2024-11-9 10:11 |

Bitcoin’s price rise to an all-time high of $77k lately has ignited speculations about whether its bull run has reached its peak. On August 29, blockchain analytics platform Lookonchain pointed to five key indicators suggesting that BTC had room to grow.

Today, these indicators remain essential in assessing Bitcoin’s current and potential trajectory. One of the key tools used by Lookonchain, the Bitcoin Rainbow2023 Chart, indicates that Bitcoin remains undervalued.

This chart uses a logarithmic growth curve to evaluate long-term price potential, showing Bitcoin as still relatively cheap compared to its historical highs. Analysts interpret this signal as a potential for further price appreciation.

BTC’s RSI and The 200-Week Moving AverageThe Relative Strength Index (RSI) currently sits at 70.38, which, though high, does not yet confirm a peak in Bitcoin’s price. An RSI above 70 often suggests an overbought status, potentially signaling a price correction.

However, Bitcoin’s historical performance suggests that it could climb further despite this level, which Lookonchain believes may still reflect upward potential.

The 200-Week Moving Average (200W MA) Heatmap provides another bullish signal, showing Bitcoin’s current price point in blue, an indication that the asset is still not overvalued.

Traditionally, blue represents buying zones, where holding Bitcoin is often encouraged among investors who seek long-term gains, further suggesting that Bitcoin has not yet reached a market top.

Read also: Here’s Why Cronos (CRO) Crypto Price Is Pumping

CVDD and 2-Year MA Multiplier: No Clear PeakThe Cumulative Value Days Destroyed (CVDD) and 2-Year Moving Average (MA) Multiplier indicators also reinforce the analysis. The CVDD currently positions Bitcoin’s price below the peak threshold, suggesting there’s still potential for growth.

Similarly, the 2-Year MA Multiplier shows Bitcoin trading between the green and red bands, a mid-point zone that further suggests a non-peak phase in Bitcoin’s market cycle.

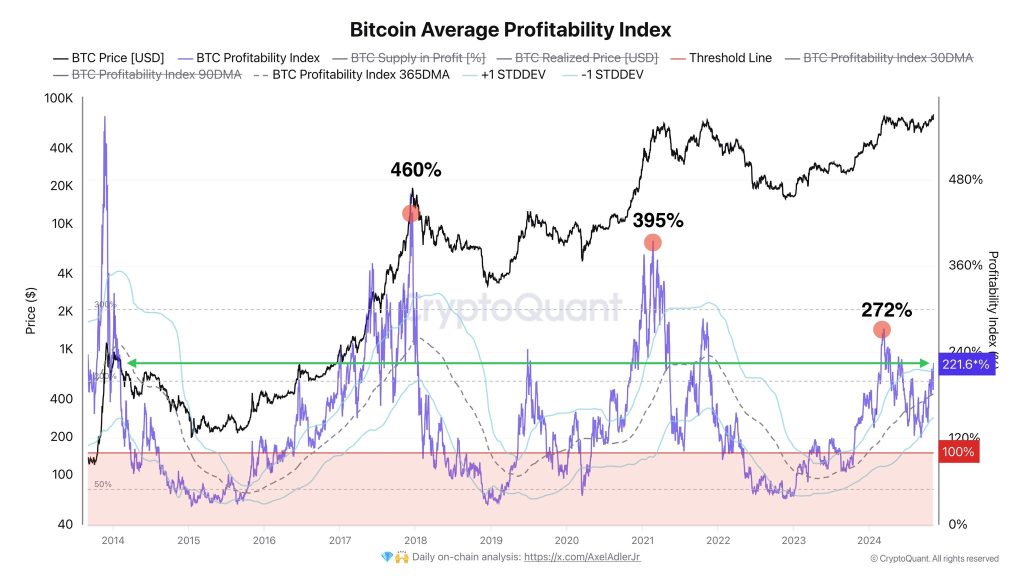

Profitability Index Remains Below Previous PeaksOnchain analyst, Axel Adler Jr. reported that the Bitcoin Profitability Index currently shows a 221% profit margin, lower than previous cycle highs of 460% and 395%.

source: Axel Adler Jr.With current users seeing returns 121% above initial investments, BTC’s profitability levels suggest there’s potential for higher returns, considering previous peaks were significantly higher.

According to CoinGecko, Bitcoin’s price is currently $76,442.83, reflecting a 0.62% increase over the last 24 hours and a 10.10% rise over the past week.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

The post Here’s Why Bitcoin (BTC) Price Has Not Peaked Yet appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|