2024-3-3 06:00 |

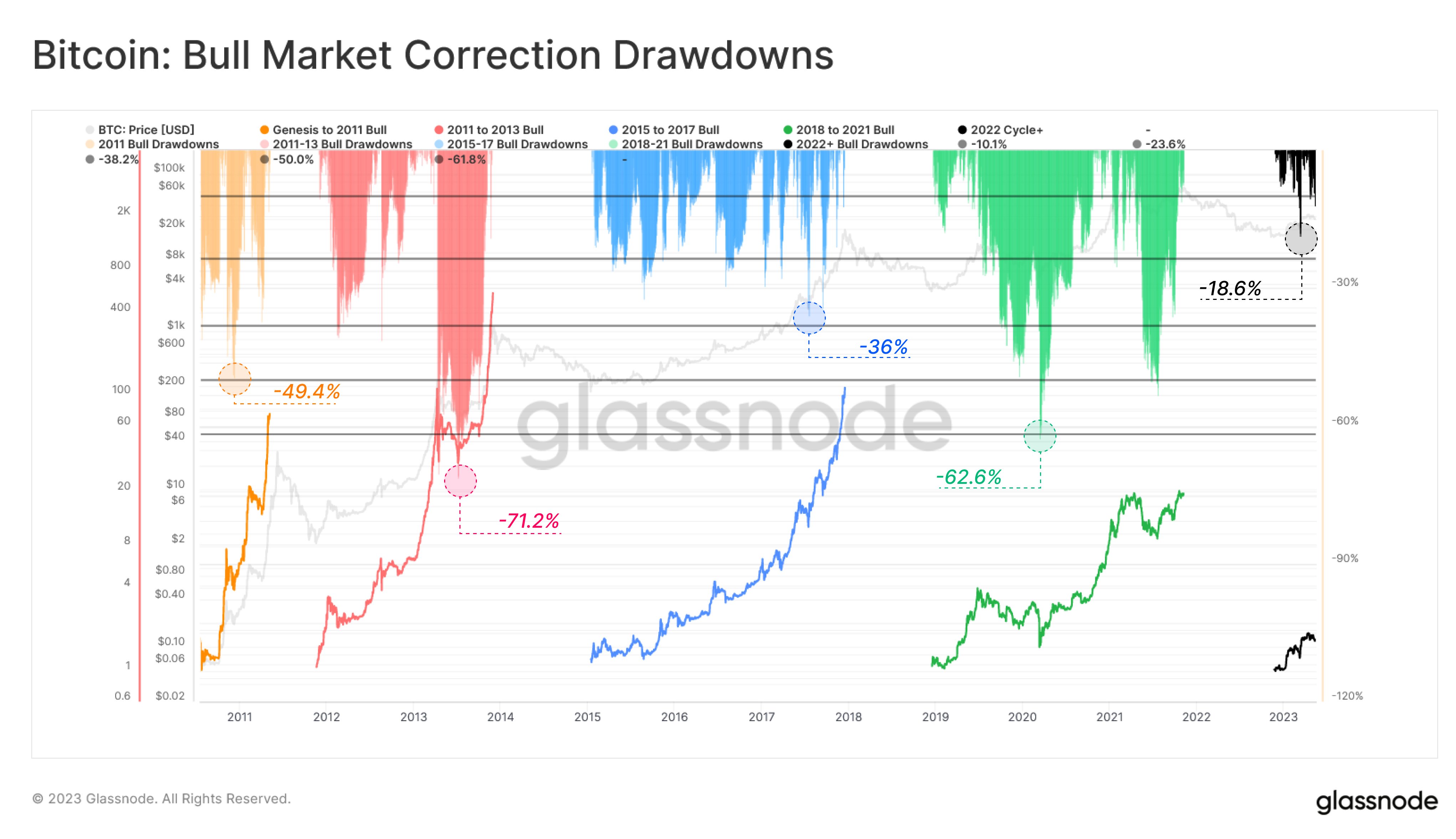

Historical data suggests that no Bitcoin cycle has peaked without experiencing significant double-digit corrections. These downturns, while daunting, have historically presented lucrative ‘buy-the-dip’ opportunities for investors.

As Bitcoin continues its ascent, with its price hovering above $62,000, the anticipation of a potential correction looms large, offering a window into the cyclical nature of cryptocurrency markets.

Market Maturity And Correction PatternsSeasoned investor CryptoJelleNL recently shared a post on X earlier today pointing towards an imminent correction in the 20-25% range for Bitcoin.

Based on cycle analysis, this predicted dip indicates a potential drop to the $46,500 range, earmarking an opportunity for investors to bolster their positions in the leading crypto.

Corrections are an essential part of a #Bitcoin bull market — but with each passing cycle, the dips become shallower.

This cycle, it looks like ±20-25% will be the sweet spot for dip-buying.

Your job is to be ready to take advantage when it comes. pic.twitter.com/xrI7iKfiPR

— Jelle (@CryptoJelleNL) March 1, 2024

This perspective gains further credence when examining the diminishing severity of corrections as the market matures; the 2016-2017 Bitcoin cycle was characterized by seven substantial corrections, with an average pullback of 32%, significantly impacting investor sentiment and portfolio values.

In the subsequent cycle that propelled BTC to its current all-time high of $69,000, the market conditions were considerably more lenient for bullish investors: experiencing five downturns, the average decline was limited to 24%.

Fast forward to the present cycle, and the landscape appears somewhat different. With only four notable corrections recorded so far and an average pullback of 21%, Bitcoin should see a notable pullback, though not as harsh as previous ones. This indicates the market’s growing maturity.

Additionally, this evolution suggests that while corrections remain a staple of the Bitcoin experience, their capacity to deter the asset’s long-term trajectory diminishes.

Navigating Bitcoin Upcoming CorrectionsThe potential correction for Bitcoin, as indicated by CryptoJelleNL is echoed by other market observers. Galaxy Digital Holdings CEO Michael Novogratz has also highlighted the possibility of a temporary dip, attributing it to factors such as excessive leverage among younger investors.

Despite these forecasts, Bitcoin’s current momentum remains strong, with recent price action showing a near 2% increase in the past 24 hours, underscoring the asset’s sturdy appeal.

In addition to speculative analysis, real-world examples of investor success stories provide tangible evidence of Bitcoin’s enduring allure. A notable instance is a smart whale who, per lookonchain analytics, invested $1.39 billion in Bitcoin in July 2022 at an average price of $21,629 per BTC.

With BTC price now surging past the $62,000 mark, this investor’s unrealized profit is a testament to the strategic potential of timely market entry and the value of patience in the face of volatility.

A smart whale has accumulated 22,670 $BTC($1.39B) at an average price of $21,629 since $BTC entered the bear market in July 2022.

He currently has an unrealized profit of more than $900M!https://t.co/gT1kfWq5YF pic.twitter.com/BTcijZB0IA

— Lookonchain (@lookonchain) March 1, 2024

Featured image from Unpslah, Chart from TradingView

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Streamr DATAcoin (DATA) на Currencies.ru

|

|