2021-5-12 15:20 |

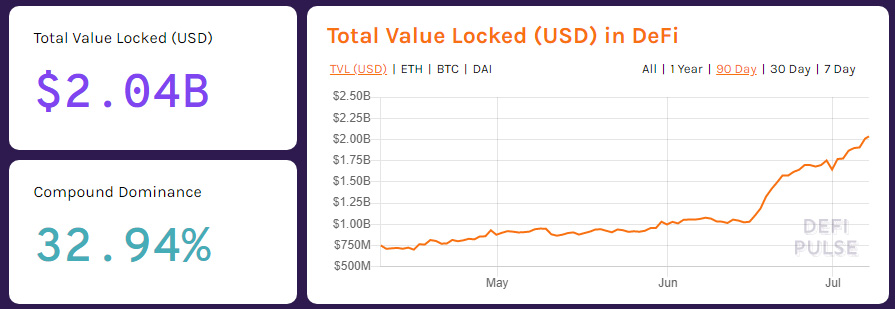

In recent years, Decentralized Finance (DeFi) has become a hot topic in the cryptocurrency industry. DeFi is a concept that envisions an open global financial system that functions without intermediaries, like banks, insurances, or clearinghouses. It is accessible to anyone with an internet connection and can use Ethereum.

Many opportunities and possibilities abound for individuals and firms embracing DeFi. Key among them is allowing individuals to lend their crypto assets in a DeFi lending protocol to earn interest. Aave and Compound are two leading DeFi lending protocols often compared due to their competitive rates.

What is Defi lending?DeFi lending platforms offer crypto loans through a permissionless process and also allow crypto holders to list their coins for lending. Lenders offer loans to borrowers in return for interest rates. In the traditional financial industry, such deals are facilitated by a third party, which can be a bank or lending institution.

DeFi protocols connect lenders and borrowers across a decentralized ecosystem. In this case, the users maintain control over their funds with trade agreements executed using smart contracts built on open blockchain solutions.

The idea of DeFi stems from the desire to have a transparent and open financial industry. DeFi is quickly emerging as a leading decentralized lending system, allowing lenders to earn interest on their coins, while borrowers can easily access credit, all happening without an intermediary.

DeFi Lending vs. Traditional LendingDeFi lending platforms are built on blockchain, tapping into the technology’s revolutionary features to offer exceptional performance compared to the traditional lending industry. These lending platforms offer the most straightforward and transparent borrowing process, one where asset holders maintain full ownership and control of their funds.

In addition, DeFi offers a censorship-free trading environment where all players have equal chances.

Aside of DeFi lending, there is also CeFi crypto lending. CeFi stands for centralized finance and that is crypto lending offered by Blockfi, Hodlnaut, Celsius, YouHodler, Nebeus, Coinloan, Spectrocoin loans etc.

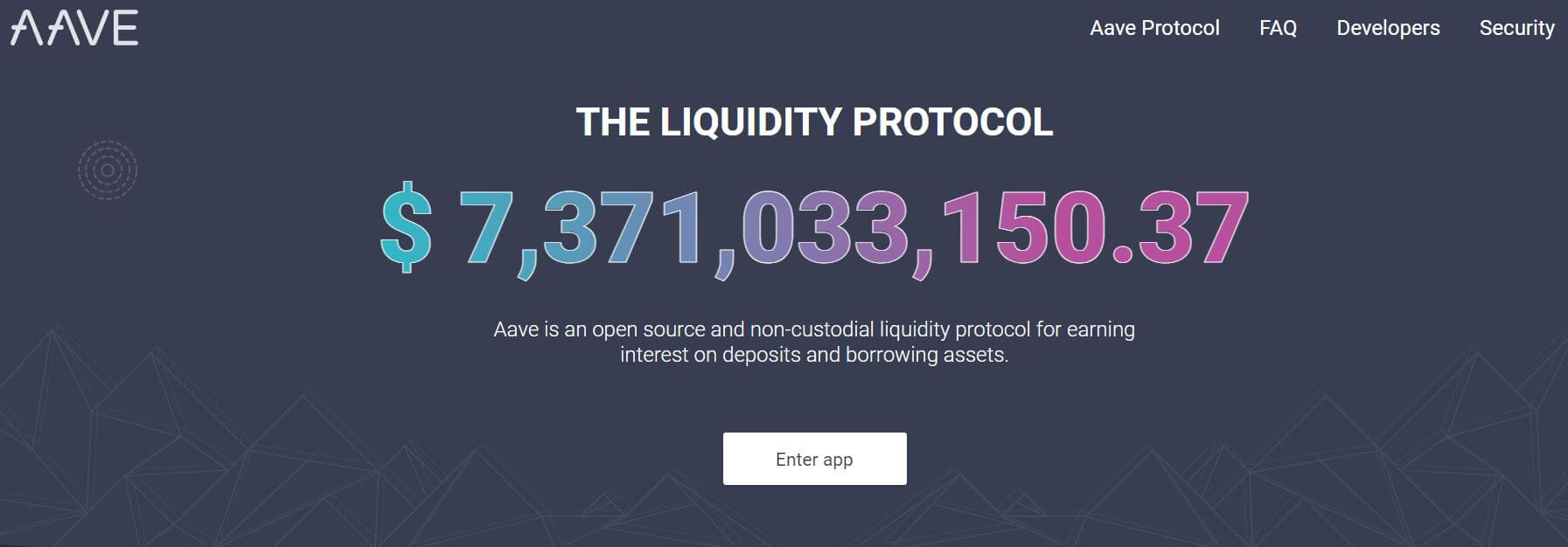

What is Aave?Aave is a decentralized lending protocol where users can borrow crypto assets and also earn interest on their deposits. The platforms enable users to access a wide range of digital assets.

The open-source lending platform was motivated by the need to have a “transparent and open infrastructure for decentralized finance.” It has emerged as one of the leading decentralized lending systems, allowing users to borrow, lend, and earn interest on their crypto assets without going through an intermediary.

Aave was initially a peer-to-peer lending platform called ETHlend before rebranding in 2020, with an aim to make it more appealing to retail and institutional investors and establish its footprint in the DeFi space.

The company is a brainchild of a team comprising of crypto evangelists, creative directors, risk managers, tech savvies, among other professionals. The rich and diverse talents are a real blessing to the company, especially in a dynamic digital world.

Aave Facts: What You Need to KnowAave attempts to solve some of the most pressing challenges in the financial industry especially the borrowing and lending sector by converting centralized financial services over to their decentralized equivalents. In this case, the interest earned from lending goes to the asset owner as opposed to normal financial systems where banks and lending institutions take up the interest earnings.

The Aave ecosystem allows everyone to lend and borrow crypto assets in a trustless and permissionless way, with the interest earned directly to the lender’s wallet. Lenders put their money into liquidity pools from which borrowers can borrow from. Each pool is backed by assets reserved to protect against volatility and lenders are able to exit the pool whenever they want.

The platform supports more than 20 cryptocurrencies although not all can be used as collaterals. Aave is open-source, audited, secure, allowing lenders and borrowers to interact with each other on a client interface, API, or through the smart contracts on the Ethereum network.

To borrow, borrowers must deposit enough credit, always more than the amount borrowed. The Aave protocol has a set collateralization ratio that borrowers much maintain. In case a borrower fails to meet the collateralization ratio, he can be liquidated by another user.

All assets deposited in the liquidity pool whether for lending or borrowing purpose earn interest which is paid out directly to their wallet in form of tokens.

How to Lend on AaveTo lend or borrow on Aave, users need to first connect a web 3.0 wallet like Fortmatic, Coinbase Wallet, and Metamask. Account-holders can then deposit funds into their wallet and lend to whoever they wish.

The deposited funds become part of the lending pool from where the owner can monitor the interest earned in real-time. Users are paid interest in the form of aTokens which represents a pro-rata claim on the underlying capital pool.

Aave PayAave Pay is a payment feature used by users in Europe to pay for everyday items using fiat currency. Aava completes the transaction based on the balance available in the user’s crypto wallet.

Users can take a loan through Aava and forward it to other bank accounts in form of fiat currency. This service is currently only available in the Euro countries.

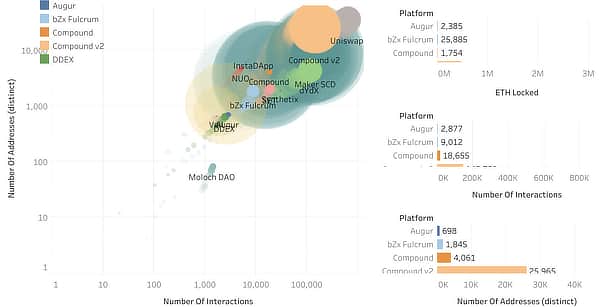

What Is Compound?Compound was launched in 2018 by a California-based company called Compound Labs, Inc. The decentralized lending platform allows lenders and borrowers to exchange crypto assets and earn interest for holding their assets in a liquidity pool.

The lending protocol uses audited smart contracts to store and manage the pooled capital. To connect to Compound, users need to have a web3 wallet where interest is paid in the form of cTokens.

Compound was initially a centralized lending platform but shifted to being decentralized between 2019 and 2020. In July 2020, the platform launched its governance token COMP, becoming the largest decentralized autonomous organization (DAO) and community-driven decentralized lending platform in DeFi.

Like Aave, Compound has a liquidity pool where lenders and borrowers contribute their crypto assets and earn interest.

Read also:

1Inch Exchange reviewDharma.io reviewPooltogether review: How does Pooltogether work? How Compound worksUsers can connect to the Compound lending platform with web 3.0 wallets like Coinbase Wallet, Argent, and Metamask. After connecting their wallets, users are directed to the Account Overview section from where they can select any market they wish to operate with and select their preferred assets. Account-holders can then lend or borrow the selected asset.

All listed assets are assigned unique Supply and Borrow APR that keep changing relative to demand and supply. Lenders earn interest in form of cTokens which represent claims to a portion of any given asset pool.

The borrowed amount is always immediately moved to the borrower’s wallet, who is also allowed to freely send to whoever he chooses. Lenders can redeem their cTokens any time after they are deposited in their wallets.

Supported Assets on Compound FinanceAssets listed on Compound include Bitcoin ($WBTC), Dai ($DAI), Tether ($USDT), Basic Attention Token ($BAT), and Ether ($ETH).

Things to Know About CompoundHere are a few quick points to note about Compound;

The platform has an in-built incentivization system hence users do not need to trust a third-party as the case with a centralized system where a bank or lending institutions bridge the gap between lenders and borrowers. It is blockchain-based making it inherently permissionless and transparent It is open-source, allowing developers to create their own apps. Risk-free and high-yield tool to store your coinsCompound is a bold step towards having a fully-functional cryptocurrency economy by encouraging easy movement and investment of crypto assets. Users can select between two Compound tokens; cTokens and COMP Coin.

While cTokens are used to facilitate interest accrual and other functions of the app, COMP Coin is a governance coin allowing holders to have voting rights on matters concerning Compound.

Compound also allows users to lend and borrow other types of coins including Dai, USD Coin, Ethereum, and Basic Attention Token. Although there are many benefits that come with Compound, its revolutionary is probably it’s for high APY yield farming. In addition to the regular interest payments, investors earn more money by acting as borrowers and lenders.

Aave Versus Compound: A Head-to-Head ComparisonGenerally, when it comes to features, functionality, and versatility of offerings, Aave is a better bargain compared to Compound. Here are a few features that set Aave aside;

1. A large number of assets; Aave offers a variety of crypto assets in its borrowing pool. In total, Aave offers 23 different crypto assets compared to 9 offered by Compound. The platform is therefore appealing to a large number of investors holding different cryptocurrencies

2. Aave offers higher borrowing amounts compared to collateral; borrowers on Aave can borrow more assets than their deposited collateral. Aave allows borrowers to borrow up to 75% of their total collateral compared to 66.6% allowed on Compound

3. Aave offers Flash Loans; Aave has attracted many borrowers with its short-term collateral-less loan service, called Flash Loan. Flash Loans is a growing trend in Decentralized Finance allowing borrowers to borrow crypto assets for a short period of time without committing any collaterals

How Aave Flash Loan worksAave’s Flash Loans works similarly to arbitrage in the normal financial industry. Arbitrage refers to the simultaneous buying and selling of the same asset in different markets in order to profit from price differences.

In centralized financial markets, instruments offered short-term use include Repos (repurchase- agreements), CDs (certificates of deposits), and Treasury Bills. For instance, traders may quickly buy or sell their crypto assets in order to profit from price differences on different cryptocurrency exchanges.

As opposed to most loans that are backed by collateral, flash loans are not secured. Flash loans rely on smart contracts built on the Ethereum network. The platform ensures that the borrowed assets do no change hands until all conditions are met.

The Aave aTokenAave is backed by two tokens, the “AAVE” token, and the aToken. AAVE token is a governance token while aToken refers to the value of the assets lent or borrowed on the lending platform. Lenders or borrowers are issued with aTokens equal to the listed crypto assets and is pegged at 1:1. It’s on aTokens that users earn interest on money lent out or money funds committed as collateral.

Ave Versus Compound: A Head-to-Head Comparison FeatureAaveCompoundTokens valueAave token has outperformed COMP since the start of 2021 and rose by 450%COMP has risen by a comparatively lower 240%Market sizeAave has a larger market cap of $4.2 billion. Aave’s fully diluted market cap is $5.4 billion.Compound has a market cap of $1.7 billion. Compound’s fully diluted market cap is $3.7 billion.Trading activityAave collects $184k in fees on average per week implying lesser activity compared to Compound.Compound collects $634k in fees per week implying more trading activities compared to Aave.Number of UsersAave has 39k usersCompound has 305k users Borrowing volumeAave commands 23% of the borrowing market or $489 million for Aave V1 and $341 million for Aave V2Compound accounts for a larger share of the borrowing market at $2.7 billion or 77% of the entire market.Innovation and diversityAave is more diverse with more than 20 different assetsCompound has listed only 11 assets. The Takeaway: Aave vs. CompoundWhile it is still in its infancy stage, DeFi lending and borrowing has taken off at high momentum and both Aave and Compound are leading the way by helping crypto holders earn from their stored assets. When the two platforms are compared against each other, Aave surpasses Compound in terms of innovation and execution. In addition, Aave is also more diversified with a variety of cryptocurrencies to choose from.

Compound has also undergone several security audits in recent days by leading companies like Trail of Bits and Open Zeppelin as it seeks to assure investors of the security of their funds.

The post Aave vs Compound: The Battle of DeFi Lending Protocols appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|