2021-5-12 15:43 |

There are few things more aggravating than a delayed Bitcoin transaction. Prevention is better than cure, so never skimp on the miner’s fees if you need your transactions to happen quickly. Incentivize the miners to prioritize your transaction by making it worth their while, and this problem should never occur.

If your transaction does end up in a mempool waiting to be picked up by the miners, it will eventually be returned to sender after about 2 weeks. I have never put this to the test, and anyway, who wants to wait around for 2 weeks? Here we discuss the solutions to stuck Bitcoin transactions and take a look at how to expedite them efficiently.

Here Is How You Can Accelerate Stuck Bitcoin TransactionsThere are several solutions to the problem, depending on the situation. Are you the sender or the receiver, or both? For sending transactions, you can use a Bitcoin transaction accelerator or increase the fees using RBF (ReplaceBy Fee).

For receiving transactions you can employ the Child Pays For Parent method (CPFP). This is especially useful when you are sending Bitcoin to yourself, for example when withdrawing Bitcoin from an exchange to your private wallet.

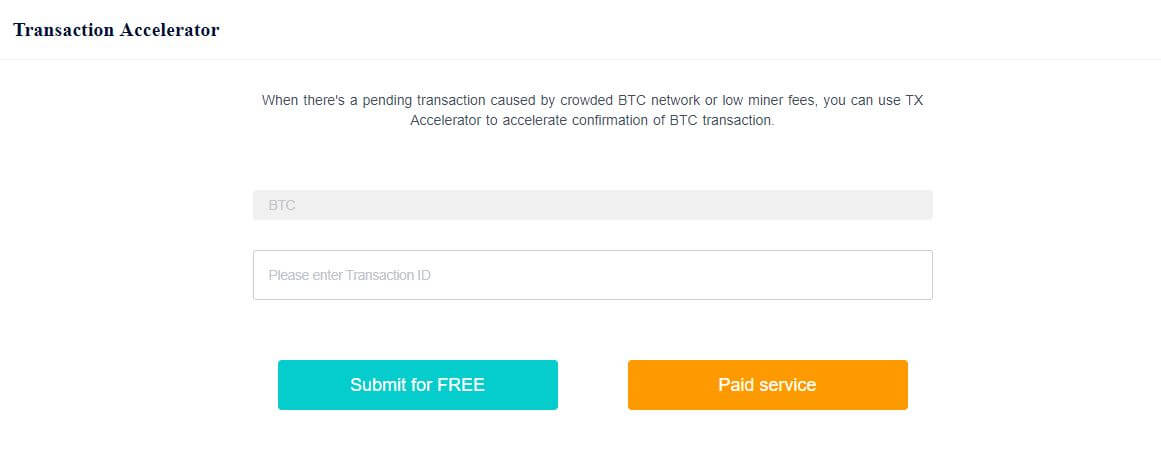

3 Best Bitcoin Transaction AcceleratorsSome of these off-chain services are offered by miners and will include your transaction in their upcoming block to ensure it’s processed immediately. Others will re-broadcast your transaction to multiple nodes in the hope that it will be confirmed on the Blockchain sooner. There are both free and paid services, and my top choices are Viabtc.com, BTCNitro.com, and Bitcoin.com.

ViaBTCThe simple process involves visiting www.viabtc.com/tools/txaccelerator and inputting your transaction I.D. For the free service, the transaction must already incorporate a minimum miner’s fee to be added to the list of transactions waiting to be serviced. ViaBTC can handle 100 transactions per hour, so if it’s not picked up the first time, resubmit it at the start of the next hour and keep your fingers crossed.

There’s also a paid service for which you will need to set up an account with ViaBTC. The fees are paid in Bitcoin Cash (BCH), so make sure you have enough in your ViaBTC wallet. This guarantees your transaction will be prioritized into the next available block they hash.

BTC Nitro.comThis is a similar service that is free to the user. BTCNitro.com will rebroadcast your transaction to 15 full nodes, reducing the amount of time it’s stuck in the mempool. Although this service is free to use, it’s funded by donations and the operators request that you do not use ad-blockers. That might be a problem for some people.

Privacy is a key facet of decentralized cryptocurrencies, so BTCNitro doesn’t ask for personal details or require you to sign up or register an account. For transactions that are not time-critical, a cost-effective strategy is to send a payment with deliberately low miner’s fees and instantly accelerate it using BTCNitro.com. It’s worth a try, especially if you are making a lot of smaller transactions.

Bitcoin.comSimilar to ViaBTC, Bitcoin.com offers an accelerator that can be paid in BitcoinCash (BCH) and can be accessed at https://pushtx.btc.com. Sign up to view information on transaction history and confirmation notifications. To know how much to pay in fees, you can visit their page at https://btc.com/stats/unconfirmed-tx. At present, the current top transaction fees are quoted at 30 Satoshis per Byte or 0.0003 BTC per KByte.

Replace By FeeAnother way to expedite stuck transactions is RBF (Replace By Fee), from an RBF-enabled wallet like Electrum. This method replaces a transaction sent with low fees with one that has higher fees, to have it confirmed quicker. This is only possible up until the transaction has been added to a block.

If you are not in a hurry, it’s a good strategy to send your transaction with low fees and see if it gets picked up from the mempool. If not, you can up the fees whenever you feel the need for speed. This is a way of managing both transaction timing and costs.

There’s a danger here that a vendor might receive a transaction I.D. and ship goods to a customer. At this point, the purchaser could replace the receiving address when they increase the fees and redirect the payment back to their own wallet. This is possible right up until the point that the transaction is confirmed on the blockchain, which may take some time if the transaction fee is low enough.

The Electrum wallet has a feature that indicates whether a transaction is “Replaceable.” If it is, the vendor should wait until it has been confirmed on the blockchain before they ship the goods. Better still, insist that the sender disables RBF on their wallet. You will be able to see the “Replaceable” status of a transaction in your Electrum wallet.

Read also:

How to buy Bitcoin anonymouslyHow to buy Bitcoin with credit cardHow to buy Bitcoin with gift cardHow to buy Bitcoin with prepaid cardsHow to buy Bitcoin with iTunes gift cardHow to buy bitcoin with VISA Gift Card?How to buy bitcoin with SkrillHow to buy bitcoin with eCheckHow to buy bitcoin & crypto with Google PayHow buy bitcoin as a minor?Can you buy a fraction of bitcoin?How long does a bitcoin transaction take?How to cancel a bitcoin transaction Child Pays For ParentIf you are receiving a Bitcoin payment that is not moving quickly enough, you can use CPFP (Child Pays For Parent). The scenario starts the same way – you have a transaction sent with an inadequate fee that’s not being processed by the miners.

The strategy is to make a further transaction that relies on the initial transaction as an input (See UTOXs below). To verify the second transaction’s input is valid, it – and therefore the initial transaction – must be processed first.

If the fees are attractive enough for the second transaction, the miners will add both transactions to the next available blocks. They’ll take a hit on the low fees for the first, ‘parent’ transaction to get paid the larger fees for the second, ‘child’ transaction.

This is useful when you are receiving funds that were not sent by a person. For example, if you withdraw from an exchange to your wallet, you can’t call them up and ask them to send the transaction with a higher fee. But you can make a transaction that depends on your wallet receiving the withdrawal first.

CPFP is controversial because it involves attempting a cheeky double-spend, which makes no-confirmation transactions untrustworthy. It works, though, and some of the most popular wallets support it. Maybe whatever you have to do to get a transaction moving is fair game.

What Are Unspent Transaction Outputs (UTXOs)?When writing a crypto article, I always run it past my mom to make sure a total noob understands what I am trying to explain. Don’t get me wrong, my mom (The Crypto-Grandma) is a smart lady, but this one had her properly flummoxed for a while.

She got it eventually, so here goes nothing…

Rather than having an account balance, the UTOX model ensures that any change due from a transaction is created afresh and sent back to your wallet at a change address. The initial coin is destroyed, and this total value is split among the various outputs as newly created coins. Part of it goes to the recipient and the rest back to you,

The golden rule is that total transaction input must equal total transaction output for it to be processed as a valid transaction. If I buy something for 17 dollars and hand over a 20, I will get 3 dollars in change. 20 in = 17 + 3 out. When I spend my Bitcoin they are destroyed and new Bitcoin is created and outputted – some to the recipient and the rest back to my wallet change address. The total amount must be accounted for.

Why on earth would they do this? The alternative model is the Account/Balance Model, used by Ethereum. Ether is debited from my account and credited to the recipient’s account. To operate as a truly decentralized platform, this model would involve maintaining a list of all confirmed account balances in all wallets on all nodes – forever. UTOX requires merely a confirmation that the last block contained only valid transactions. It’s way more efficient.

UTXOs are a critical part of the Bitcoin protocol to avoid double-spending and ensure no coins are created or destroyed. But as we can see, it does lead to the bug/feature of Child Pays For Parent.

I will leave it there because this article is no fun anymore. You don’t need to know any of this UTOX stuff to use Bitcoin, but go to Youtube and check out the full story. Take care to pause and watch cat videos every 10 minutes, or your brain might melt.

Jargon Buster UTXOs – Unspent Transaction Outputs – An blockchain accounting system that prevents double-spend and ensures transaction efficacyTransaction I.D / Transaction Hash – The unique code that identifies your Bitcoin transactionMempool – Memory Pool. A ‘waiting room’ for transactions on a node, yet to be confirmed on the blockchainRBF – Replace By Fee. A method of increasing the miner’s fee to facilitate a faster transactionCPFP – Child Pays For Parent. A method of encouraging a miner to process an old transaction by paying larger fees for a transaction that is dependent on it This Really Happened…Back in the heady days of the last bull market, transaction fees varied from unreasonable to outrageous. After some investigation, I discovered that the fastest and cheapest network for sending crypto was… wait for it… DogeCoin. Think what you like about meme-coins, but DogeCoin was my go-to cryptocurrency when the Bitcoin network was overwhelmed and I needed to send crypto to myself or my friends.

It’s a shame I didn’t hang onto any of them. It has since 100x’ed.

The post What To Do If Your Bitcoin Transaction Gets Stuck – Accelerate BTC Transaction appeared first on CaptainAltcoin.

origin »Data Transaction Token (XD) на Currencies.ru

|

|