2022-6-9 12:00 |

The decentralized nature of crypto assets ensures that transactions and activities involving the assets have no third parties interference. This has remained a leveraging feature that decentralized finance uses against its centralized counterpart.

Yet, most criminal activities relating to cryptocurrency are scaling through based on its decentralized characteristics. One of such prevalent crimes is money laundering.

Such loopholes have prompted some jurisdictions to propose laws for crypto and its related activities. The action is to control some of the excesses within the crypto industry and protect citizens investing in cryptocurrencies. Some of the laws center on stolen assets and illegal activities with them.

Related Reading | Bitcoin Market Cap Shed Over $120-B Last Month – How Much More Can It Lose?

Among the cryptocurrency laws is the new one from Japan that could seize crypto assets obtained illegally. According to the report, the country’s Justice Ministry plans on revising the law on crypto seizures for organized crime-related cases. There’ll be a forceful take-off of any crime-related cryptocurrency with the amended law.

A few days ago, the Japanese parliament passed a bill banning non-banking firms from stablecoin issuance. Their motive was to maintain and enhance consumers’ protection by cutting down potential system risks.

Also, the bill listed the authorized groups that could participate in stable development or issuance. These include local trust firms, licensed banks, and registered agents on money transfers.

Japanese Law Seizes Illegally Obtained Crypto AssetsNew reports from local media outlet Yomiuri Shimbun stated some processes that could birth the proposed law. The initial step would be a meeting between the Justice Ministry and the Legislative Council. Another included agenda would be discussions officials could retrieve the private keys of criminals.

With the acceptance of the proposal, the legislature would revise the Act on Punishment of Organized Crimes and Control of Proceeds of Crime (1999). Hence, both courts and law enforcement officials would have legal backing to seize crime-related cryptocurrencies. These include proceeds from money laundering and others.

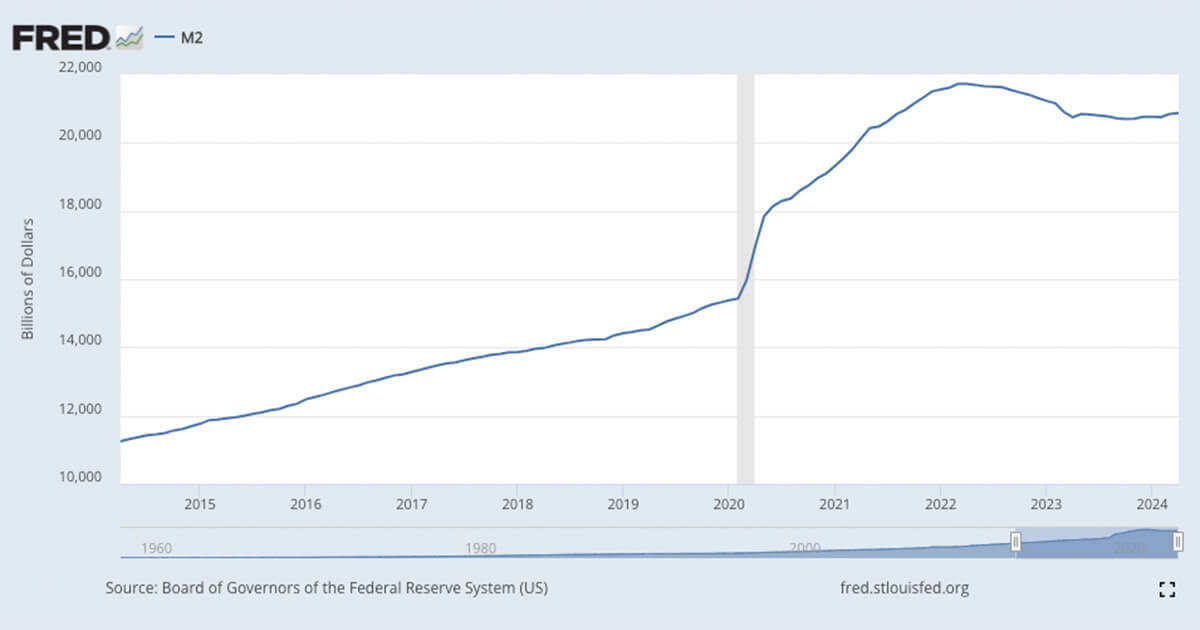

Cryptocurrency market stands at $1.2T | Source: Crypto Total Market Cap on TradingView.comAccording to Jiji Press, there’s an expectation that the discussion with the Legislative Council could commence by next month. The law concentrates on confiscating virtual assets from organized crime.

However, it creates no detailed explanation of the procedures for cryptocurrencies acquired illegally. This poses the concern about continuous criminal indulgence in illegal practices using their free assets holdings.

If all the necessary details are kept in the right order, there’ll be no further delay with the law amendment. The cabinet would approve it, followed by the parliament’s signing off. With such moves and the proposal’s nature, the implementation would have no resistance.

Related Reading | Polygon (MATIC) Price Falls Short Of Reaching Full Potential Despite Recent Developments

Also, the law has listed some of the categories of assets that the officials could seize. However, it’s still confusing to find that cryptocurrency doesn’t match any type. The list includes monetary claims, physical property, and mobile assets like vehicles, supplies, tools, machinery, etc.

Featured image from Pexels, chart from TradingView.comSimilar to Notcoin - Blum - Airdrops In 2024

Decentralize Currency Assets (DCA) на Currencies.ru

|

|