2018-9-28 22:00 |

Why Is Important To Understand The Latest ‘Institutional FOMO’?

Cryptocurrencies have been expanding all over the world in the last years. During 2017, the famous virtual currency Bitcoin reached an all-time high of $20,000 dollars. In January 2018, most of the other virtual currencies in the market registered all-time highs as well. Since that moment, the market is in a bear trend and most of the cryptocurrencies registered losses between 70% and 95%.

However, this exponential growth experienced by most of the virtual currencies has been tied to retail investors. Institutions did not appear in the market yet, but they can start to do it very soon. And indeed, some experts believe that the next cryptocurrency bull run will be triggered by institutions that want to participate in the cryptocurrency market.

Even when in December 2017, Bitcoin was traded close to $20,000 this increase was not driven by institutions or big players in Wall Street. People investing small (and sometimes not so small) sums of money into virtual currencies.

Nonetheless, in the near future, we could see institutions entering the cryptocurrency space by placing important sums of money. For example, the investment bank Goldman Sachs recently announced that it was going to provide different services and products for institutional investors. Among the different plans that the company has in mind, we can mention a crypto custody service specifically designed for wealthy investors.

This means that Goldman Sachs will be managing and taking care of the assets of hundreds and thousands of investors from all over the world. Coinbase is also doing something similar and will be offering custody services to companies.

If these products are developed and regulators approve them, it would be possible for several institutions to start investing in virtual currencies, including Bitcoin and Ethereum.

Perhaps, the most important and known example of this ‘institutional FOMO’ is the Bakkt platform. The Intercontinental Exchange (ICE), one of the most influential and powerful financial institutions around the world is working in order to provide a new global regulated ecosystem aimed at institutional investors.

The company is working side by side with Starbucks and Microsoft in order to create one of the most revolutionizing exchanges in the market for wealthier investors. One of the first offerings will be physical Bitcoin futures, allowing traders to easily exchange BTC against USD, EUR or GBP.

All these things the market is experiencing are very important. Bitcoin’s value could soon start to grow again and reach new levels. And this is what experts believe for the long and middle-term.

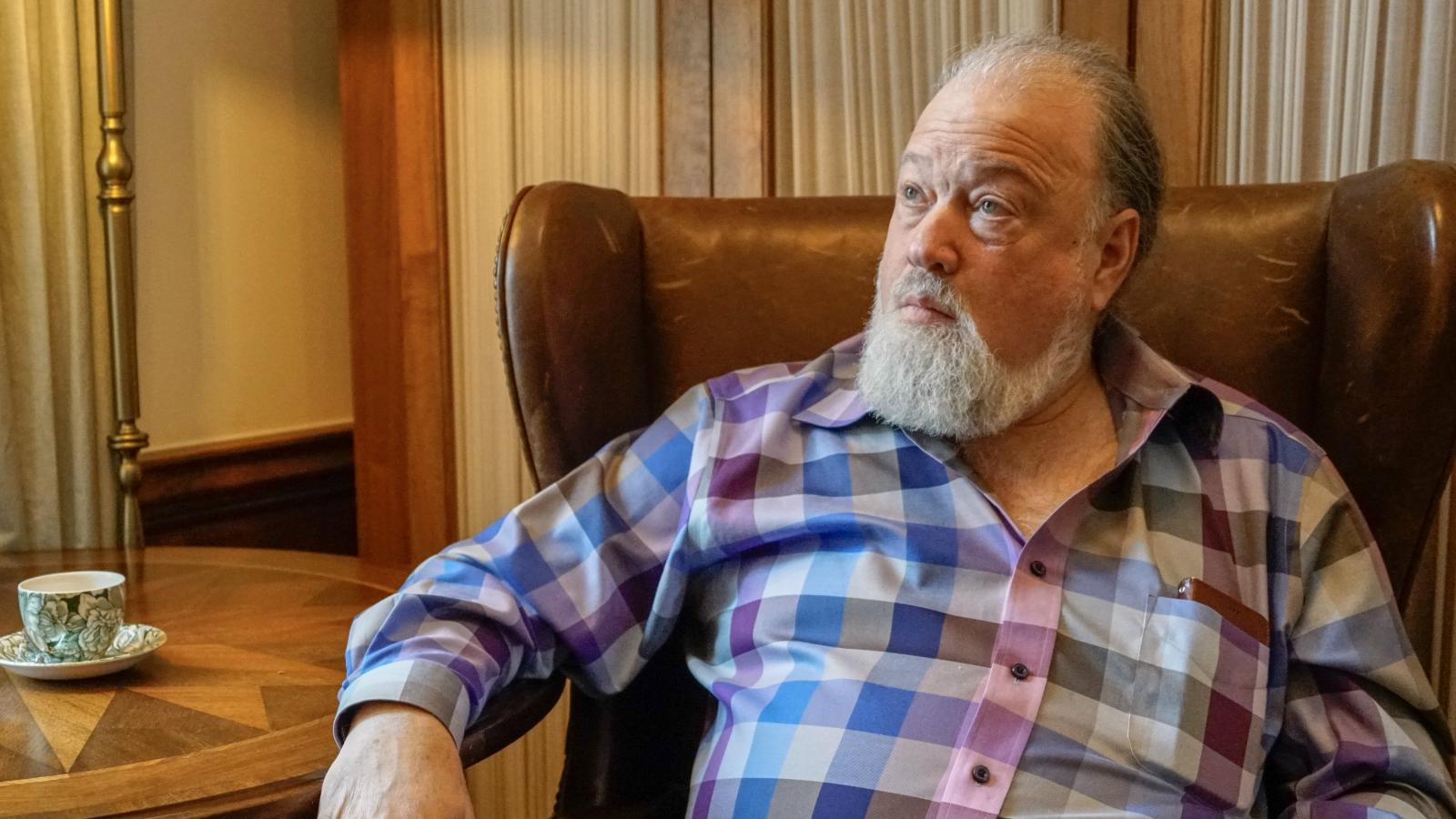

For example, Mike Novogratz said that Bitcoin could be traded close to $8,400 by the end of the current year.

About It He Mentioned:“You’re not going to see the massive run until the institutions actually start buying in a lot, and the architecture is being put in place now.”

The most awaited products and services for institutions will start to be rolled out in the market between the last months of 2018 and the first two quarters of the next year.

origin »Bitcoin (BTC) íà Currencies.ru

|

|