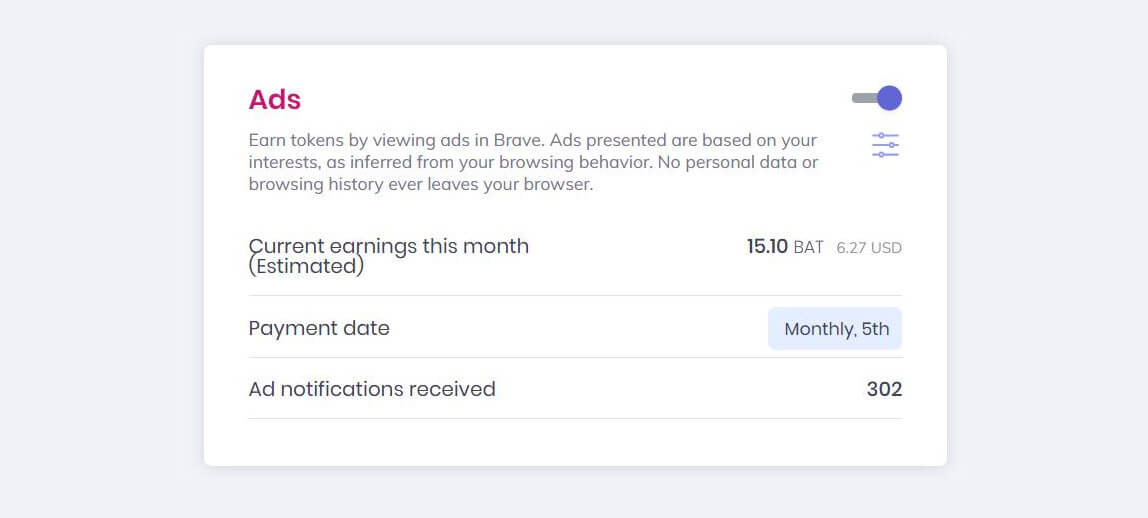

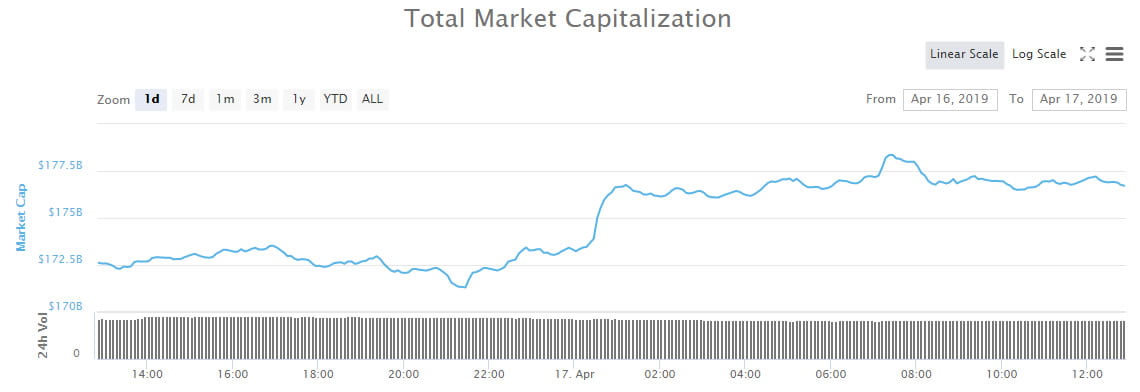

Bitcoin’s price has fallen by 26% in six days. Source: CoinMarketCap

But while some investors wish they had sold last week, analysts suggest that the dip is merely excitement from the Facebook announcement finally running out of steam.

Joshua Frank, the co-founder of analytics site The TIE, says that daily sentiment – a measure of the sentiment on Twitter against a seven-day moving average – peaked the same time that the Bitcoin price hit its zenith.

Source: The TIE

As prices began to tumble, so did sentiment. Twitter volume has halved since last week and even with the temporary price corrections on June 28th and 29th, Frank says, sentiment has remained very low.

But on a longer-term metric – Twitter volume over a fifty-day period against a 200 MA – Frank points out that sentiment has continued to increase. Social media sentiment has risen without interruption for the past seven months.

Via The TIE.

Traders may have been “overly eager” following the Libra announcement, Frank said, driving sentiment and price up over a seven day period.

“Once the excitement over Libra cooled down, shorter-term sentiment fell and a correction was due,” Frank explained. “For over a week we saw that Libra and Facebook were the most mentioned terms in Bitcoin tweets, that trend has ended.”

There’s further evidence that this week’s Bitcoin dip might just be a storm in a teacup. Demand for crypto-linked derivatives, both regulated and unregulated, remains high.

CME Group reported yesterday that the notional value for its Bitcoin futures reached $1.7bn last week, surpassing its previous record by 30%. Furthermore, more than a trillion dollars’ worth of crypto derivatives have been traded on BitMEX since this time last year.

George McDonaugh, CEO of VC fund KR1, thinks this is just another correction which will do little to change the overall direction of the Bitcoin price.

The recent drop comes, in McDonaugh’s opinion, as some investors realized a quick profit from an overheating market. “There are always groups taking advantage of movements,” he said. “[I]t’s a normal fluctuation.”

Even if a $20,000 Bitcoin is still some way off, McDonaugh points out that there were five corrections during the last bull run in 2017. The fact that weekly volumes continue to surge upwards, on top of what’s happening on the derivatives side, suggests the market is still setting itself up.

Meanwhile, cryptocurrency markets are once again green across the board, and Bitcoin appears to be headed back upwards at the time of writing.

The post Analysis: Bitcoin Dip Looks Like A Temporary Correction appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

LikeCoin (LIKE) на Currencies.ru

|

|