2024-4-2 22:30 |

Since day one, the Decentralized Finance (DeFi) world has continuously evolved, and new solutions constantly emerge to tackle liquidity obstacles and open fresh avenues for maximizing returns.

Among the latest trends that have emerged are Liquid Staking Tokens (LSTs) and Liquid Staking Tokenized Finance (LSTfi). This evolution is a significant step forward in DeFi, particularly in optimizing yield strategies. It brings in a new level of flexibility and opportunity where users can maintain liquidity while their assets are staked.

Are you looking for ways to make your idle crypto work for you? Imagine earning passive income while still having the freedom to access your staked assets whenever you need them. That’s the power of LSTfi.

Imagine staking your crypto assets and still having them readily available for other lucrative DeFi ventures. Sounds like a dream, right? Well, that’s what Liquid Staking Tokens (LSTs) and Liquid Staking Tokenized Finance (LSTfi) are all about.

Liquid Staking Tokenized Finance (LSTfi) refers to the use of Liquid Staking Tokens (LSTs), which are tokenized receipts representing staked assets on Proof-of-Stake (PoS) networks. Traditionally, staking meant locking up your assets for ages and leaving them out of reach for other DeFi opportunities. But LSTs flip the script! They tokenize your staked assets and give you liquid tokens in return.

Let’s break it down with a relatable example: Ethereum staking. You can stake your ETH to become a validator and earn rewards for securing the network. However, this process traditionally requires locking up a significant amount of ETH (32 ETH) for an extended period. With this, that amount is illiquid and inaccessible for other purposes.

With LSTfi, you can stake your ETH through platforms like Lido and receive liquid staking tokens called “stETH” in return. You can now use these stETH tokens in various DeFi protocols while your original ETH keeps staking and securing the Ethereum network. It’s like having your cake and eating it too, all the while maximizing your yield potential without sacrificing your staking position or the network’s security.

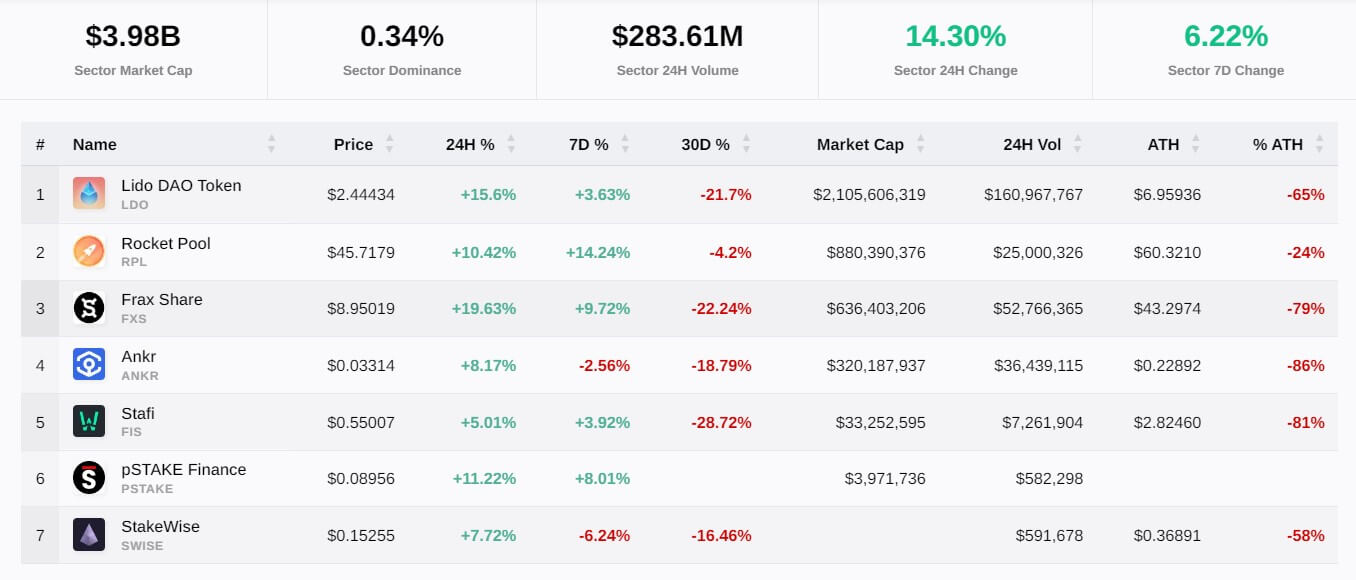

The growth of the LST marketThe LST market is relatively new, but it has already seen remarkable growth. LSTs make up more than 40% of all the staked ETH. According to Coingecko, the Liquid Staking Tokens market cap today is $41.8 billion.

What’s more, in February 2024, the total value locked (TVL) of LSTs in Lido, a leading decentralized liquid staking platform surpassed over $30 billion.

This growth is fueled by the crypto community being on its proverbial toes when it comes to looking for opportunities to increase yield. With liquid staking offering flexibility and convenience, it’s no wonder LSTs are the talk of the town.

Inter Protocol’s role and potentialLet’s take another example. Inter Protocol is a platform built on Agoric and focused on enhancing liquidity and financial interoperability across the blockchain ecosystem.

On Inter Protocol, you can deposit approved crypto assets such as stTIA, stOSMO, ATOM or stATOM into vaults to mint Inter Stable Token (IST), an over-collateralized, decentralized stable token for the interchain ecosystem. IST provides a means for you to engage in transactions across various blockchain networks. Like other staked tokens, the ATOM in this case is illiquid.

Inter Protocol recognizes the significance of LSTfi in shaping the future of DeFi. Now, you can mint IST using LSTs. This bridges the gap between staking and cross-chain liquidity. Talk about breaking barriers.

How does it work? Inter Protocol uses blockchains like Stride and pSTAKE to provide liquidity for staked tokens. For example, you can now use stATOM (stride staked ATOM) as collateral to mint IST on Inter Protocol. This allows you to use stATOM for different DeFi activities while still being able to mint IST which can be seamlessly transferred and utilized across multiple blockchain ecosystems.

This cross-chain interoperability of IST promotes liquidity across different chains and facilitates development that spans multiple blockchain networks. Inter Protocol’s integration of liquid staking with stablecoins creates a stable and reliable source of liquidity that can be tapped into for various DeFi applications, such as lending, borrowing, and liquidity provision.

The stable liquidity provided by Inter Protocol’s LSTfi implementation can help mitigate volatility risks and promote the growth of a more robust and resilient DeFi ecosystem within the Cosmos ecosystem and beyond.

By accepting LSTs as collateral, Inter Protocol can provide stable liquidity sources and offer innovative financial products that cater to the evolving needs of the DeFi community. This approach also opens up new avenues for cross-chain interoperability and yield optimization strategies.

Challenges and risksWhere there’s potential, there are pitfalls. While the potential of LSTfi is undeniable, it is crucial to acknowledge the inherent risks involved. Smart contract vulnerabilities, token volatility, and the complexities of interacting with multiple protocols can pose challenges for participants.

A major concern tied to liquid staking tokens (LSTs) is price uncertainties. The chance that LSTs prices may differ from the original staked asset. Each LST’s token model affects several aspects such as price behavior, yield accumulation approach, user interaction, and compatibility with on-chain platforms.

However, the DeFi community has been proactive in addressing these risks through rigorous audits, the use of bug bounties to incentivize ethical hackers to find vulnerabilities, and the development of user-friendly interfaces that simplify the process of engaging with LSTfi protocols.

Future outlookLooking ahead, the future of LSTfi is filled with potential. As the technology matures and regulatory landscapes evolve, we can expect to see further innovations that push the boundaries of what is possible with liquid staking.

Developers may explore novel use cases for LSTs, such as potentially integrating them into decentralized autonomous organizations (DAOs) or creating synthetic assets that combine the benefits of staking and other DeFi primitives.

Moreover, the continued growth of LSTfi could have far-reaching implications for the broader DeFi space and even traditional financial systems. As more assets become tokenized and liquid, we may witness a paradigm shift in how value is transferred, traded, and utilized within financial ecosystems. Platforms like Inter Protocol will play a pivotal role in facilitating this transition by ensuring seamless interoperability and opening up new possibilities of financial innovation.

Final thoughtsLSTfi emerges as a game-changer in DeFi that enables users to maintain liquidity without compromising on their staking activities. This newfound flexibility is bound to open the door for a wide range of yield optimization strategies, which will propel DeFi into uncharted territories of innovation and growth. Meanwhile, platforms like Inter Protocol are already leveraging liquid staking tokens and derivatives to create more efficient and democratized financial ecosystems.

Disclaimer: We advise readers to do their own research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in cryptoassets is high-risk; consider the potential for loss. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Liquid Staking Tokenized Finance (LSTfi): Revolutionizing DeFi with Liquid Staking and Enhanced Yields appeared first on CaptainAltcoin.

Similar to Notcoin - Blum - Airdrops In 2024

Liquid (LQD) на Currencies.ru

|

|