2023-5-3 17:27 |

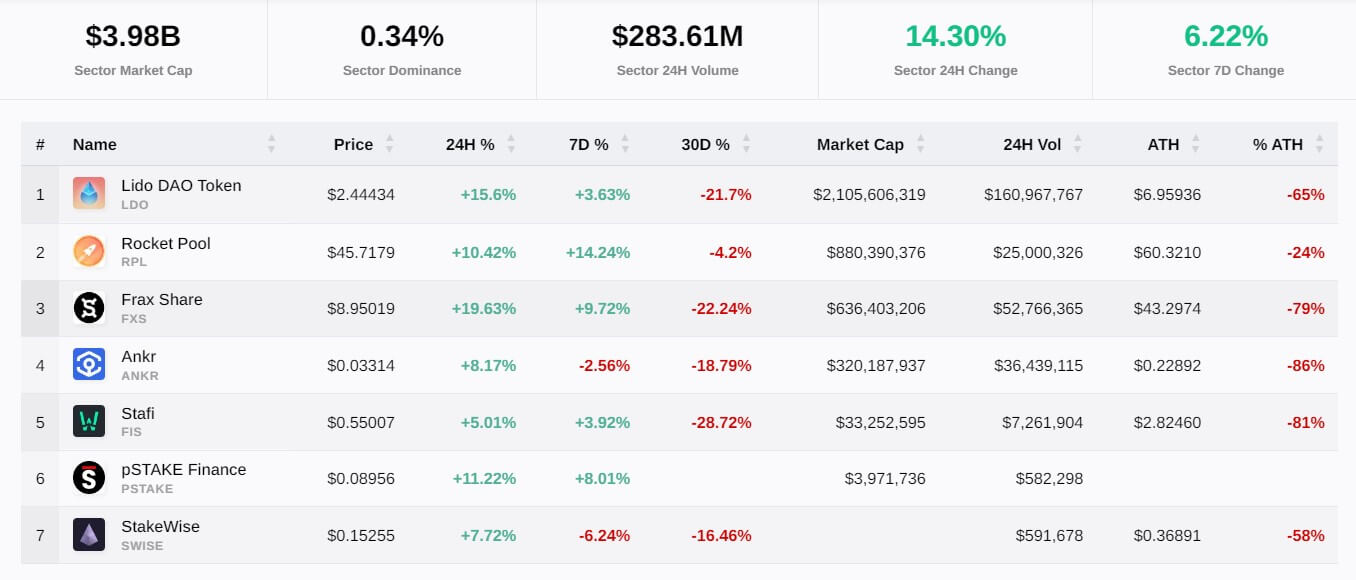

Liquid Staking Derivatives layer 1 blockchain is called Tenet. The blockchain will create a hub for Liquid Staking Derivatives (LSDs). Tenet’s testnet went live today allowing developers to interact and experiment with the platform.

Former Ankr and Blockdaemon executives have joined hands to create Tenet, the first Layer 1 blockchain built to create a hub for Liquid Staking Derivatives (LSDs).

The Tenet Testnet has been launched today, allowing developers to interact and experiment with the platform.

Tenet protocol featuresTenet is an Ethereum Virtual Machine (EVM) compatible Layer 1 protocol. It is designed to bring additional liquidity and yield opportunities to LSDs by allowing users to re-stake their assets in the network and participate in the network’s DeFi ecosystem.

Different from other Cosmos chains that rely on their own native tokens for PoS security, Tenet validators can make use of a unique mechanism called Diversified Proof of Stake (DiPoS). DiPoS allows validation by re-staking LSDs from other L1 ecosystems supported by Tenet, such as Ethereum, BNB Chain, Cosmos, Solana, and Polygon.

Re-staking LSDs from other blockchains ensures the long-term security of the Tenet chain by leveraging the joint security of each of the Layer 1 ecosystems it services.

Commenting on the launch of Tenet’s Testnet, the co-founder of Tenet, Greg Gopman, said:

“At Ankr, we helped bring Liquid Staking Tokens to eight Blockchains and built out some of the best LSD infrastructure in the industry, but no one used it. Tenet was really a golden opportunity for being first to market in utilizing best-in-class technology with almost $20B in untapped liquidity. We analyzed what other projects like Berachain and Eigen Layer were doing and realized that there was a better way to position ourselves to best address the market. We’ve chosen to take a user-centric path, making the staking and LSD experience simpler and more secure for the average user.”

Using LSDs on TenetThe re-staked LSDs on Tenet are usable just like LSDs or LLSDs to take advantage of DeFi opportunities on the Testnet ecosystem.

Besides taking advantage of lending pools and DEXs, Tenet users will also be able to mint the Universal Stablecoin interest-free, allowing them to receive an “advance” on their future LSD yields.

Tenet also offers the first L1 ecosystem with native gauges, which allow veTenet token holders to earn direct rewards to the pools they choose.

The post EX Ankr and Blockdaemon executives launch Liquid Staking Derivatives L1 chain appeared first on CoinJournal.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Liquid (LQD) на Currencies.ru

|

|