2021-8-4 13:21 |

Traditional banks have been among the largest critics of the crypto industry for years, back when they still had hope of suffocating the emerging industry and preventing it from taking over. Now that it has become obvious that this is not going to happen, banks are rapidly changing their stances. Many central banks are now working on either integrating crypto or developing their own, while the American Bankers’ Association (ABA) even encouraged partnerships with crypto firms.

This change in attitude was strongly stressed in ABA’s recent report, where it suggested banks consider such partnerships due to the crypto sector’s increased profitability, as well as growing demand from the banks’ clients.

The 20-page-long report provided a thorough, high-level overview of digital currencies, including even a glossary. The report mapped the activities of cryptocurrency businesses showing in which ways they can be tied to the banks’ own products and services.

ABA’s crypto classification and recommended use casesFurthermore, the ABA also offered some suggestions regarding the ways in which banks themselves can use cryptocurrencies, alongside revenue models, and even regulatory issues that may accompany every of the mentioned use cases.

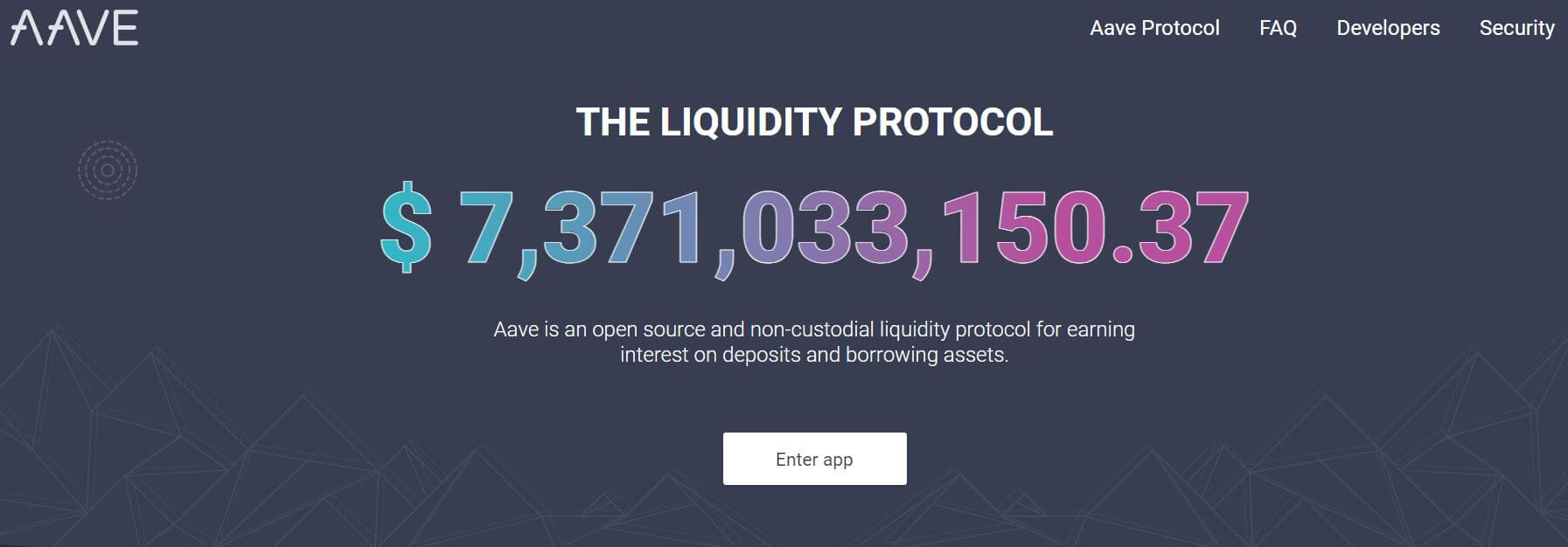

According to the report, the ABA recognizes four different crypto asset classes. These include cryptocurrencies, stablecoins, CBDCs, and NFTs. It also mentioned the DeFi sector, thus recognizing all of the major crypto trends at this time. As for the listed use cases, it proposed store of value, custody/wallet provider, interest-bearing accounts, payments, lending, exchange trading, broker-dealer, insurance, network utility, and asset management.

Each of the use cases was accompanied with a description of what it means and includes, indicating that ABA has done its homework quite well. The ABA recommends ways in which the banks may profit from offering such services, such as charging fees for processing payments, loans, offering custody services, adding charges for transactions, listings, and even deposits, and more.

With this report, the banking sector finally has not only a recommendation but also instructions on how to profit from offering cryptocurrency services, which may be the encouragement that it needed to take its first major step into the emerging industry.

The post ABA’s new report encourages teaming up with crypto companies appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|