2018-10-11 17:00 |

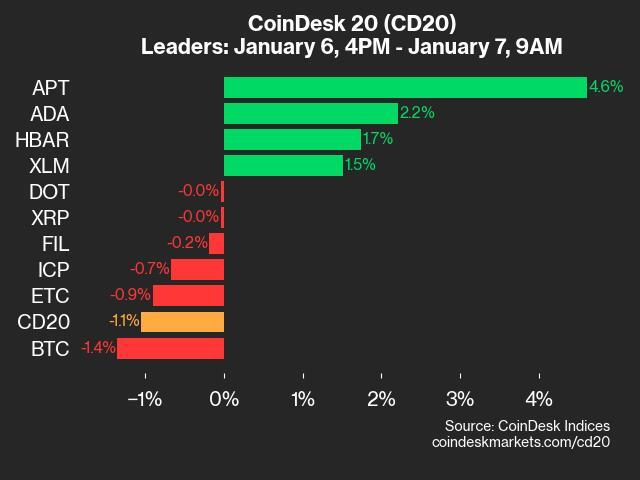

Bitcoin (BTC) held its ground when the stock market plunged deep into the red yesterday. Both the S&P 500 and Dow Jones Industrial Average registered significant drops. However, Bitcoin (BTC) remained unaffected by it. Today, the stock market registered heavy losses again. This time Bitcoin (BTC) seems to have succumbed to the global market pressure. The decline, shown by the above 4H chart for BTC/USD, was a sharp one. The price nosedived below the triangle and has yet to show any signs of a reversal. Bitcoin (BTC) and the stock market have little in common at this point. The current value of Bitcoin (BTC) is based mainly on the cost of mining one Bitcoin (BTC). However, for the stock market, it is based primarily on speculation. Most big stocks are way overbought at this point.

It is likely that the stock market may continue to fall further. A crash however is not likely in the near future. Bitcoin (BTC) seems to have danced to the tune of the stock market today, but this does not seem to last for long. The reasons behind a loss of confidence in stock market have absolutely nothing to do with Bitcoin (BTC). On the very contrary, Bitcoin (BTC) is supposed to be the perfect hedge against a market crash in the future. A recent survey conducted by Fundstrat asked institutional investors how they thought cryptocurrencies will behave during a market crash. A vast majority of them answered that the cryptocurrency market will benefit off a crash in the stock market.

Chart for BTC/USD (1D)

We have seen Bitcoin (BTC) linked to the stock market sometimes due to its speculative nature. Yet at other times, it is linked to commodities as it practically is one. It cannot be both at the same time. It is not a stock. Yet people keep talking about a Bitcoin (BTC) bubble about to collapse. There is no Bitcoin (BTC) bubble. The stock market has been in long term bear markets and bull markets. Bitcoin (BTC) on the other hand has only been in a long term bull market. All the short term bear trends that we see can be termed minor corrections in the grand scheme of things. Bitcoin (BTC) has crashed a hundred times in the past and every time people try to look for ‘easy reasons’.

The whales or big institutional investors being aware of this, dump Bitcoin (BTC) at a time when people can find an easy reason. When the stock market crashed yesterday, the whales were not prepared to pull off this trick. However, today they were prepared. So, when the S&P 500 fell today, they dumped some Bitcoin (BTC) on exchanges and the price nosedived. Now, an amateur investor would think why would these people want to dump their Bitcoin (BTC) at the bottom? The answer is, when the volumes are this low; all it takes is a couple of million dollars to trigger some panic selling. As the price falls to $6,000, they keep buying on over the counter (OTC) markets without affecting the price. After that, they pump some on an exchange to push the price up. All of this is very easy to do when the volume is this low.

googletag.cmd.push(function() { googletag.display('div-gpt-ad-1538128067916-0'); });The post Has Bitcoin (BTC) Finally Succumbed To Stock Market Pressure? appeared first on Crypto Daily™.

origin »Bitcoin (BTC) на Currencies.ru

|

|