Новости о Volatility Stock [ Фото новости ] [ Свежие новости ] | |

Why Crypto: Stock Market Volatility Surmounts That of Bitcoin

The global markets have seen crypto-esque levels of volatility throughout the past several months, with all of the major benchmark stock market indices seeing intense downwards pressure that led them to post recession-level losses in a short multi-week period. дальше »

2020-3-29 22:00 | |

|

|

Forget crypto: Robert Kiyosaki says the stock market is “manipulated”

The crypto market has been relatively stable in the last four days. The Bitcoin price has generally been moving in between a five percent range, showing an unusually low level of volatility. In contrast, the U. дальше »

2020-3-29 23:31 | |

|

|

Bitcoin to See Major Increase Based Off of Three Economic Signals

It’s been a difficult time for the stock market. S&P 500 and Dow Jones Industrial Average have lost over 30% value in march by far. These numbers also signal major volatility, with swings of more than 1,000 points. дальше »

2020-3-25 10:07 | |

|

|

What Bitcoin’s Extreme Volatility Says About Its Skyrocketing Interest In 2020

Bitcoin (BTC) has experienced significant volatility lately, which has made its price rather unpredictable. More recently, the price has crashed to an unprecedented level alongside the stock market. дальше »

2020-3-24 20:17 | |

|

|

This set of data shows that Bitcoin’s “safe haven” narrative may lead to a price boom

Bitcoin has seen some heightened volatility over the past few weeks, with much of its recent downside coming about as a result of that incurred by both Gold and the benchmark U. S. stock indices, which have all cratered due to the rapidly mounting economic impacts of COVID-19. дальше »

2020-3-23 19:00 | |

|

|

Market Bottom or Not, Bitcoin and Stock Volatility Likely to Persist [Opinion]

The unprecedented swings in the stock market through last week left traders jittery. With a $2 trillion swing to the upside on Friday, the week was the most volatile in market history. [Bloomberg] Many pundits and traders called this the ‘bottom’ of the coronavirus scare. дальше »

2020-3-16 08:15 | |

|

|

Bitcoin is “Waiting for the Stock Market to Open” as Analysts Eye Another $2,000+ Move

Following a bout of unprecedented volatility seen earlier this week, Bitcoin has found itself caught in limbo, with its bulls and bears reaching an impasse as the crypto hovers within the lower-$5,000 region. дальше »

2020-3-16 23:00 | |

|

|

Tesla (TSLA) Stock Shows Volatility, Price Crashes to $500 Despite Dow Recovery on Friday

Coinspeaker Tesla (TSLA) Stock Shows Volatility, Price Crashes to $500 Despite Dow Recovery on FridayThe Tesla (TSLA) stock price has crashed 45% from its 2020-high in less than a month's time. дальше »

2020-3-14 15:48 | |

|

|

Popular Crypto & Stock Trading App Drops Service During Major Volatility

The popular cryptocurrency and stock trading application Robinhood went offline today for the second time in less than a week. The service is now live again, but it’s clear that it remains poorly equipped to deal with huge swells of demand for its services. дальше »

2020-3-10 02:12 | |

|

|

Bitcoin May See Substantial Increase Based on 3 Economic Signals

Last week was another harrowing time for stock traders. The Dow Jones Industrial Average lost 1%, and the S&P 500 shed 1. 7%. These numbers also belie the massive volatility, with swings of more than 1,000 points twice. дальше »

2020-3-8 03:12 | |

|

|

Питер Шифф рекомендует продавать биткоин

-Известный «золотой жук» и биткоин-скептик Питер Шифф заявил, что биткоин нужно «продавать». В своем недавнем твите он пишет: If @Bitcoin can't rally with an emergency 50 basis point rate cut, plus all of the recent stock, bond, currency and gold market volatility, under what circumstances will it rally? If Bitcoin won't go up, why own […] Материал Питер Шифф рекомендует продавать биткоин появился сначала на WHATTONEWS – Новости криптовалют. дальше »

2020-3-5 11:40 | |

|

|

High Stock Volatility Drives Record Investment in Bonds, Safe Haven Assets Like Bitcoin

Investors have moved a record amount of funds out of stocks and into bonds and other ‘safe’ assets, like Bitcoin, according to analysis. Bond inflows last week reached $23. 6 billion, which would see a record $1 trillion added to the $10 trillion bond market in 2020. дальше »

2020-2-16 16:23 | |

|

|

Cryptocurrency Markets Hold Gains While Wall Street Braces for Volatility

All eyes are on Asia for another day as markets across the globe brace for the fallout of another stock rout. Cryptocurrency asset markets, however, remain buoyant, holding on to gains made over the past week. дальше »

2020-2-5 03:18 | |

|

|

Dow Rockets Higher but Bernie Could Trigger a 40% Crash

Bernie Sanders is now favorite to clinch today's crucial Iowa vote. Wall Street analysts say the stock market hasn't priced in this huge potential volatility shock yet. The post Dow Rockets Higher but Bernie Could Trigger a 40% Crash appeared first on CCN.com дальше »

2020-2-4 15:08 | |

|

|

What Raging Forex Volatility Tells Us About Friday’s Stock Market Plunge

As the U.S. stock market falls amid coronavirus concerns, forex has sprung to life, hinting that the sudden weakness in the S&P 500 is real. The post What Raging Forex Volatility Tells Us About Friday’s Stock Market Plunge appeared first on CCN.com дальше »

2020-2-1 22:11 | |

|

|

Bitcoin Price to Outpace S&P 500 Next Year, Say 168 Financial Experts

Bitcoin (BTC) will most likely perform better than the S&P 500 stock index, believe nearly half of the 350 financial professionals polled by Chainalysis. Volatility Undermines Gains Potential Despite short-term volatility, Bitcoin will be the most promising asset class in the coming year, believe financial experts in a Chainalysis poll. дальше »

2019-11-13 14:48 | |

|

|

Is Chinese Bitcoin Mining Firm Canaan’s $400M IPO a Desperate Move?

Chinese bitcoin mining hardware maker, Canaan, plans to raise $400 million through public sale of its stocks. But will the IPO ride be smooth or bumpy? Volatility is usual for bitcoin and crypto market participants. дальше »

2019-11-12 11:42 | |

|

|

Dow Futures Brace for Volatile Week as Damages from U.S.-China Trade War Begin to Surface

Futures on the Dow and broader stock market rose sharply on Friday, but finished lower for the week as threats to U. S. and global economic health resurfaced. Volatility is likely to simmer near the surface next week as attention shifts to U. дальше »

2019-10-5 11:00 | |

|

|

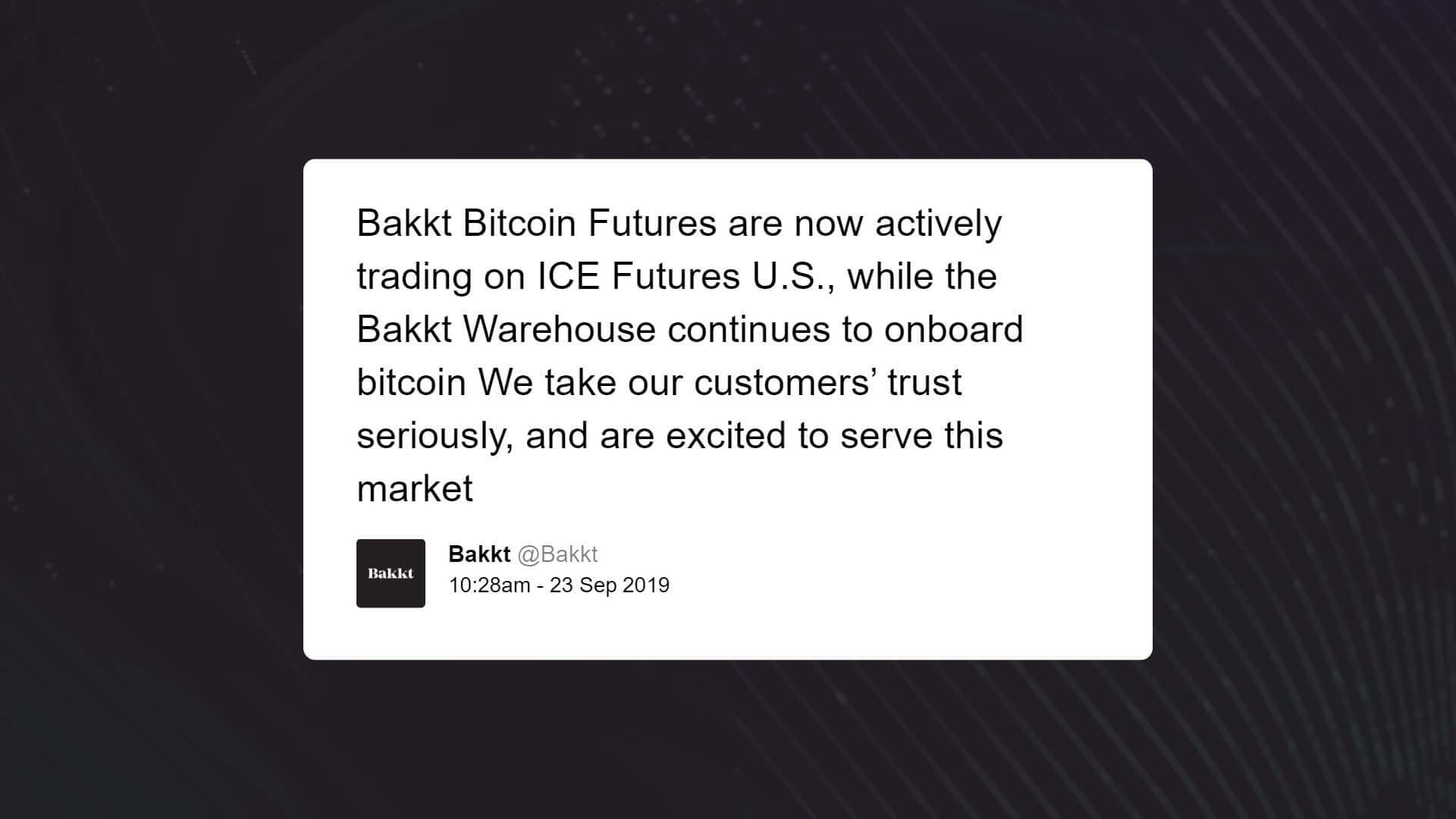

Bitcoin price drops sub $10k after Bakkt launch but investors aren’t worried

The bitcoin price (BTC) has slipped to $9,900 following the highly anticipated launch of Bakkt, a bitcoin futures market operated by ICE, the parent company of the New York Stock Exchange (NYSE). Traders expected the dominant cryptocurrency to demonstrate large volatility as the opening of Bakkt coincided with a weekly close for BTC. дальше »

2019-9-23 12:56 | |

|

|

The U.S. Stock Market’s ‘Fear Index’ Is Flashing an Eerie Warning

The CBOE Volatility Index, commonly known as the VIX, is supposed to be one of the most reliable indicators of investor sentiment on Wall Street. The number, which can range anywhere from 1 to 100, provides important insight into how well the S&P 500 Index is performing. дальше »

2019-9-15 20:28 | |

|

|

Bitcoin Looks Attractive As Negative-Yielding Debt Crosses $17 Trillion

Global negative-yielding debt is now over $17 trillion, making investors extremely nervous. And it is forcing them to focus on non-traditional assets, like bitcoin. Investing in Debt and Holding it to Maturity Guarantees a Loss Investors are becoming increasingly fearful as they see that the soaring negative-yielding debt is altering the global economy. дальше »

2019-9-2 21:52 | |

|

|

Dow Jumps 258 Points But Dangerous New Trade War Looms

The Dow and broader U. S. stock market rose on Wednesday, shrugging off early volatility as rising oil prices boosted energy shares. Global equities were much more subdued amid concerns that another trade war was unfolding between two neighboring Asian economies. дальше »

2019-8-29 22:39 | |

|

|

Stock Market 'Fear Gauge' Spikes 20% as Trump Tweets Trigger Panic

By CCN Markets: Friday was one of those days where headline news scared the heck out of investors, and the stock market's "fear gauge" proves it. The Cboe Volatility Index, or VIX, soared nearly 20%, peaking at 21. дальше »

2019-8-25 17:34 | |

|

|

Stock Futures Stabilize After Wild 600 Point Dow Swings

Stock market futures point to a stable open on Wall Street after yesterday’s wild session which saw the Dow Jones plunge 600 points before recovering. The volatility subsided overnight as China stabilized the yuan and US Treasury yields recovered after plunging near all-time lows on Wednesday. дальше »

2019-8-8 15:03 | |

|

|

Gold Beats the S&P 500 YTD but Risks Abound for the Safe-Haven Asset

As volatility ravages the stock market, it is no surprise that demand for safe-haven assets is soaring. The controversial godfather of defensive assets, gold, has outperformed the S&P 500 year-to-date, and it’s undoubtedly no coincidence. дальше »

2019-8-8 00:00 | |

|

|

Dow Plunges 890 Points as Market Volatility Spikes to Crisis Levels

The Dow and broader U. S. stock market hastened their declines Monday, with intraday volatility reaching its highest level in nearly eight years after the People's Bank of China effectively weaponized its exchange rate. дальше »

2019-8-6 22:03 | |

|

|

Bitcoin Price Smashes $11,800 As Global Stock Markets Collapse

The bitcoin price soared more than 10 percent over the last 24 hours, briefly hitting $11,840 on Coinbase. The surge higher coincides with a blistering selloff on the Asian stock markets, triggered by a breakdown in US-China trade relations. дальше »

2019-8-5 11:22 | |

|

|

Stock Market Bull Tom Lee: Buy the Trade War-Induced S&P 500 Dip

Stock market bull Thomas Lee of Fundstrat has invited investors to “back up the truck” and load up on the trade war-induced dip in the S&P 500. His client letter comes at the end of an action-packed week full of economic data, a landmark interest rate decision, and political wrangling that caused volatility to spike […] The post Stock Market Bull Tom Lee: Buy the Trade War-Induced S&P 500 Dip appeared first on CCN Markets дальше »

2019-8-4 23:30 | |

|

|

Bitcoin chart analysis against patterns of other assets highlights future possibilities, not conclusions

Chart and pattern Analysis is a major part of analysing and predicting traditional stock, commodities and cryptocurrency trading in the financial market. The price and valuation of these assets over time and different market trends are often used to gauge several metrics and predict future trends, market volatility, price direction etc. дальше »

2019-7-1 18:30 | |

|

|

Bitcoin & Gold’s Stock-to-Flow ratio drives their market and monetary value

Bitcoin has been one of the standout performers of 2019, outperforming several traditional commodities. However, the virtual asset is often criticized for its price volatility and a higher risk of investment. дальше »

2019-6-14 02:30 | |

|

|

Wall Street Veterans Introduce Innovative Volatility Product to Digital Asset Space

With global policy development and adoption underway, the trading volume of digital assets has been steadily rising especially as the Bitcoin price recovers last several months. Different from the traditional stock market that is limited by trading hours and circuit breakers, digital asset trading runs continuously 24*7 across all geographic regions with fewer regulations in place and less institutional participation. дальше »

2019-6-5 08:33 | |

|

|

3 Stocks to Short to Make a Killing from Trump’s Mexico Tariffs

By CCN: President Trump’s shock announcement that he would impose tariffs on all Mexican imports rocked the stock market last week, but the White House-induced volatility creates the perfect storm for investors to make a killing by aggressively shorting several Mexico-linked companies. дальше »

2019-6-3 23:45 | |

|

|

Bitcoin is for Suckers – Fight Me

By CCN: There are countless reasons why bitcoin and cryptocurrencies rank among the biggest bubbles in history and the dumbest places to put your hard-earned money. Bitcoin Investors Don’t Consider Volatility Bitcoin return or cryptocurrency return compared to stock market return means nothing unless one considers volatility. дальше »

2019-6-2 16:30 | |

|

|

Wall Street Veterans Introduce Innovative Volatility Product to Digital Asset Space

With global policy development and adoption underway, the trading volume of digital assets has been steadily rising especially as the Bitcoin price recovers last several months. Different from traditional stock market that is limited by. дальше »

2019-6-1 02:43 | |

|

|

Just Bitcoin: Why A Diverse Cryptocurrency Portfolio Makes Little Sense

Bitcoin educator and entrepreneur, Jimmy Song, has posted on the benefits (or lack thereof) of a diverse cryptocurrency portfolio. He suggests a fresh argument as to why adding altcoins to a portfolio with Bitcoin makes little sense. дальше »

2019-5-21 16:00 | |

|

|

Bullish Hedge Funds Speculate on US Stock Market with an Insane Bet

By CCN: The number of U. S. hedge funds betting on more stock market volatility has reached lows not seen in months. Hedge funds and other investors speculate on volatility by purchasing Volatility Index options (VIX) from the Chicago Board Options Exchange (CBOE). дальше »

2019-5-21 13:59 | |

|

|

Does the Recent Stock Market Volatility Showcase Bitcoin’s Growing Popularity?

Our readers may be aware of the fact that stock markets all across the globe have been facing a lot of bearish pressure over the course of the past few weeks. However, despite all this, Bitcoin has continued its strong financial ascent — with the flagship cryptocoin recently breaking past its all-important $8K resistance barrier […] дальше »

2019-5-18 07:01 | |

|

|

Bitcoin Is Booming Again After A Prolonged Bear Market Bubble, But Look At This Stock Market Crash Comparison

Crypto Bubbles Not Alone In Bursting Despite Strong Fundamentals Many in the traditional financial markets decry cryptocurrency due to its volatility and point to the 2018 crash as proof that crypto is somehow alone in being a fickle good for true investment. дальше »

2019-5-13 21:51 | |

|

|

Dow Crashes 473 Points as Bond King Warns of Stock Market Meltdown

By CCN: The Dow and broader U. S. stock market plunged anew on Tuesday, as President Trump’s latest tariff gambit triggered an extreme bout of volatility for Wall Street. Dow, S&P 500 Race Into Meltdown Mode All of Wall Street’s major indexes reported massive declines on Tuesday, mirroring a volatile pre-market for Dow futures. дальше »

2019-5-8 23:06 | |

|

|

Dow Bounces Back from China-Inspired Volatility

The Dow and broader U. S. stock market bounced back on Wednesday, as investors tried to piece together a narrative to explain the apparent stalling of China trade negotiations ahead of next week’s summit in Beijing. дальше »

2019-3-21 18:34 | |

|

|

Elon Musk’s Days as Tesla CEO Could Be Numbered: JPMorgan Analyst

Elon Musk is the tech billionaire that many people from Wall Street to Hollywood (e. g. , Johnny Depp) love to hate. At a time when investors should be celebrating the Tesla CEO for the release of the Model Y, an electric SUV crossover, analysts are instead pouncing on Musk and TSLA shares amid renewed regulatory and key man fears, among other things. дальше »

2019-3-18 16:17 | |

|

|

Revolut Launches Auto-Exchange Feature for Select Crypto and Fiat Currencies

Revolut, a mobile finance and payment application based in the U. K. , has launched a service that makes it possible for its clients to “auto-exchange” fiat and digital currencies on its platform. дальше »

2019-3-9 02:03 | |

|

|

Wall Street Trading Bots Fail as Fed Flip-Flops and Trump Tweets

The party may be over for automated trend-following trading strategies on Wall Street. As a recent report by Bloomberg highlights, the once legendarily profitable investment systems run on computers by hedge fund managers have lost their edge. дальше »

2019-3-4 18:53 | |

|

|

New Bitcoin Market Data Shows Substantial Drop in Degree of BTC’s Price Volatility as Maturity Settles In

Bitcoin has a terrible rap for volatility. And after what happened during 2018, it would seem obvious it is very volatile, but if you look at the available hard data, it's actually not. Specialists have compared Bitcoin's behavior with that of the stock market, oil, and other traditional financial investment instruments and they've concluded that, […] дальше »

2019-2-23 20:26 | |

|

|

XBT Provider Suspends Launch of Altcoins ETN Due to Crypto Market Uncertainty

XBT Provider AB, the issuer of Bitcoin and Ether exchange traded products listed on the Nasdaq stock exchange in Sweden, has announced it’s putting plans to launch altcoin products on hold, citing the current market volatility and uncertainties, reports Bloomberg on February 13, 2019. дальше »

2019-2-15 08:00 | |

|

|

Stock Market Trades Sideways, Analysts Believe Strong Chance of Rally in 2019

The stock market is currently experiencing a sideways trading session, with all of the major benchmarks trading down slightly. Although the markets have seen unprecedented volatility towards the end of 2018, analysts still have lofty expectations for how some major stocks will perform in 2019. дальше »

2019-1-3 02:00 | |

|

|

Economist Claims Investors Should Expect Volatile Stock Market in 2019

Following the recent downturn in the US stock market, investors have now bore witness to wild market volatility, the likes of which haven’t been seen in years. Although the markets are ending 2018 on a less-than-positive note, one prominent economist now claims that massive daily price swings will become a new reality for the markets. дальше »

2019-1-1 02:00 | |

|

|