2024-5-31 10:39 |

Today, approximately $8.12 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are due to expire.

Market watchers are particularly attentive to this event due to its potential to influence short-term trends through the volume of contracts and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

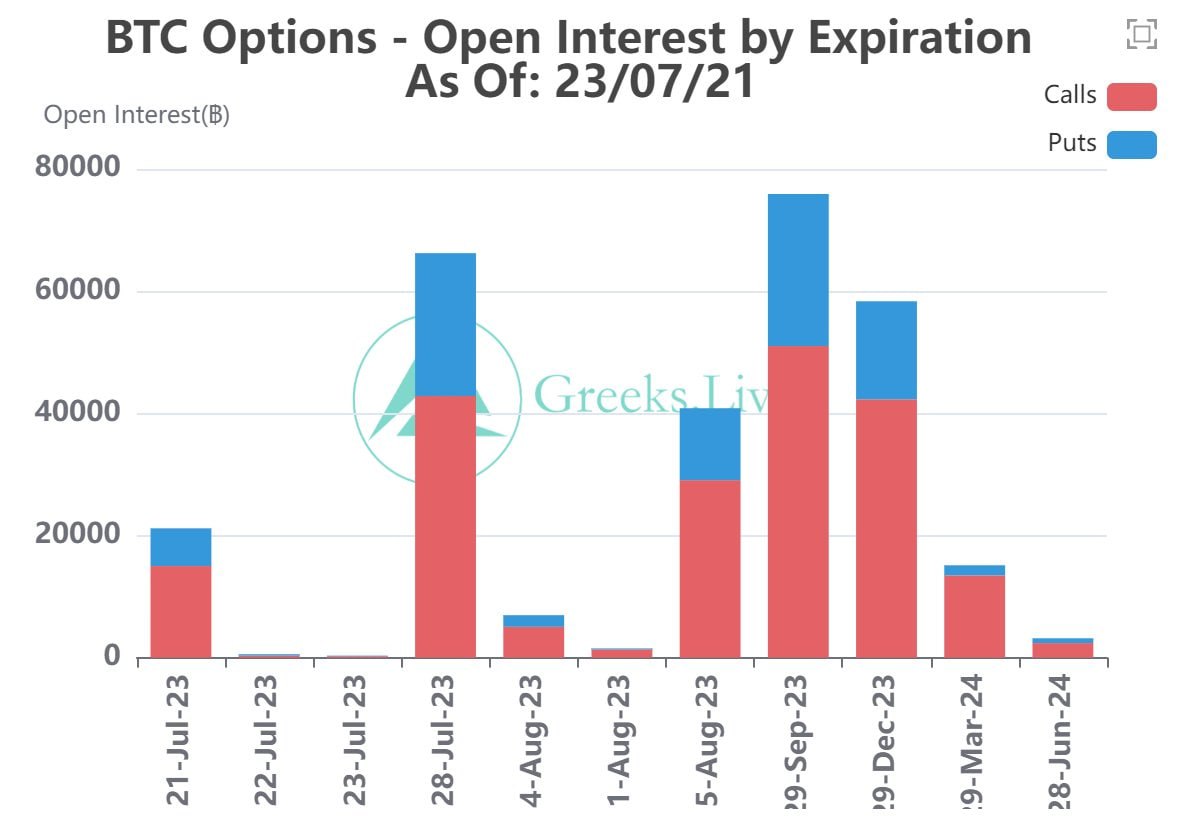

Insights on Today’s Expiring Bitcoin and Ethereum OptionsThe notional value of today’s expiring BTC options is $4.65 billion. According to Deribit’s data, these 261,390 expiring Bitcoin options have a put-to-call ratio 0.6. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $65,000. The maximum pain point is the price at which the asset will cause the greatest number of holders’ financial losses.

Read more: An Introduction to Crypto Options Trading

Expiring Bitcoin Options. Source: DeribitIn addition to Bitcoin options, 2,750,922 Ethereum options contracts are set to expire today. These expiring options have a notional value of $3.47 billion, a put-to-call ratio of 0.85, and a maximum pain point of $3,300.

The number of today’s expiring Ethereum options was significantly higher than last week. BeInCrypto reported that last week’s expired ETH options were 352,861 contracts, with a notional value of $1.33 billion.

Expiring Ethereum Options. Source: DeribitAhead of the expiration, options trading tool provider Greeks.live shared its insights into the options market. It suggested that market volatility is expected to remain low, making current conditions favorable for options trading with lower implied volatility.

“There are fewer macro events this week, and they don’t affect the macro market. The crypto world is dominated by the approval of ETH [exchange-traded funds] ETFs, but it’s unlikely that they will go straight through to listing, and less volatility is expected. Volatility in the crypto market has been dropping fast recently. [Implied Volatility] IV is dropping fast, and ETF funding and Block data is still worth watching,” it said.

Read more: 9 Best Crypto Options Trading Platforms

While option expirations can cause sharp price movements, the impact is usually temporary. The market generally stabilizes the next day, offsetting initial fluctuations. Traders should carefully analyze technical indicators and market sentiment before investing in this volatile environment.

The post $8.12 Billion in Bitcoin and Ethereum Options Expiring Today: Market Impact appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|