Borrowing - Свежие новости [ Фото в новостях ] | |

NFT Marketplace DigiCol Launches Lending & Borrowing w/ “Negative Fee” Trading

The NFT sector continues to expand its use cases and seems poised to onboard millions of users in the coming years. These digital assets have seen great adoption in 2021 and could propel the crypto industry into a new era of adoption as more platforms introduce features that make them more accessible. дальше »

2021-12-8 10:11 | |

|

|

EasyFi Lending Protocol Goes Live with Money Markets on Polygon

The universal layer 2 digital assets lending protocol, EasyFi Network has announced that it is now live with its lending protocol on Polygon. The new lending protocol went live on Nov 15, 2021 and will be initially supporting six money markets with supplying and borrowing on Polygon Network. дальше »

2021-11-16 10:19 | |

|

|

CanonX.Finance launches incubator platform for DeFi projects on Cardano

CanonX. Finance, a Cardano blockchain project accelerator & fundraising platform is now launching. CanonX will offer DEX development, a borrowing/lending platform, and oracle integration. The recent Alonzo hard fork has brought DeFi and smart contract functionality to the Cardano blockchain. дальше »

2021-11-12 00:54 | |

|

|

CoinRabbit Review [2021] – Is CoinRabbit Safe & Legit?

COINRABBIT LOANS The Cryptocurrency world is more than just trading. It’s a whole ecosystem. In it, there’s something for everyone. The various arms of this ecosystem include lending and borrowing, staking, mining, Non-Fungible Tokens(NFT), launch pads, etc. дальше »

2021-11-10 17:31 | |

|

|

Institutions Exploring Yield Opportunities Across Layer 1s With “Greater Borrowing Appetite” for ETH – Genesis Q3 Report

Crypto lender Genesis reported a record $35. 7 billion in loan organizations for the quarter third of 2021, up 40% from the previous quarter and a growth of 586% year-over-year. In its Q3 report, the company noted the continuous institutionalization of Bitcoin has made it less attractive to more opportunistic traders. дальше »

2021-11-5 16:55 | |

|

|

Easier Lending and Borrowing with Blockchain

The introduction and popularization of decentralized finance (DeFi) have opened the doors for innovating and regulating how digital assets are traded, transferred, lent, borrowed and bought. DeFi is a constantly growing space and, in some ways, has outgrown Ethereum, the blockchain that hosts a majority of DeFi projects. дальше »

2021-11-5 09:00 | |

|

|

Bitcoin Sidechain Protocol Mintlayer Set To Launch Testnet On November 10

Mintlayer, a blockchain for participating in trustless staking, lending, and borrowing with Bitcoin, has announced that it is going to launch its testnet on November 10, 2021. Thereby enabling asset tokenization, staking, lending, and decentralized exchanges for native Bitcoin. дальше »

2021-11-3 23:46 | |

|

|

Celsius Network delivers more than $1 Billion in yield to its community

Celsius Network, the leading global cryptocurrency earning and borrowing platform, announced it has paid more than $1 billion in digital assets to its community of... дальше »

2021-11-2 06:55 | |

|

|

Tron founder Justin Sun Removes $4.2 Bln from the Lending Protocol Following Yearn & Aave’s Online Dispute

Currently, a proposal to disable borrowing of xSUSHI, DPI, and the LP tokens on the AMM market is being voted on. The post Tron founder Justin Sun Removes .2 Bln from the Lending Protocol Following Yearn & Aave’s Online Dispute first appeared on BitcoinExchangeGuide. дальше »

2021-10-30 18:32 | |

|

|

Lending Platform Adayield – New Method in DeFi Lending Market

Adayield in full operations will provide borrowers with better interest than competitors, a new mechanism for determining interest rates is considered, choosing each market’s borrowing interest rate. дальше »

2021-10-23 21:29 | |

|

|

Avalanche DEX Trader Joe turns to Chainlink for new lending platform ‘Banker Joe’

Avalanche DEX Trader Joe today announced the launch of Banker Joe, new lending and borrowing platform powered by Chainlink price feeds. The post Avalanche DEX Trader Joe turns to Chainlink for new lending platform ‘Banker Joe’ appeared first on CryptoSlate. дальше »

2021-10-21 21:00 | |

|

|

UniLend Lists on AscendEX

AscendEX is excited to announce the UniLend token (UFT) listing under the trading pair UFT/USDT on Oct. 18 at 1 p. m. UTC. UniLend is a comprehensive permissionless DeFi protocol that combines both spot trading services and lending and borrowing functionality within the same platform. дальше »

2021-10-18 04:00 | |

|

|

Kava.io Price Prediction 2022 – 2025 – 2030 | KAVA Price Forecast

What is Kava. io? Kava. io is a DeFi platform that describes itself as “the most trusted DeFi platform by financial institutions”. It offers a variety of DeFi products including cross-chain asset swaps, lending, borrowing, staking and more. дальше »

2021-10-5 00:54 | |

|

|

DeFi Platform Compound Mistakenly Pays Out Millions in COMP After Upgrade

DeFi protocol Compound (COMP) seems to have fallen victim to a bug in one of its smart contracts, leading to overpayment of COMP liquidity mining rewards to users. Compound Pays Out Millions in COMP Tokens Compound (COMP), the world’s fourth-largest Ethereum-based DeFi lending and borrowing protocol with more than $9 billion in TVL today sufferedRead More дальше »

2021-9-30 15:30 | |

|

|

Crypto Lender BlockFi Increases All Stablecoin Rates amidst Regulatory Pushback

After making a series of cuts in its interest rates for crypto holdings in 2021, crypto lender, BlockFi has finally made the first increase of this year. BlockFi, which sets the rates based on market dynamics for lending and borrowing, announced this week that starting October 1st, the company is raising increasing rates for all […] The post Crypto Lender BlockFi Increases All Stablecoin Rates amidst Regulatory Pushback first appeared on BitcoinExchangeGuide. дальше »

2021-9-29 17:54 | |

|

|

Celsius Network Review 2021 – How Legit Is This Crypto Loan Provider?

Lending and borrowing is the core of world’s finance and a driving force for economies worldwide. It has entered the world of cryptocurrencies as well with a slew of platforms offering cryptocurrency backed loans. дальше »

2021-9-28 10:50 | |

|

|

Crypto lending app Minterest unveils new protocol to make DeFi fairer

An experienced team of cryptographers and blockchain experts, today unveiled Minterest, a value-capturing lending and borrowing protocol designed to make DeFi fairer for users. Unveiling the new protocol follows a recent private funding round that saw the team behind the project raise USD $6. дальше »

2021-9-17 21:08 | |

|

|

Jet Protocol launches its borrowing and lending alpha product on Solana devnet

Jet Protocol, a borrowing and lending protocol built on Solana, today announced the launch of its alpha product on the Solana devnet introducing the ecosystem to its improved cross-margining borrowing and lending experience. дальше »

2021-9-14 22:07 | |

|

|

DeFi Stablecoins Record a Surge in Interest Rates, Total Stablecoin Supply Grows 4x in 8 Months

Lending and borrowing rates on DeFi stablecoins keep trending up. The rates first started going up in late July when the crypto asset prices bottomed and began their recovery. As crypto-assets started their uptrend, funding rates also gradually increased as traders joined in on the action. дальше »

2021-9-7 17:10 | |

|

|

DeFi platform EQIFI to offer Tezos (XTZ) staking and borrowing

EQIFI, a decentralized finance platform, today announced new products for the Tezos blockchain ecosystem and will offer its users Tezos (XTZ) staking and borrowing. Powered by EQIBank a licensed and regulated digital bank, EQIFI operates under a community-focused, decentralized standard through its native EQX token. дальше »

2021-9-5 21:08 | |

|

|

How to Choose a Staking Platform in 2021

The summer of 2020 will undoubtedly be regarded as a landmark year for the whole decentralized finance (DeFi) space. DeFi didn’t stop creating new and exciting opportunities in borrowing and lending; it went a step further in changing the staking business. дальше »

2021-8-30 16:22 | |

|

|

BENQI And Avalanche Partner Up To Launch $3 Million Liquidly Mining Incentive To Expand Defi Ecosystem

BENQI, a decentralized non-custodial liquidity market protocol, and Avalanche plan to allocate $3 million AVAX, Avalanche’s native token, to be used as liquidity incentives for BENQI users. As per the announcement, the AVAX tokens will be used to reward users who are lending and borrowing ETH, LINK, AVAX, wBTC, USDT, and DAI on the protocol […] дальше »

2021-8-11 00:20 | |

|

|

EQIFI, the First Decentralized Protocol in Partnership With a Global Bank Now Available on the Bloomberg Terminal

British Virgin Islands, Aug. 9, 2021 — EQIFI, a regulated and licensed decentralized protocol for pooled lending, borrowing and investing Ethereum-based cryptocurrencies, stablecoins, and select fiat currencies, has announced that its native token, EQX, has been enlisted on the Bloomberg Terminal under the EQX ticker symbol. дальше »

2021-8-10 17:00 | |

|

|

EQIFI now available on the Bloomberg Terminal

EQIFI, a regulated and licensed decentralized protocol for pooled lending, borrowing, and investing Ethereum-based cryptocurrencies, stablecoins, and select fiat currencies, has announced that its natThe post EQIFI now available on the Bloomberg Terminal appeared first on AMBCrypto. дальше »

2021-8-9 14:45 | |

|

|

EQIFI Launches Suite of Decentralized Financial Products Powered by a Global, Licensed Bank

Powered by EQIBank, EQIFI’s highly anticipated launch provides a single uniform platform for decentralized finance products. British Virgin Islands, Aug. 6, 2021 — EQIFI, a decentralized protocol for pooled lending, borrowing and investing Ethereum-based cryptocurrencies, stablecoins and select fiat currencies, launched its decentralized finance platform today, including newly introduced fixed- and variable-rate lending products, asRead More дальше »

2021-8-7 17:00 | |

|

|

EQIFI launches decentralized financial products powered by a global licensed bank

EQIFI, a decentralized protocol for pooled lending, borrowing and investing Ethereum-based cryptocurrencies, stablecoins, and select fiat currencies, has today launched its DeFi platform, including neThe post EQIFI launches decentralized financial products powered by a global licensed bank appeared first on AMBCrypto. дальше »

2021-8-6 13:00 | |

|

|

Aave (AAVE) Rebrands Its Institutional-Grade DeFi Offering to Aave Arc

Leading DeFi lending and borrowing protocol Aave announced a rebranding to its institutional-grade DeFi offering. Aave Pro Rebrands to Aave Arc Aave (AAVE) the top decentralized finance (DeFi) lending and borrowing protocol with more than $11 billion TVL recently announced the rebranding of its upcoming institutional platform from Aave Pro to Aave Arc, the platform’sRead More дальше »

2021-7-28 17:00 | |

|

|

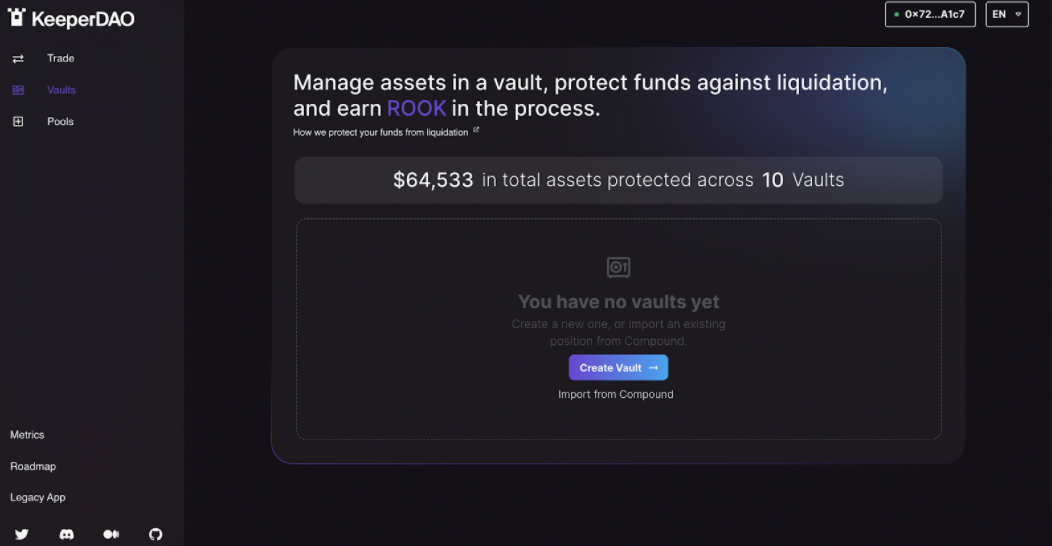

DeFi app KeeperDAO introduces new smart contract borrowing and liquidation protection

KeeperDAO, an MEV protection protocol on Ethereum, announced today a major update to its DeFi platform. KeeperDAO has introduced a smart contract-based borrowing and liquidation protection service; that gives borrowers the most profitable way to open or upgrade a borrow position on Compound. дальше »

2021-7-20 00:23 | |

|

|

IQ Protocol by PARSIQ to Empower DeFi Projects, Developers, And Users

Launched on the mainnet last month, PARSIQ’s new lending and borrowing IQ Protocol is the first risk-free and collateral-less solution in the DeFi industry. Innovative Protocol to Make Decentralized Subscriptions A Reality The PARSIQ ecosystem has grown substantially since its inception in 2018. дальше »

2021-7-15 13:44 | |

|

|

Sovryn Team Puts SOV on Uniswap, Project Crosses $50Mln Mark in TVL

Sovryn, a project aiming to bring decentralized finance (DeFi) to Bitcoin, has surpassed $50 million in total value locked (TVL). According to data tracking site DeFi Llama, the non-custodial, smart contract-based system for bitcoin lending, borrowing, and margin trading has seen an uptick in its TVL from just under $45 mln at the end of […] The post Sovryn Team Puts SOV on Uniswap, Project Crosses Mln Mark in TVL first appeared on BitcoinExchangeGuide. дальше »

2021-6-11 20:49 | |

|

|

MicroStrategy To Pump $500 Million More Into Bitcoin After 50% Crash

Michael Saylor has doubled down on MicroStrategy’s huge bets on bitcoin, borrowing $500 million through junk bonds to plow into the cryptocurrency – $100 million more than expected. Michael Saylor’s MicroStrategy ramps up junk-bond The firm said that it will borrow around $500 million in the form of senior secured notes. At a time when […] дальше »

2021-6-10 02:12 | |

|

|

AI-Powered Decentralized Financial Platform, TribeOne – “BE YOUR OWN BANK”

If you are not a part of the crypto industry yet or are an existing crypto enthusiast, here is a fantastic project that would magnetize you to make it big. Introducing TribeOne, the world’s first AI-powered decentralized financial platform backed with RAROC (Risk-Adjusted Returns On Crypto) technology. дальше »

2021-5-28 20:33 | |

|

|

First Bitcoin, now Ethereum: What you need to know when dealing with inflation concerns

"We are printing money, we are creating government bonds, we are borrowing on unprecedented scales. Those are things that surely create more of a risk of a sharp dollar decline than we had before". дальше »

2021-5-27 20:00 | |

|

|

Crafting Finance Launches Synthetic Asset Project on Polkadot

Crafting Finance is the next-generation Polkadot-based ecosystem of decentralized finance products that comprises swap, lending, borrowing, and synthetic asset features. It is combining the best of its features to create a bonded system and redefining how DeFi works. дальше »

2021-5-26 16:00 | |

|

|

Binance Margin vs Futures: What is The Difference?

Binance Margin trading allows traders to open crypto positions by borrowing funds. It also allows traders with more capital available to leverage their positions. So thanks to margins traders can see bigger trading results on their profitable positions. дальше »

2021-5-20 13:49 | |

|

|

BENQI to Integrate Chainlink Price Feeds to Secure its Protocol

BENQI, an algorithmic Liquidity Market protocol on Avalanche, has announced it will be integrating with Chainlink Price Feeds to increase security against flash loan attacks. BENQI protocol has highly reliable, and tamper-proof data feeds on all the assets offered in its lending and borrowing markets. дальше »

2021-5-19 21:02 | |

|

|

Blockfi vs Celsius Network: Safety, Interest Rates, Supported Coins

BlockFi is one of the leading crypto lending platforms available on the market. The platform has advanced borrowing and lending capability. Additionally, BlockFi has built its own crypto exchanges to enable users to access a variety of crypto assets. дальше »

2021-5-14 17:27 | |

|

|

Notional Finance raises $10M in Series A to bring fixed rates to DeFi

CryptoNinjas » Notional Finance raises $10M in Series A to bring fixed rates to DeFi Notional Finance, a protocol on Ethereum that facilitates fixed-rate, fixed-term crypto-asset lending and borrowing through a novel financial instrument called fCash, today announced the completion of a $10 million Series A funding round from institutional investors. дальше »

2021-4-30 19:07 | |

|

|

Ethereum Spikes To New Highs On Historic European Investment Bank Bond Launch

Ethereum these days even more so than Bitcoin, is disrupting traditional finance as we know it. DeFi is booming and has introduced lending and borrowing at scale. Institutional trading volumes are “exploding” according to reports. дальше »

2021-4-28 20:13 | |

|

|

Monero (XMR) breaks $300 resistance, here are levels to watch

Monero (XMR) price has continued to rally higher as the price action now trades at a 3-year high above the $300 handle. Fundamental analysis: Developer accuses MobileCoin of borrowing code Monero’s lead maintainer Riccardo Spagni has accused MobileCoin of borrowing Monero’s code without acknowledging its origins. дальше »

2021-4-13 17:23 | |

|

|

Crypto Trading App, Abra Rolls Out Bitcoin & Ethereum-Backed Loans in 35 US States

Crypto trading app, Abra, introduces a fiat borrowing feature using crypto collateral assets. The post Crypto Trading App, Abra Rolls Out Bitcoin & Ethereum-Backed Loans in 35 US States first appeared on BitcoinExchangeGuide. дальше »

2021-3-25 22:15 | |

|

|