2020-9-27 05:00 |

Uniswap’s UNI token has seen its price stagnate in the time following its rebound from lows of $3.75. Shortly after being announced, the token gained listings on a plethora of exchanges, including Coinbase, Binance, and others.

Some trading platforms like FTX even listed perpetual swaps for the token, with the trading frenzy surrounding its launch sending its price from lows of $1.00 to highs of $8.50.

These highs were only tapped for a brief moment, as the token’s price subsequently plunged all the way down to the $3.00 region.

UNI is likely to see continued growth when it comes to its liquidity, as it just garnered a listing on Gemini.

As for what could come next for Uniswap’s governance token, many investors are now awaiting revelations regarding V3 of the platform before increasing their exposure.

Regardless of when V3 of the decentralized exchange launches, UNI may be primed to see some short-term upside due to the extremely negative funding rates seen across the board.

Uniswap’s UNI Token Garners Gemini ListingUniswap’s UNI token is one of the few cryptocurrencies that has garnered listings on multiple major exchanges within one hour of launching.

Coinbase, Binance, FTX, and other platforms all added spot trading or perpetual futures trading for the token, which added fuel to the fire and helped its price rally as high as $8.50 – marking an over 900% surge from its post-launch lows.

Today, Gemini announced that they too are adding support for the token, making it now readily available to retail crypto investors no matter which exchange they use.

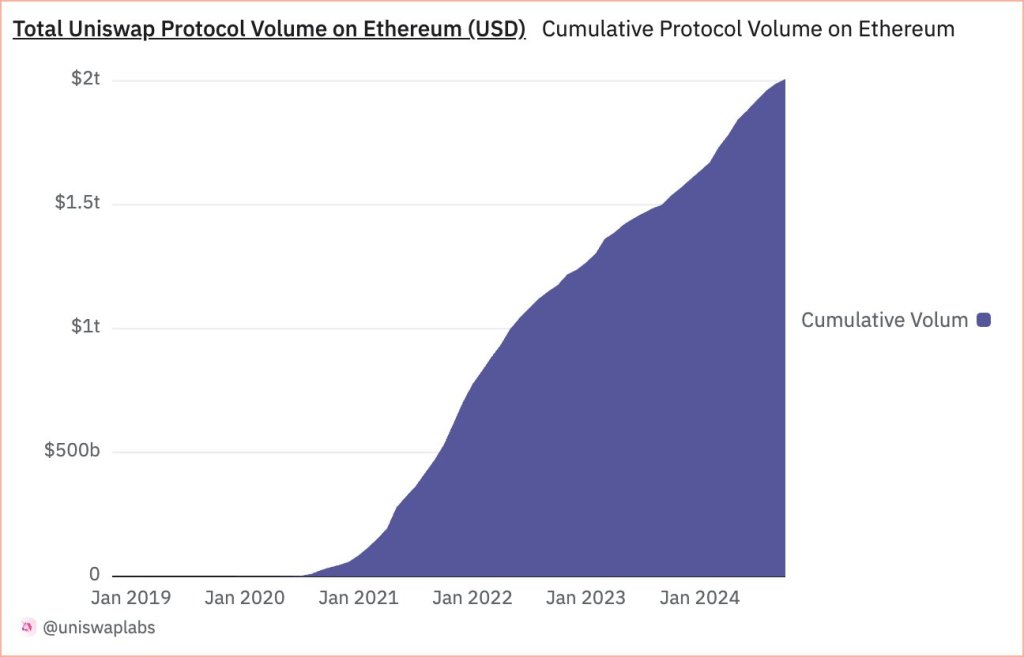

What Could Come Next for UNI?The next couple milestone events that could help boost the Uniswap token’s price action are the implementation of fee distributions to token holders – which is something that will have to be voted through – as well as the potentially imminent release of Uniswap V3.

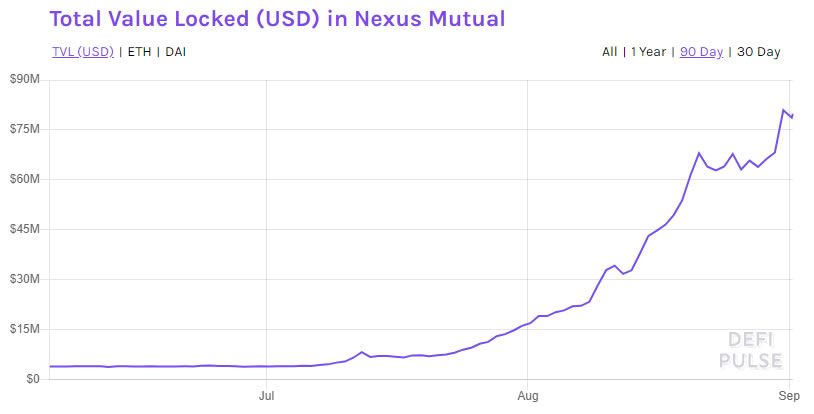

The third version of the platform will allow users to tap into a plethora of new features and could spur further adoption of the platform.

In the short-term, one technical trend that could allow UNI to push higher is negative funding rates for its perpetual swaps. One trader explained:

“Listen, I can’t look into the future so IDK if UNI is going to pump or not. But if you are shorting this with leverage then you are batshit insane. That’s for sure.”

Image Courtesy of Byzantine General.Because traders are disincentivized from shorting the cryptocurrency, this could lead to an inflow of buy-side pressure.

Featured image from Unsplash. Charts from TradingView. origin »Bitcoin price in Telegram @btc_price_every_hour

Waves Community Token (WCT) на Currencies.ru

|

|