2023-9-20 21:00 |

Here’s where the next major resistance to clear Bitcoin could lie from the perspective of on-chain analysis.

Bitcoin Resistances According To On-Chain DataBitcoin has recently observed a surge beyond the $27,000 mark, and many have been wondering how long this fresh rally could continue for the cryptocurrency. One way to determine this could perhaps be by looking at where the major resistance levels are.

In terms of on-chain analysis, “resistance” generally lies in regions where many investors have their cost basis present because of how holder psychology tends to work.

The “cost basis” here refers to the average price at which an investor buys coins. When the spot price is below a holder’s cost basis, they are in a net amount of loss.

Once BTC returns to the investor’s acquisition price, they may want to sell, as at least that way, they would have avoided exiting at any losses. Due to this reason, whenever a large number of investors have their cost basis present inside a particular price range, the range could provide resistance to the asset because of the volume of selling pressure that may arise in it.

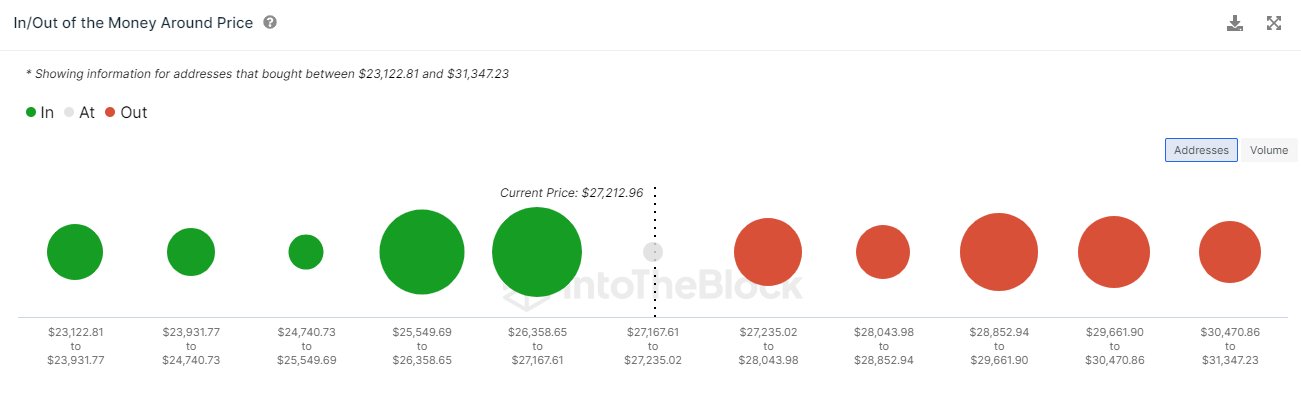

Now, here is what the different Bitcoin price ranges look like in terms of investor cost basis concentration, according to data from the market intelligence platform IntoTheBlock:

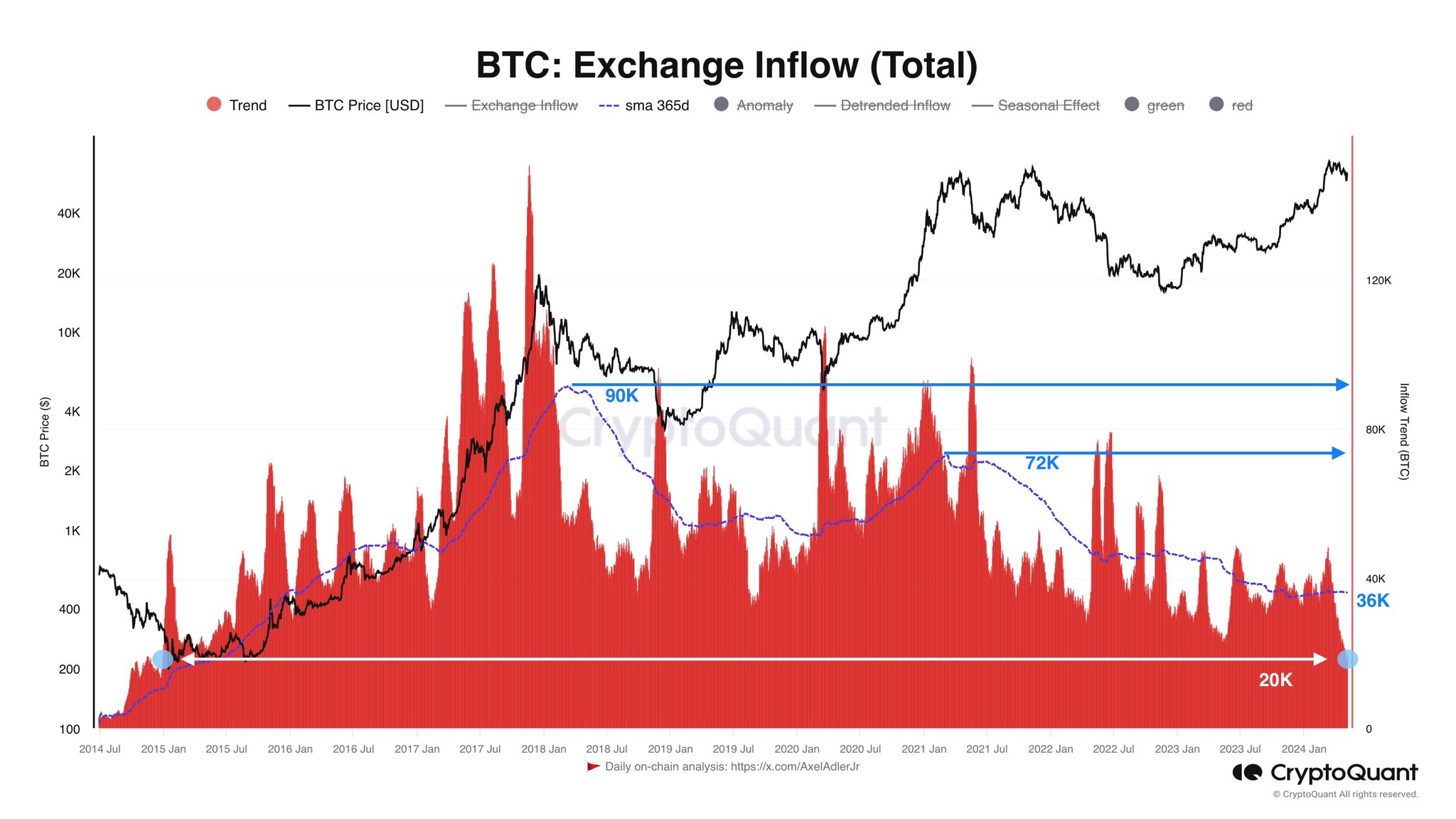

As displayed above, the following particularly thick cost basis range is $25,853 to $29,662. “Key resistance is anticipated around $29.2K — a point of acquisition for over 1.77M addresses,” explains IntoTheBlock.

The $27,200 to $28,000 range (the range just after the current spot price of the cryptocurrency) isn’t exactly thin, either, but it has notably fewer investors than the other one. The following range, $28,000 to $28,853, doesn’t have many investors, so if BTC can clear the upcoming range, the run-up to nearly $29,000 may be clear.

While investor cost basis can act as resistance on retests from below, they can also support when being touched from up. The reason behind this could be that an investor that had earlier been in profits might have reason to believe the asset would go up again, so they might buy more at their cost basis, thinking it to be a profitable entry point.

From the image, it’s apparent that both the ranges just below the current price are very thick with addresses because Bitcoin had earlier consolidated at these price levels for a significant time.

It might be due to these strong support levels that when the asset had retraced back to $26,600 yesterday, it quickly found a rebound to the current price level.

BTC PriceAt the time of writing, Bitcoin is floating around the $27,200 level, up 4% during the past seven days.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|