2023-6-20 19:05 |

Key Takeaways Regulators are clamping down hard on the US crypto industry, with recent lawsuits announced against Binance and Coinbase Bitcoin’s correlation with stocks is at a 5-year low, with the latter soaring but Bitcoin’s price suppressed by concerns around future of industry in US Exchanges have seen net outflows for 33 days in a row, but size of withdrawals are not particularly notable Binance is seeing the largest withdrawals, 7.3% of its balance heading for the exit doors Allegations against Binance go beyond securities violations which most centralised companies are facing

Binance’s war with the SEC goes on. As does Coinbase’s. As does, well, the entire cryptocurrency space, which suddenly faces a regulatory threat that feels existential for the crypto industry in the US.

The market has responded, unsurprisingly, by selling. Bitcoin dipped below $25,000 for the first time in three months last week, before bouncing back to where it currently trades at $26,500.

More notable, however, was that this came amid a time when the stock market is soaring. As I detailed in depth last week, the correlation between stocks and Bitcoin is now at a 5-year low. This is similar to the dip in correlation we saw in November when FTX collapsed while the stock market surged off softer-than-expected inflation numbers.

In such a way, while Bitcoin’s price decline seems minor on the face of things, it is underperforming relatively as the rest of the market is red hot.

Bitcoin on exchangesBut beyond price, how are markets reacting? Are people again concerned about storing their assets with these centralised exchanges?

Well, looking at the total amount of Bitcoin sitting in these exchanges, there has been net outflows for 33 days in a row. That is the longest streak since November 2022 amid the FTX scandal.

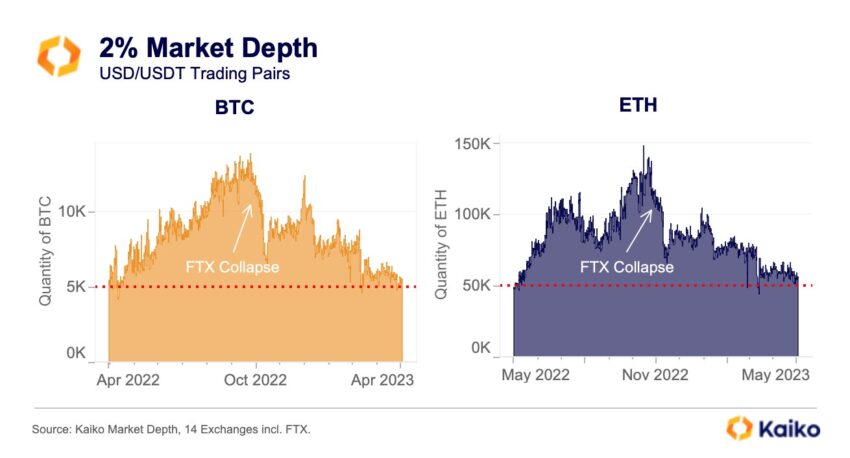

The scale of withdrawals is not the same, however. Back in November, the last time we saw a consistent stream of net withdrawals, FTX was exposed as insolvent (and fraudulent) with $8 billion of customer assets gone. Fear was extreme and the entire market panicked, concerned that other exchanges could follow. Bitcoin ran for the exit doors, much of it sent straight to cold storage (or sold for cash).

While the current developments are concerning for crypto in their own way, there appears to be no fear that customer assets are in danger. This is not a repeat of FTX, and the market reaction is also significantly more muted.

Indeed, if we look at the total balance of Bitcoin across exchanges, we can see that the recent dip does not stand out in the context of the steep downtrend we have seen since the start of 2020.

Is Binance different?

But what about Binance? Accusations levelled at the world’s biggest crypto exchange are certainly more sordid than merely securities violations. Binance and CEO Changpeng Zhao have been accused of trading against customers, manipulating trade volume, failing to implement adequate money laundering procedures, encouraging US customers and VIPs to circumvent location-based restrictions, and commingling customer funds.

It is the latter accusation which is the headline one and throws up painful memories of FTX. While I have been critical of Binance for operating in an incredibly opaque manner (they have always refused to reveal their liabilities), there has been no evidence to date that customer funds have been misappropriated as they were in the FTX case. Again, this really has little in common with the FTX situation.

On Saturday, a US court even approved an agreement between Binance and the SEC that would dismiss a temporary restraining order to freeze all Binance.US assets.

“We are pleased to inform you that the Court did not grant the SEC’s request for a TRO and freeze of assets on our platform which was clearly unjustified by both the facts and the law,” Binance.US said on Twitter.

This appears to have assuaged the doomsday scenario, whatever chance there was of that to begin with. In looking at the flows on Binance specifically, however, it has seen more outflows than any other major exchange. 7.3% of its Bitcoin balance was withdrawn in the two weeks since the lawsuit was announced on June 5th. That equates to 52,000 Bitcoin, or about 0.3% of the total circulating supply.

For context, when Binance came under fire for its lack of transparency around reserves after FTX collapsed, 13.3% of its Bitcoin balance was withdrawn in a similar two-week period – evidently bigger as seen on the above chart, nearly double the flows of what have been seen thus far amid this SEC case.

What does this all mean? Not very much, really. Binance has long operated in the shadows, and as I wrote here upon the SEC’s case being announced, it was a day that had long been coming. But there should not be a sudden uptick in concern around the safety of customer funds, and that is reflected in the relatively small flow of funds out of the platform.

Nonetheless, the allegations against Binance are far more than merely selling unregistered securities, which is the main sticking point across the industry (and what Coinbase is being sued for). It is for this reason that funds have moved out of Binance at a faster pace than other exchanges, even if the size of these is no reason for alarm.

All in all, the reaction is not surprising. Nor were the news of these lawsuits, really.

The post Report: 33 straight days of net withdrawals from crypto exchanges appeared first on CoinJournal.

origin »Emerald Crypto (EMD) на Currencies.ru

|

|