2020-1-7 23:30 |

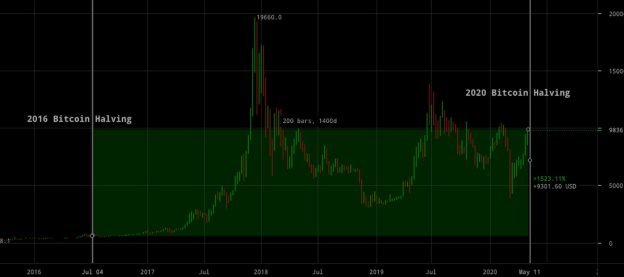

Bitcoin reward halving is just about four months away and the market is divided on if it is already priced in or we would see sparks flying yet again.

Amidst this heating up debate, the crypto research company Skew sheds some light on this from the options market point of view.

Whether or not the halving is already priced in, it has been claimed that some volatility in the spot price should be expected around the upcoming halving scheduled on May 13. This is because the market will be making adjustments to the sharp decrease in the natural supply from miners.

The third reward halving will cut down miners’ reward from 12.5 BTC to 6.25 coins. Bitcoin’s inflation rate will also drop from the current 3.69% to 1.80%.

Kink in Implied Volatility will DetermineTo determine if the event is priced in, Skew analyzes the implied volatility of the crypto asset that exhibits a “kink”. Traders it says can trade an implied move by using “option calendar spread.”

Implied volatility is the market's prediction of a likely movement of an asset’s price which is calculated using supply/demand and time value. High implied volatility results in options with higher premiums while the lower implied volatility in lower premiums on options.

In bearish markets, implied volatility increases while in a bullish market, it decreases.

No Such Kink, At least not at the right timeThe Bitcoin options market, however, finds no such kink in the implied volatility structure for the options contracts expiry in June 2020, closest and relevant to halving date.

This means the options market does not anticipate any increased volatility around the upcoming halving event.

Source: @SkewdotcomThe kink in the BTC options chart occurs in the March 2020 expiry which means the market anticipates heightened relative volatility months before the halving event, in Q1 of 2020 instead of Q2 of 2020.

If the turmoil for this event is actually anticipated by the options market, one would expect to see higher forward volatility for Q2 2020 in comparison to the rest of the forward volume curve, argues Skew.

This the company says means either the BTC options market believes the having is already priced in or it is a “very inefficient” market.

Bitcoin (BTC) Live Price 1 BTC/USD =$7,918.0083 change ~ 6.74%Coin Market Cap

$143.68 Billion24 Hour Volume

$5.29 Billion24 Hour VWAP

$7.61 K24 Hour Change

$533.5415 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");Similar to Notcoin - Blum - Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|