2023-6-12 10:15 |

The world’s leading crypto exchanges are seeing trading volumes slumping across the board. Moreover, the fallout from America’s war on crypto exchanges appears to be affecting them all.

All top crypto exchanges have experienced severe declines in trading volumes over the past 24 hours. However, weekends are usually quieter on crypto markets, and the data may not be all that bad.

Crypto Exchange Volumes PlungeBillions left centralized exchanges last week in the wake of twin lawsuits and heavy-handed enforcement action by the U.S. Securities and Exchange Commission.

However, the recent fall in volumes may be seen as a positive since the exchange exodus appears to have abated.

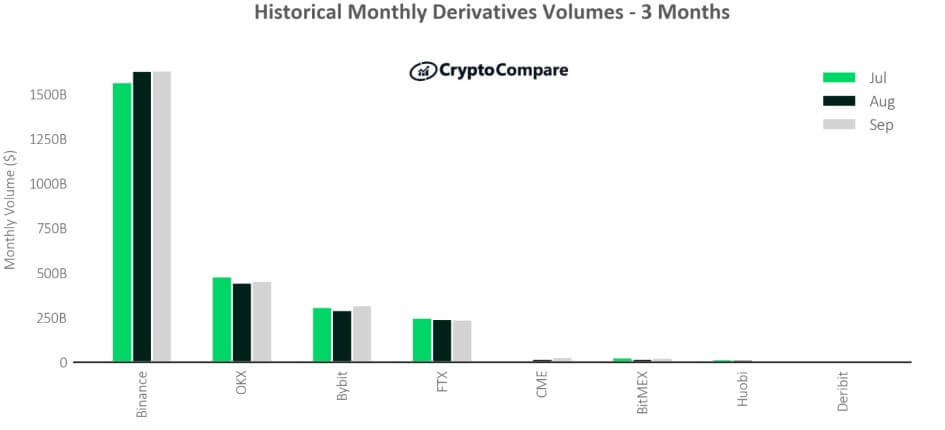

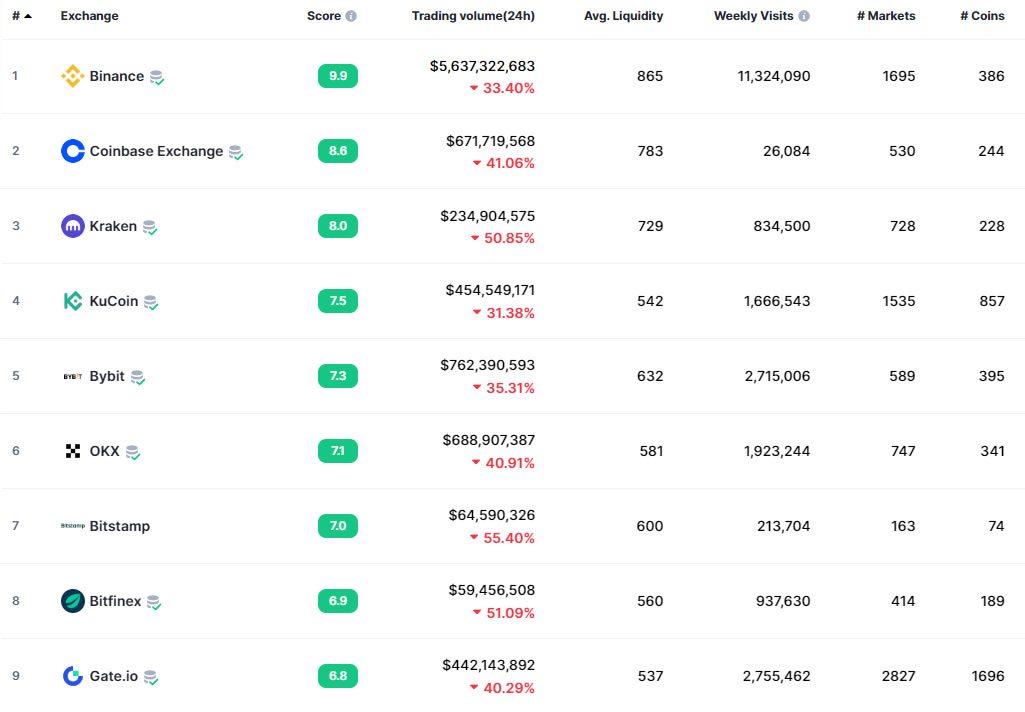

According to CoinMarketCap, crypto exchange trading volume for the top nine exchanges has fallen between 30% and 55% over the past 24 hours.

Trading volume on Binance has declined 33.4% to $5.6 billion, with BTC/USDT being the top traded pair with 23.3% of that total.

Furthermore, Coinbase, also sued by the SEC, has seen a decline in 24-hour volume by 41%. It also saw a spike in staked Ethereum redemptions as fears over its staking services mounted last week.

Kraken, Bitstamp, and Bitfinex Volumes had slumped by more than 50%.

Top crypto exchange trading volumes. Source: CoinMarketCapAdditionally, Binance has seen significant outflows over the past seven days. According to Glassnode, its BTC balance has declined by 5.7% or around $1 billion in Bitcoin since the SEC action last week.

However, this loss is tiny compared to the outflows that followed the collapse of FTX in November.

Find out which are the top five spot trading exchanges:

Top 5 Spot Trading Crypto Exchanges

Over the weekend, Binance CEO Changpeng Zhao cautioned investors not to read too much into exchange outflow figures. Many analytics platforms use the TVL (total value locked) metric, which includes decreases in crypto asset prices.

DeFiLlama, for example, states that there has been an outflow of $3.4 billion from Binance over the past week. However, the crypto market cap has declined by over $80 billion over the same period, so its data is slightly skewed.

Binance TVL fell 13.8% from $64.2 billion to $55.3 billion on June 11, but that does include declines in crypto asset values.

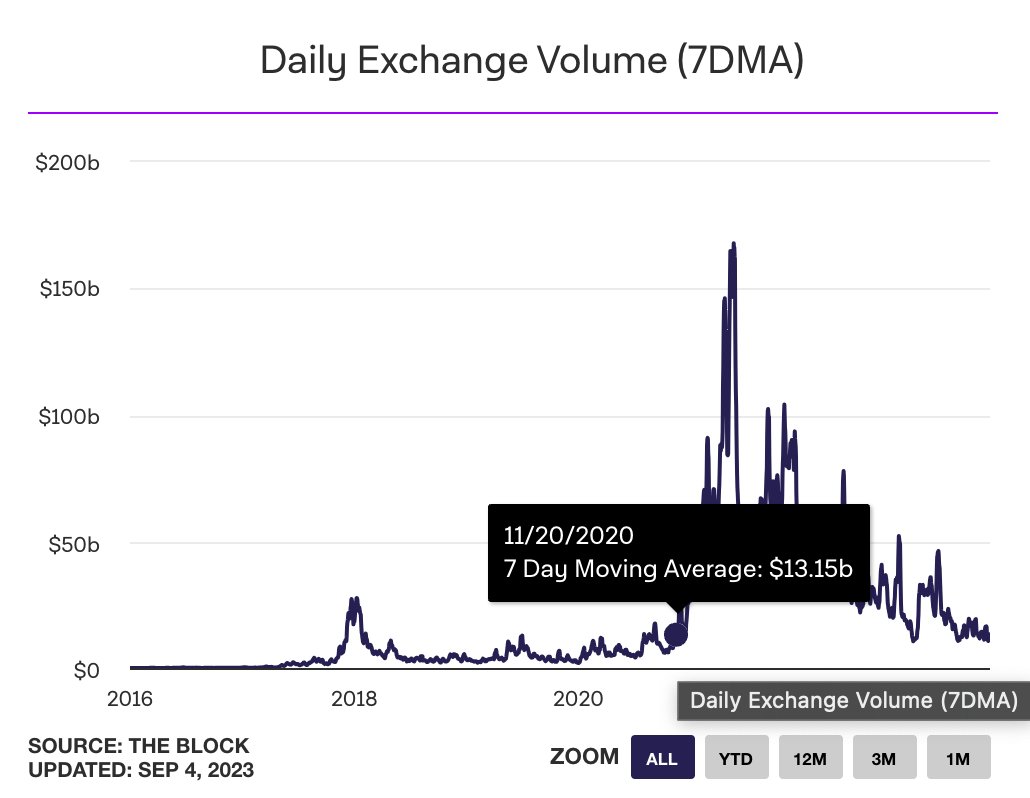

Volumes Return to ‘Normal’On June 12, CoinMarketCap reported a daily volume of $26.4 billion. This is about half of the $54 billion daily trade volume recorded on June 6 when panic gripped markets.

Total trading volumes have returned to where they were before last week’s double exchange whammy from the SEC.

The sell-off has abated, and total capitalization has remained mostly flat over the weekend.

The post Major Crypto Exchange Trading Volumes Slashed By Over 30% appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|