2020-6-25 13:15 |

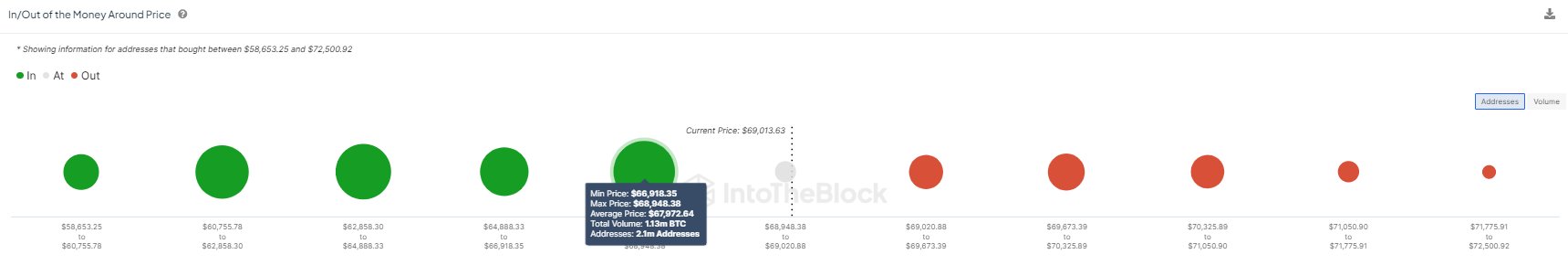

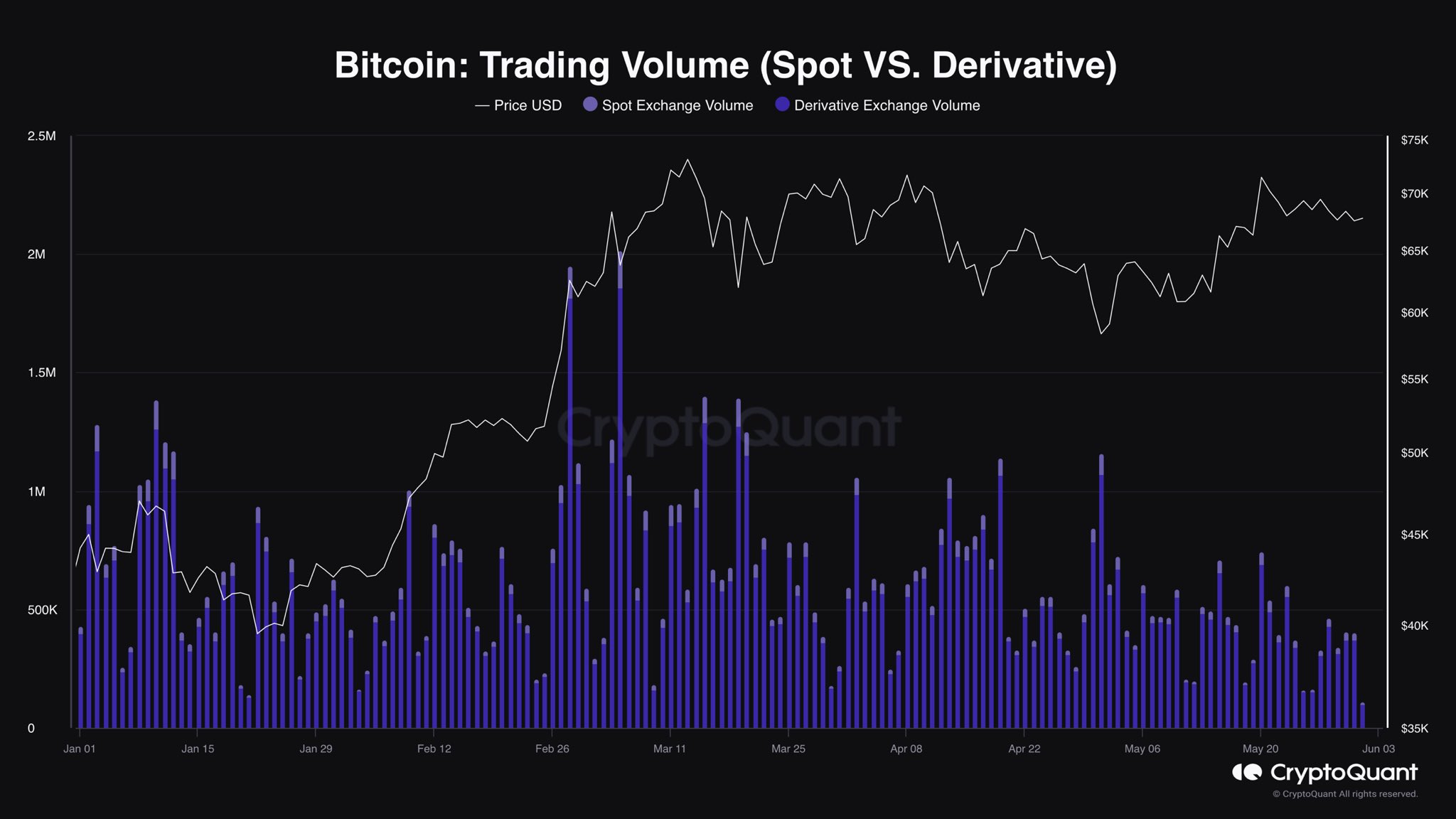

In recent weeks, much of the Bitcoin that whales have been piling up has been steadily removed from the exchanges where they were bought, and moved to private wallets. In the past, whales have made moves like this prior to bull runs, so the whale exodus from exchanges could mean a significant bull run is about to arrive.

Ki-Young Ju, CEO of the blockchain analysis company CryptoQuant, thinks that the large volume of BTC leaving exchanges is a sign that a big move in price is coming.

The idea is that whales are moving their funds to more secure wallets. Exchanges can be subject to hacks and even the most reputable cryptocurrency exchanges are not 100 percent secure. And of course, moving the coins is an indication that the holder won’t be selling imminently.

His advice for the coming months can be broken down pretty simply.

“BUY #BTC when whales send bitcoins out of the exchange.”

In terms of a timeline, Ki Young Ju uses past history as a guide.

“The BULL market usually starts four months after the exchange average withdrawal hits year-high.”

According to Ki Young Ju, Bitcoin whales use the mere movement of coins to impact the price of digital assets.

“In my opinion, the whales seem to sell #BTC when the exchange is quiet and get attention from other investors by using price plunge.”

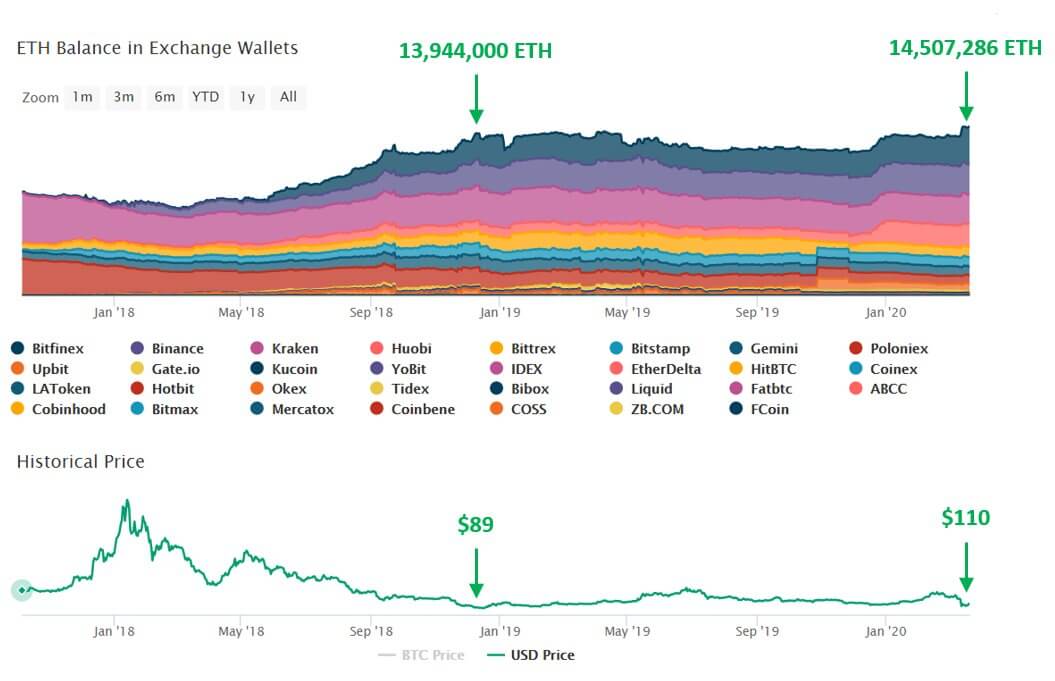

Other studies have acknowledged these coin movements as well. Data from Santiment, a blockchain analysis company, shows that the amount of Bitcoin held on centralized exchanges is currently at a multi-year low. In fact levels have not been this low since May 2018. And the amount of Bitcoin held on exchanges is down 40% from its all-time high in February of this year.

The last bitcoin halving event was a catalyst for people buying Bitcoin. And it was definitely part of the reason Bitcoin experienced big growth a few months back. The halvings have historically driven bull markets, so as whales anticipate the coming increase in value it makes sense that they are ensuring their assets are more secure.

Part of the beauty of Bitcoin is the fact that the community can monitor the movement of these whales. As time passes and we build bigger samples, this information will only become more valuable and helpful in allowing us to predict the future behavior of the cryptocurrency markets.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|