2024-3-29 01:00 |

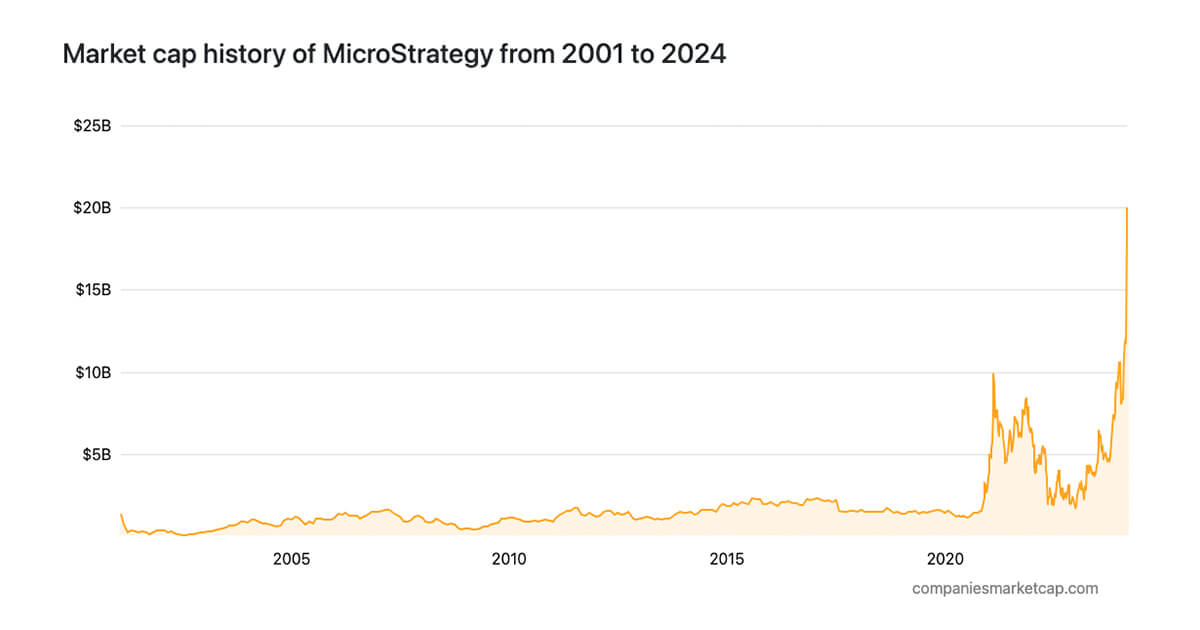

Kerrisdale Capital, a hedge fund, today disclosed a nuanced investment thesis: going long on Bitcoin while concurrently taking a short position on MicroStrategy shares. This move is predicated on the assessment that MicroStrategy, which has positioned itself as a de facto Bitcoin investment vehicle, is trading at a significantly unjustified premium to the underlying cryptocurrency that primarily constitutes its value.

Long Bitcoin, Short MSTRThe hedge fund’s analysis articulates, “Shares of MicroStrategy have soared amid a recent rise in the price of Bitcoin but, as is often the case with crypto, things have gotten carried away.” Kerrisdale highlights a critical discrepancy, noting that MicroStrategy’s stock price implies a BTC value of “over $177k, i.e., two and a half times the spot price of Bitcoin.”

Delving into the reasoning behind the premium on MicroStrategy’s shares, Kerrisdale debunks several arguments that have been made in favor of the company’s market valuation. The report categorically states, “None of the reasons commonly provided for MicroStrategy’s relative attractiveness justify paying well over double for the same coin.” This statement underscores the hedge fund’s stance on the overvaluation of MicroStrategy in relation to direct BTC exposure.

MicroStrategy, under CEO Michael Saylor’s leadership since 1989, has aggressively pursued BTC accumulation, making it a central pillar of its investment strategy. From August 2020 to 2023, the company made significant financial maneuvers to increase its holdings, which now exceed 214,000 BTC.

Kerrisdale’s valuation approach considers MicroStrategy’s enterprise software business and its BTC reserves. The analysis concludes that the software business, while still operational, “no longer contributes meaningful value to the overall enterprise,” spotlighting the overwhelming influence of Bitcoin on the company’s valuation.

A key aspect of Kerrisdale’s critique focuses on the inflated premium over Net Asset Value (NAV) attributed to MicroStrategy’s shares. “At 2.6x, MicroStrategy’s equity premium is exceptionally high,” the report states, suggesting an unsustainable market position relative to historical data. Kerrisdale argues that a correction towards a more historically consistent premium would imply a substantial downside for MicroStrategy’s stock relative to Bitcoin’s performance.

The report thoroughly examines the potential implications of MicroStrategy’s financial strategy, including its reliance on leverage and the dilutive effects of its financing mechanisms. Kerrisdale’s analysis suggests that while MicroStrategy’s aggressive capital market activities have succeeded in increasing its Bitcoin holdings, they have simultaneously led to a stagnation in the amount of Bitcoin per share, due to the dilutive impact of debt financing and equity offerings.

Concluding, Kerrisdale Capital estimates that “assuming the current premium of 2.6x contracts to a more historically consistent 1.3x represents 50% downside in MSTR relative to bitcoin.” This conclusion is drawn from an examination of the interplay between MicroStrategy’s stock premium, its Bitcoin holdings, and the broader market dynamics.

The reactions from the community were rather critical. Bit Paine (@BitPaine) commented, “Are you selling advance tickets to your funeral?”. Another crypto analyst, Trey Sellers (@ts_hodl), stated, “Seems like a logical position to me, although markets can remain irrational longer than you can stay solvent, as they say.”

OSF (@osf_rekt) added, “There is probably nothing more dumb than publishing your mid-curve trade idea to an army of irrational degens who will make it their life mission to liquidate you.”

At press time, BTC traded at $71,519.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|