2023-5-13 14:58 |

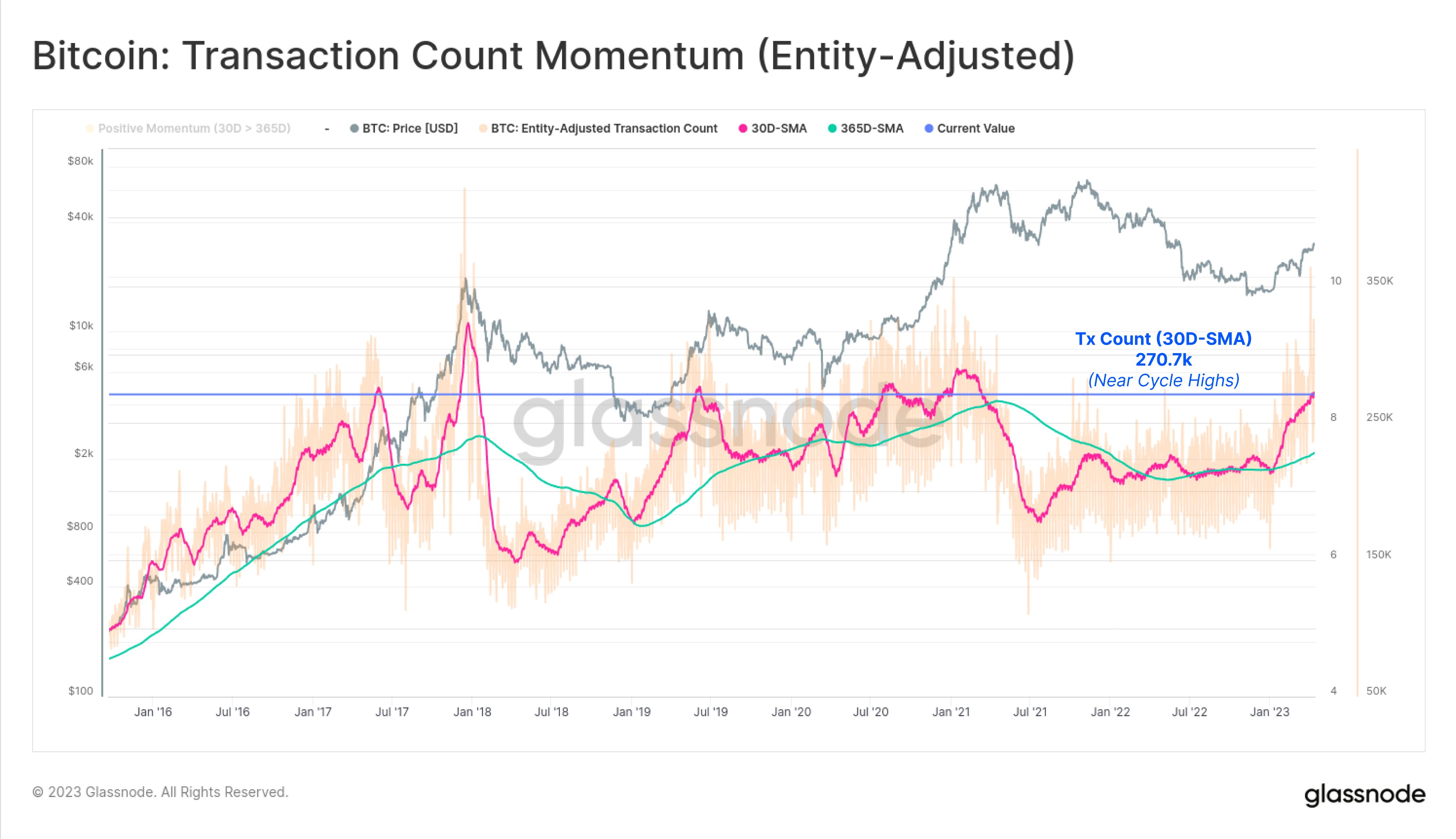

Bitcoin (BTC) has experienced downward price pressure in May, with the token failing to surpass the $30,000 resistance mark. This development could be linked to on-chain activities that indicate an increase in the number of Bitcoins sold on exchanges during this period.

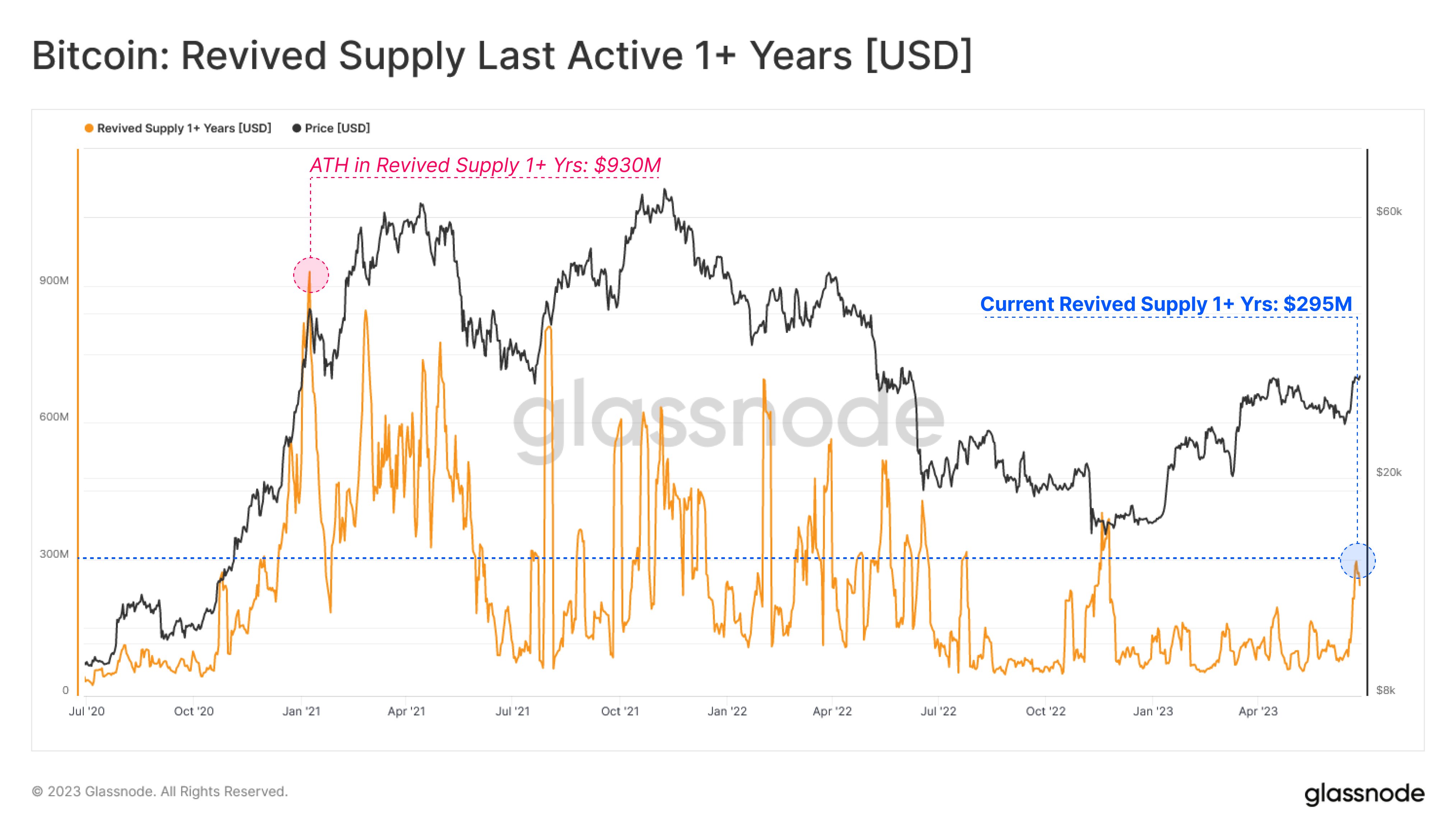

300,000 Bitcoin Sold On Exchanges In MayAccording to CryptoQuant, a data explorer, over 300,000 bitcoins purchased between one to six months ago have been sold this month. It is worth noting that the majority of these sales were made by individuals who acquired the cryptocurrency between November of last year and January of this year.

According to the data explorer, 266,000 bitcoins were purchased between November and January, while 78,000 bitcoins purchased between January and March were sold in May. The motivation behind these sales could be to take profits due to the significant price increase that Bitcoin has experienced since the investors purchased it.

From November to April, the price of Bitcoin rose from $16,000 to $31,000. However, since April, the cryptocurrency has been making lower highs, possibly due to the selling activity of these investors in May.

Related Reading: PEPE Attempts Market Rebound, Surges By 28% In 24 Hours

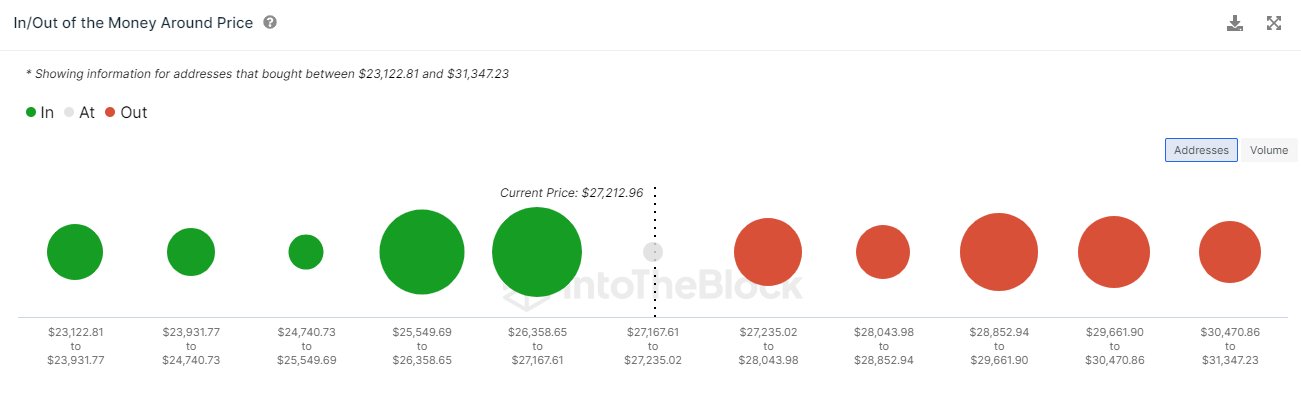

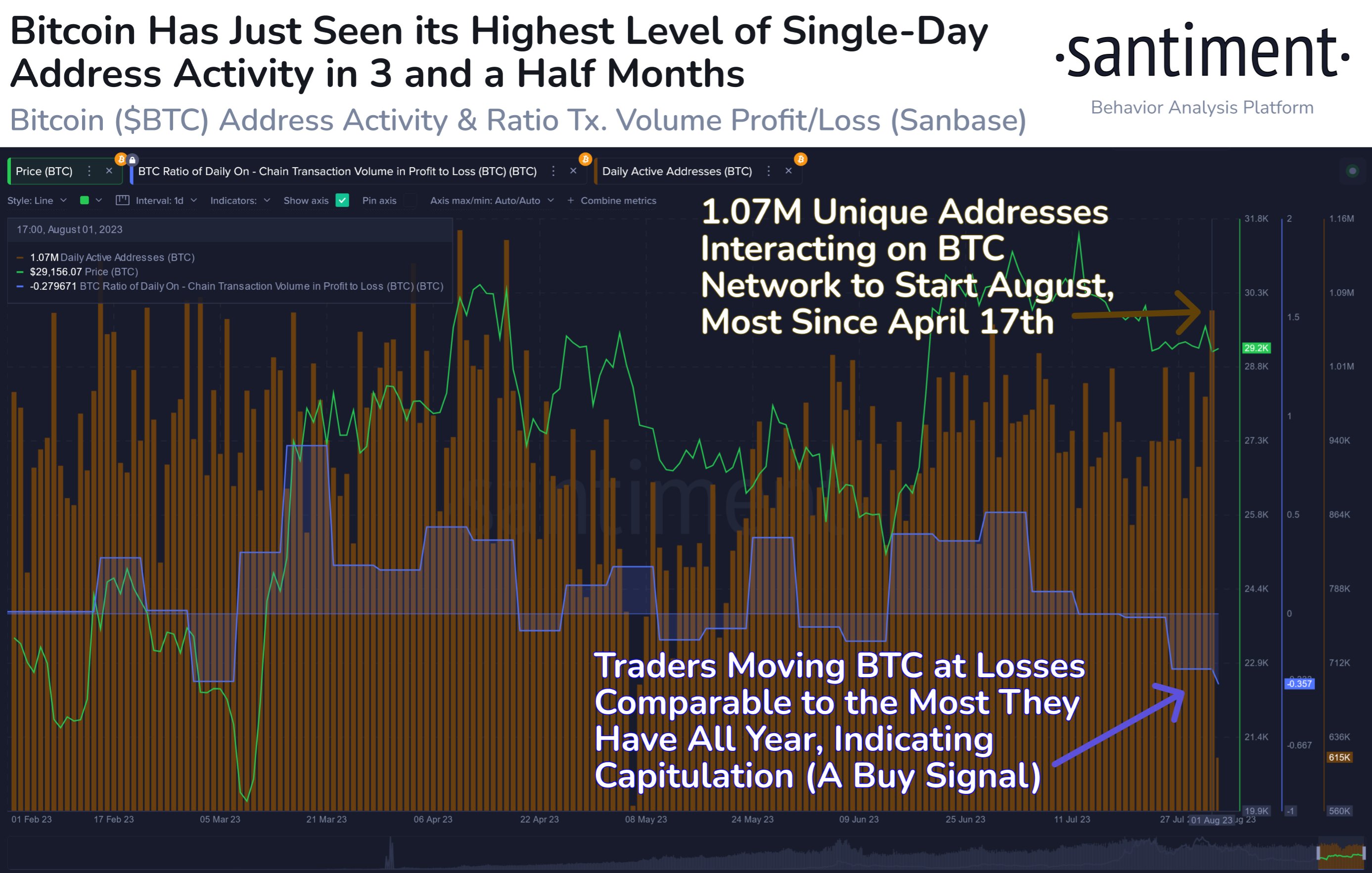

Bitcoin Shows Strength At Around $27,000Bitcoin’s price action in recent days was significant as it demonstrated the resilience of the cryptocurrency in the face of market volatility. As mentioned, Bitcoin had fallen to as low as $26,800 before quickly rebounding and testing support at its low of $27,000. This successful retest of support once again confirmed the strength of Bitcoin in this price zone.

The market’s high volatility yesterday can be attributed to the United States’ inflation report, which revealed a higher-than-expected increase in prices. Additionally, false rumors that the US government was selling Bitcoin caused bearish pressure on the market. Despite these events, Bitcoin held strong and was able to retest support.

Related Reading: Polkadot (DOT) Price: The Bear Vs. Bull Battle Continues – Who’ll Take The Beating?

Bitcoin has tested the support around $27,000 several times in the past two months and has formed a solid bottom. In addition, the Fear & Greed Index has declined, putting the market back into neutral territory. While this level is not necessarily bad when taken at face value, the fact that the index has declined from greed back to neutral is concerning.

Nevertheless, despite some analysts predicting that the cryptocurrency could fall to lower levels, it has not dropped below this price zone. This is a positive sign for investors as it shows that there is a strong demand for Bitcoin at this level. Bitcoin price has consolidated as the market seeks a new equilibrium after the recent price correction.

Bitcoin PriceAt the time of writing, Bitcoin is trading at $26,804 with a 24-hour price rise of 2%. It remains to be seen whether the token will make a renewed push toward the $30,000 resistance mark in the coming days.

-Featured image from iStock, charts from TradingView.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|