2020-5-10 19:09 |

The halving is almost here.

Bitcoin block reward halving occurs once every four years. This third such event will result in the bitcoin emission rate cutting in half to 900 BTC per day from the current 1800 BTC a day.

However, there can only be 21 million bitcoin that will ever exist, the only major tradable asset with a supply cap. This helps bitcoin retain its purchasing power especially in a world where fiat currencies with unlimited supply are losing their value fast.

This halving is also the remainder of the leading digital currency’s hard money characteristics.

No major impact from only supply sideBut the speculation around price is just as strong with people debating the decrease in emission rates tends to push bitcoin prices up because post halving there will be less sell pressure from miners. BlockTower explained in its latest newsletter.

“While this may have been true in the past due to the large amount of emission relative to outstanding supply, the reality of the current situation is that there is regularly $1b in Bitcoin volume and a decrease of $9m of sell volume is negligible on a day to day basis.”

“From a pure supply side look, the halving doesn’t have a major impact.”

But this reduction in new supply issuance combined with the stability of new demand will lead to “a steady upwards drift on price.”

Search interest on Google for the term “bitcoin halving” has already jumped to its all-time highs.

What happened the last two times?After leading 2019, the best performing asset class in 2020 with over 30% returns, bitcoin is beating gold and Treasuries that are up an impressive 21% and 13% gains respectively.

According to Fundstrat’s Tom Lee, the upcoming halving along with the macro investor Paul Tudor Jones buying bitcoin are “a solid set of tailwinds.”

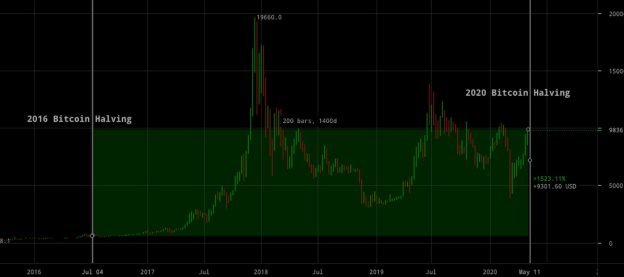

Historically, halving has resulted in bull runs. In 2012, pre-halving, bitcoin price jumped 663% and post halving it gained over 3400%.

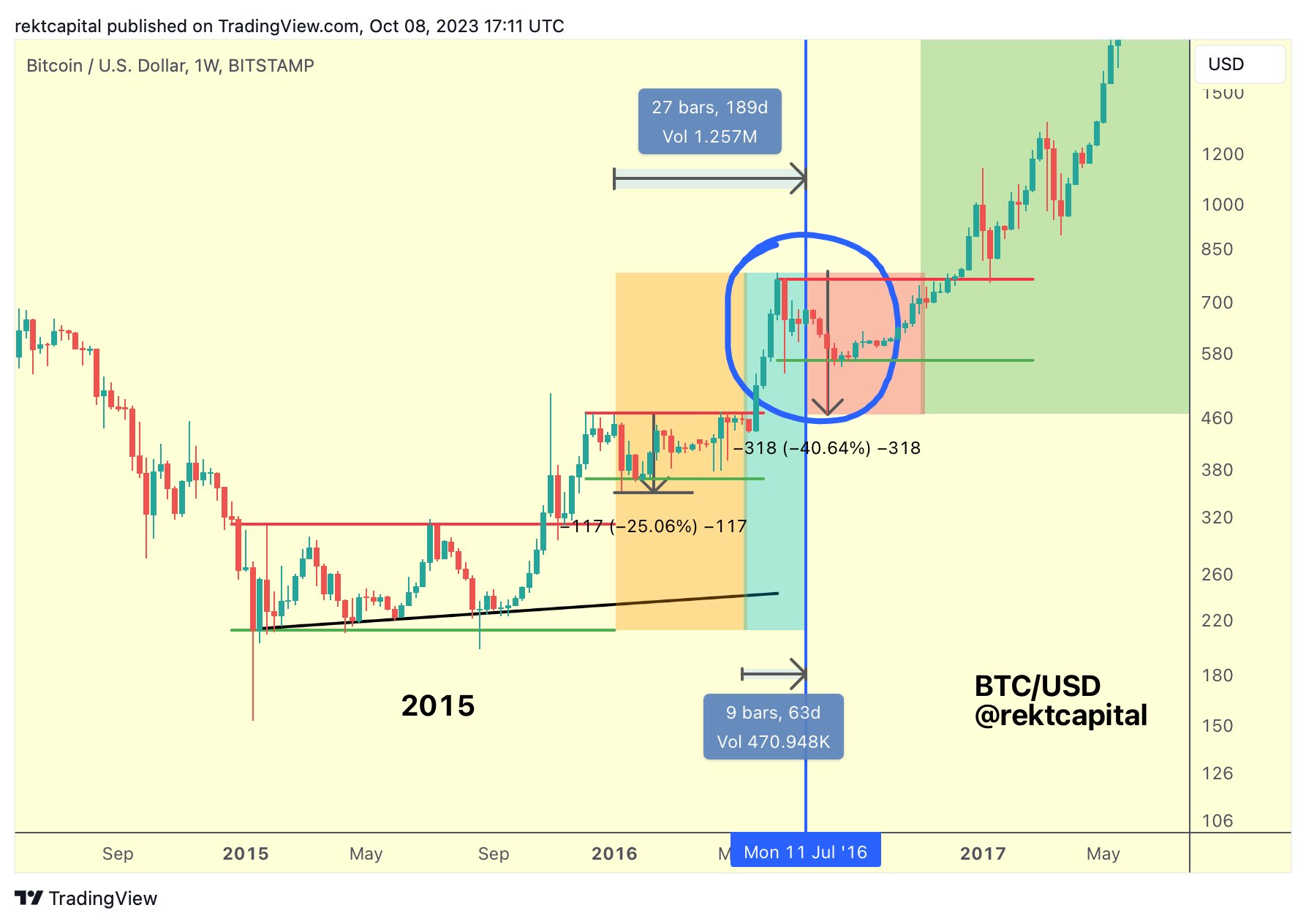

Before the second halving, BTC spiked 383% and post halving, the returns were of 4,080%. However, during the last 2016 halving, the price of bitcoin remained steady for over a month which was followed by a strong correction. The bull run didn’t come two months after that.

This time, Bitcoin has rallied over 340% since December 2018 bottom. But these low returns could actually be a good thing as analyst Rekt Capital pointed out, “if bitcoin rallies less pre-Halving, then it will rally more post-Halving.”

Moreover, most of the exponential growth actually occurs after the halving.

“The bitcoin halving is a key catalyst to beginning a new Bitcoin bull market,” and BTC “rallied between 12,000%-13,000% in each of its halvings to date,” noted the analyst.

On the other hand, although the reduction in supply is relatively negligible, halving is working as a strong marketing tool for bitcoin because of being in stark contrast to the greatest monetary expansion experiment in history.

“With much of the world staring down the barrel of potential inflation, currency crisis (such as in Lebanon) and global instability — this becomes an undeniably attractive opportunity to take a look at a truly scarce asset as a hedge.”

origin »Bitcoin (BTC) на Currencies.ru

|

|