2022-6-26 19:45 |

Uniswap is once again hogging the headlines following the token’s comeback in the wake of optimistic signs that the bear market may be winding down.

In the past week, UNI, its native token, has seen enormous growth, as the decentralized exchange’s trading volumes have rivaled those of Ethereum, the blockchain on which it is constructed.

Multiple news agencies stated that Uniswap had exceeded the Ethereum network in terms of transaction fees. The flagship DEX collected more than $4 million, surpassing the second-largest blockchain.

UNI increased by roughly 45 percent in the last week, reaching $5.46, its highest level in more than three weeks.

Uniswap Making Northbound TrajectoryThe biggest DeFi exchange has been trending upward since the beginning of the week. Looking at the price trend over the last few days, it appears that UNI’s main objective is to close June on a positive note.

In addition, the stockpiling of UNI tokens by whales is a significant component in the token’s price bump.

After a debilitating first half of the year, rising fees on Uniswap may be an indication that the DeFi market is beginning to recover.

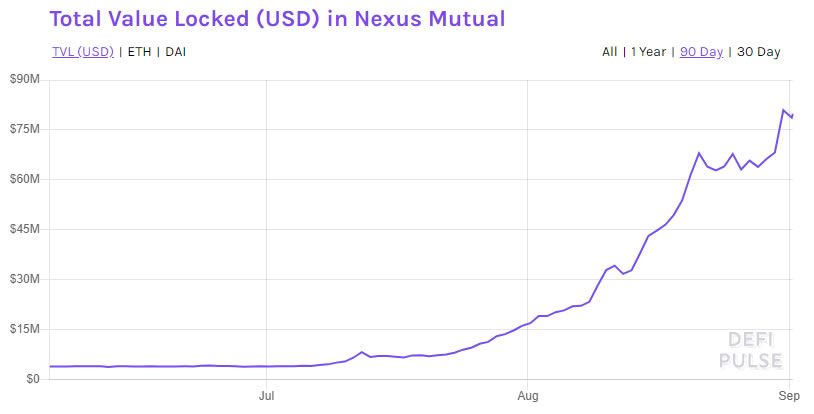

UNI total market cap at $4.14 billion on the weekend chart | Source: TradingView.comThis year, total value locked (TVL) in DeFi has shrunk by more than 60 percent, according to data from DeFi Llama.

Katie Talati, an analyst at Arca, attributes the DeFi exchange’s most recent accomplishment to quickly increasing volatility, which led to a substantial increase in trading volumes.

Simultaneously, Ethereum has witnessed a significant fall in user activity, whereas layer-2 solutions are gaining popularity because of their low transaction fees.

UNI Facing Bullish MomentumUniswap is among those that have benefited from the recent market restoration, having lately attempted a price turnaround. UNI is up 2% in the last 24 hours, which is a significant increase for the token since it dropped to $3.39 during the last slump.

Faced with the continued bullish advance, there is no selling opportunity for bears in the $5.8 to $6.2 resistance zone, which has been in place for more than 30 days and has been repeatedly retested.

Although bears are still prominent in the bull market, bulls do not wish to relinquish their UNI token holdings.

This year, Uniswap has lost less than 50 percent of its total value locked (TVL). This week has also seen modest inflows, with the TVL increasing by 11 percent to $5.1 billion.

Enhanced participation with Ethereum Layer 2s may contribute to the exchange’s rising popularity. Already embraced by major organizations like Polygon and integrated into other Ethereum-based applications, Uniswap has a large user base.

Featured image from Cryptokio, chart from TradingView.comSimilar to Notcoin - TapSwap on Solana Airdrops In 2024

Waves Community Token (WCT) на Currencies.ru

|

|