2019-5-30 08:30 |

Crypto Trading Dominated By OTC

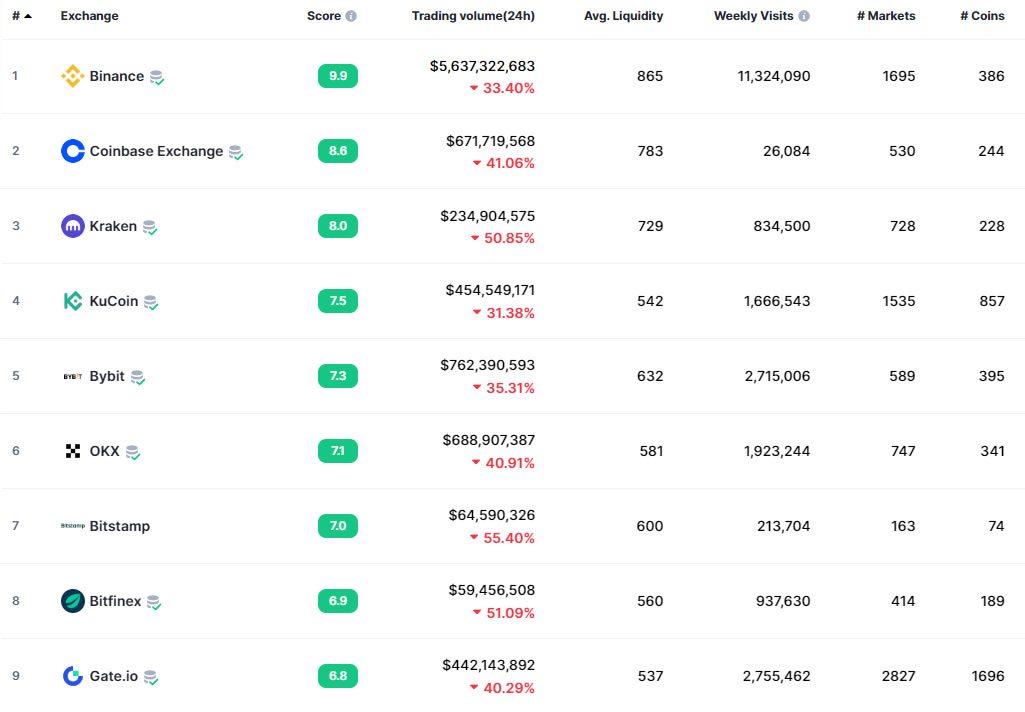

Although you think Binance, Coinbase, and its ilk are big for Bitcoin (BTC) and crypto trading, these platforms don’t make up the entire market. In fact, a new report suggests that up to 60% of the entire cryptocurrency market is comprised of over-the-counter (OTC) desks and dark pools, a sign of a maturing market in the eyes of some commentators.

Per The Trade, which cited a report from Aite Group, 60% of all cryptocurrency trades executed in 2018 were OTC, up from the 32% registered in 2016. This and the fact that exchanges have seen “narrowing spreads and opportunities for simple linear arbitrage vanishing”, according to the report’s author, suggests that Bitcoin is maturing as an asset, as are all other digital assets.

While opinions vary on where this OTC volume is coming from, it is widely agreed that many Chinese investors are behind cryptocurrency interest. Despite the fact that Bitcoin trading is technically banned in the nation, the middle and upper class have managed to skirt around rules, specifically to either get their money out of China, or invest in more risky assets like BTC for a chance to grow their capital.

As Qiao Wang of Messari notes, he has a growing belief that “the largest Bitcoin market in the world is OTC in China.”

I have a growing belief that the largest Bitcoin market in the world is OTC in China.

This market is incredibly opaque, and that's what makes analysis of relationships between macro and Bitcoin so difficult.

Highly recommend this Bitmex piece on China: https://t.co/HlJqlofX2z

This would corroborate the theory that the Chinese and cryptocurrency markets are still inextricably linked. As reported by Ethereum World News previously, Garrick Hileman, the head of research at industry startup Blockchain.com, told the SCMP that his team, sees a “strong inverse correlation” between the Chinese Yuan (Renmenbi) and Bitcoin. He does add that Blockchain.com can’t be “100% certain that Bitcoin’s recent price increase is being driven by trade tensions”, but subsequently noted that the Yuan has traded inversely to the RMB in the past.

Why OTC, Institutions Will Boost BitcoinAll this lends to the idea that institutions are getting into the Bitcoin industry, which analysts say bode well for the cryptocurrency markets.

As Andy Cheung, OkEX’s head of operations, suggested in a recent email, “$20,000 is a conservative prediction” for Bitcoin to reach in 2019, as institutional backers should boost this space to new heights.

Naeem Aslam of Think Markets agreed. In a comment obtained by MarketWatch, the analyst remarked that Bitcoin’s has strong upside momentum due to strong technicals and the fact that institutions are rushing back into cryptocurrency, boding well for the current rally.

And most recently, Sonny Singh of BitPay, explained that the recent rally is “just the tip of the iceberg”, as the cryptocurrency space is being backed by some of the biggest names in technology and finance, like Fidelity Investments and Facebook.

Photo by Chris Liverani on UnsplashThe post 60% Of Crypto Trading Reportedly OTC, Bodes Well For Bitcoin (BTC) Boom appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|