2023-7-24 17:00 |

Peer-to-peer crypto exchanges, which operate in a decentralized manner, have experienced a significant decline in their spot trading volumes over the past year.

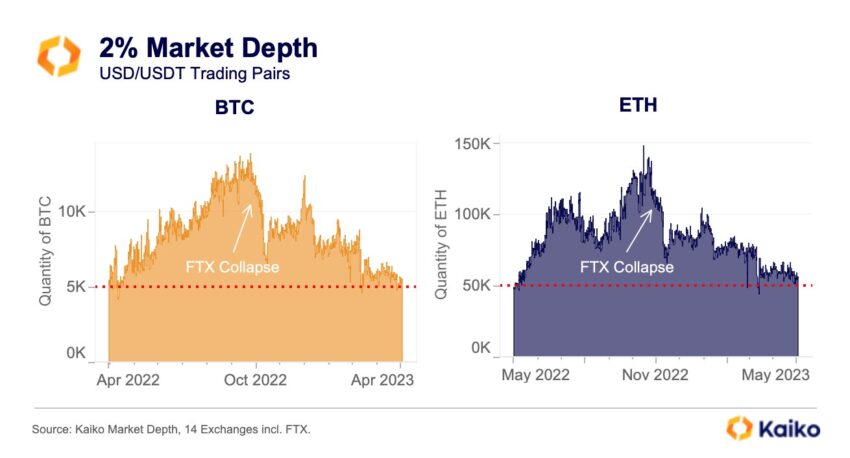

This decline is a striking contradiction to the optimistic forecasts made by crypto enthusiasts, who anticipated a “golden age” for decentralized exchanges following the collapse of crypto exchange FTX, eroding confidence in centralized platforms.

Surprisingly, these decentralized exchanges’ monthly spot trading volumes have plummeted by a staggering 76% to $21 billion between January 2022 and June of the current year. In comparison, centralized crypto platforms witnessed nearly 70% in decrease during the same period, as reported by Bloomberg News, citing data provided by Kaiko.

The unexpected downward trend has raised questions about the prospects of peer-to-peer decentralized crypto exchanges.

Peer-To-Peer Crypto Exchanges: Balancing Appeal And ChallengesDecentralized platforms have garnered a dedicated following among crypto enthusiasts who prefer avoiding intermediaries in traditional financial systems.

However, these platforms often need help in the form of more intricate user interfaces, slower transaction speeds, and lower liquidity compared to major centralized venues like Binance or Coinbase.

Recent data reported by Bloomberg indicates that the market share of peer-to-peer digital-asset platforms has experienced a decline from its peak of 7% achieved in March 2023, dropping to 5%. This trend hints at the challenges faced by decentralized exchanges in maintaining their competitive edge in the crypto market.

Despite struggling with trading volumes, decentralized exchanges have witnessed a steady increase in monthly active users since 2020. The report notes that the number of active users has consistently surpassed 1 million this year.

This surge in user activity may respond to the uncertainties surrounding centralized platforms, particularly in the aftermath of FTX’s bankruptcy and the subsequent allegations of massive fraud, leading to heightened scrutiny from regulatory authorities.

Decentralized Finance’s Quest For Market ShareKaiko’s recent report coincides with the emergence of protocol-native stablecoins introduced by top DeFi teams Curve and Aave. A significant development in this space is Aave’s governance approval for the mainnet launch of its GHO stablecoin, which launched in July.

These innovative protocols enable users to mint stablecoins by depositing collateral assets and incurring low ongoing fees. This approach empowers users to access fiat-denominated liquidity while still earning DeFi yields, presenting an attractive proposition for those seeking stability and returns.

Since its inception, crvUSD has experienced a surge in adoption, solidifying its position as the sixth-most traded stablecoin, according to CoinGecko data.

One of its key features is introducing a soft liquidation mechanism, which automatically converts a user’s collateral into stablecoins when they approach a liquidation event. While this mechanism offers a safety net, users may still encounter slippage during the soft liquidation.

Despite the success and growing popularity of protocol-native stablecoins, the decentralized stablecoin market faces a formidable challenge.

The market capitalization of centralized stablecoins has reached an impressive 12-figure figure, posing whether decentralized alternatives can make significant inroads into the stablecoin market share dominated by their centralized counterparts.

Featured image from Keyring Pro

origin »Emerald Crypto (EMD) на Currencies.ru

|

|