2021-4-12 22:44 |

JPMorgan has released a report on the futures and derivatives market around bitcoin, providing insight and bullish sentiment.

In a report titled “Why Is The Bitcoin Futures Curve So Steep?” JPMorgan Chase analysts examined the growing futures and derivatives market surrounding bitcoin, provided insights as to why the contango is so steep and explored what the future holds for the monetary asset as it becomes increasingly financialized.

Here are some of the highlights from the report.

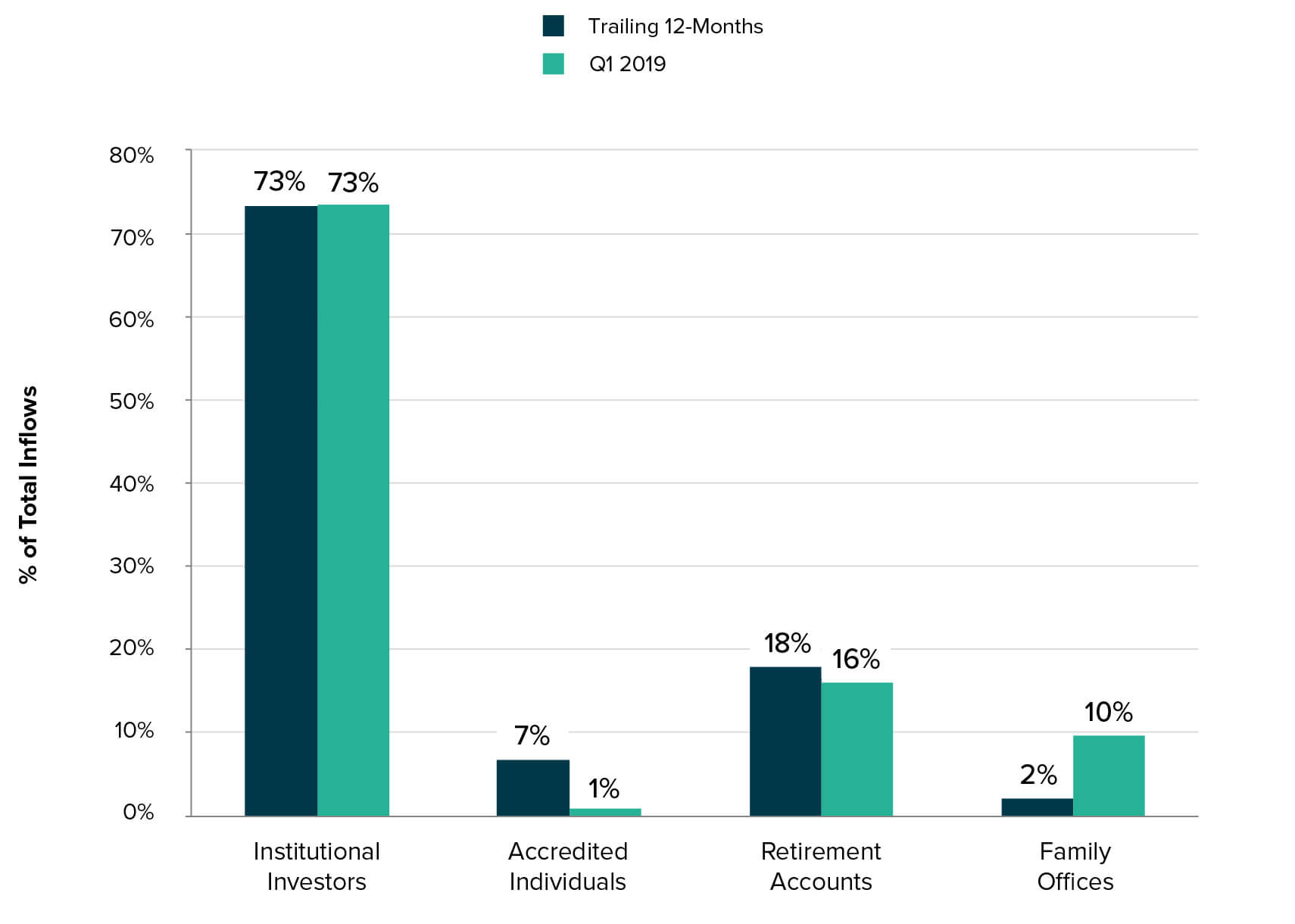

“As has often been the case in the past, the growth and gradual maturation of cryptocurrency markets has naturally generated interest in derivatives and other sources of leverage. Though futures trade against a range of pairs, Bitcoin unsurprisingly dominates this nascent marketplace. Similarly to the spot market, these products trade within a highly fragmented ecosystem, with nearly 30 active venues. The vast majority is traded offshore as well, with less than 15% of the total open interest listed on major, regulated domestic venues like the CME (Exhibit 1). Normalized depth in futures has also kept pace with the deepening of the cash market, suggesting it too is benefiting from institutional inflows and improved liquidity provision in spot (Exhibit 2).”

With the launch of CME bitcoin futures contracts in late 2017, institutional investors in the United States began to have access to bitcoin derivatives exposure, but access to “spot bitcoin” has been harder to come by, even as the bitcoin market cap has increased more than 200 percent above the 2017 peak.

The analysts offered up potential reasons for why the contango has remained so large. Among the possible explanations provided by JPMorgan is counterparty and repatriation risk in offshore markets, complications with obtaining spot BTC exposure in the legacy system and, subsequently, the Grayscale Bitcoin Trust (GBTC) being a main source of BTC exposure on the street (and all of the premium/discount problems that come along with the investment vehicle).

“Why has such attractive pricing not simply been arbitraged away? One could perhaps blame counterparty and repatriation risk in unrelated offshore markets, but certainly not the CME. In a market with rampant bullish sentiment and heavy retail involvement it is tempting to simply blame demand for leverage. And that is certainly true to some extent. However, there are also some more idiosyncratic but equally important aspects of how these contracts are designed in the context of market segmentation that are specific to Bitcoin and likely explain a substantial fraction of this richness.”

Annualized yields offered via the cash and carry bitcoin trade. Source.JPMorgan believes that the introduction of a bitcoin exchange-traded fund (ETF) will compress the yields offered by the trade, as a liquid investment vehicle that trades at net asset value (NAV) will give investors the access to “spot BTC” that they need in order to execute the arbitrage trade.

As shown in the chart below, net positions in the CME bitcoin futures market shows that hedge funds have continued to increase their short positions into 2021, totaling about $1.45 billion at the time of writing. Are hedge funds naked short bitcoin? Absolutely not, they are simply executing the cash and carry trade, and capturing the large spread in the process.

Net positions of CME bitcoin futures by trader category. Source.“These basis trades are particularly attractive in the cryptocurrency market. As of this writing, the June CME Bitcoin contract offers ~25% annualized slide relative to spot. The richness of futures is even more acute if we broaden our view to include unrelated exchanges, where carry can be as high as 40+% (Exhibit 4). To put this in context, very few fiat currencies, including both developed and emerging markets, offer easily monetizable local yields (e.g., from FX swaps) in excess of 5% (Exhibit 5). There is of course the special case of TRY, but with local consumer price inflation around 10% or higher, as compared to the explicitly deflationary monetary policy and cross-border transferability of Bitcoin, this hardly seems a plausible substitute.”

It is quite bullish for JPMorgan to compare bitcoin with foreign fiat currencies, and not only highlight the massive opportunity offered by the steep futures curve, but also highlight the disinflationary monetary policy, transferability and global liquidity of the asset throughout the report. The analysts also pointed to the global aspect of bitcoin’s liquidity and market penetration, displaying the yield offered on CME futures as well as other offshore markets.

The report also pointed to the introduction of a bitcoin ETF as a key step for the assets liquidity and trading volumes into the future.

“This makes launching a Bitcoin ETF in the U.S. the key to normalizing the pricing of Bitcoin futures, in our view. As has been widely discussed, it could reduce many barriers to entry, bringing new potential demand into the asset class. A risk factor worth considering, however, is that it would also make basis trading much more efficient and attractive at current pricing, particularly if those ETFs can be purchased on margin. We would expect that to bring more basis demand into futures markets, especially the CME but also potentially other onshore exchanges. To the extent that contango normalizes for those contracts, we would expect some pass-through to pricing on unrelated exchanges as well, since presumably there is some arbitrage activity between the two.”

In a large, but expected development, the big banks seem to be eyeing the bitcoin market in a significant way. JPMorgan surely isn't the only legacy institution eyeing the developments in the ecosystem, and it is only a matter of a time before it begins to get exposure itself, possibly via the cash and carry trade.

The key question for investors is, what happens if the contango doesn’t normalize as the bitcoin spot and derivatives market continue to grow exponentially?

What happens when the markets of an absolutely scarce monetary asset and a fractionally-reserved fiat currency with centrally-controlled discount rates converge?

Maybe, just maybe, the true “risk free rate” is bitcoin...

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|