2024-7-23 01:48 |

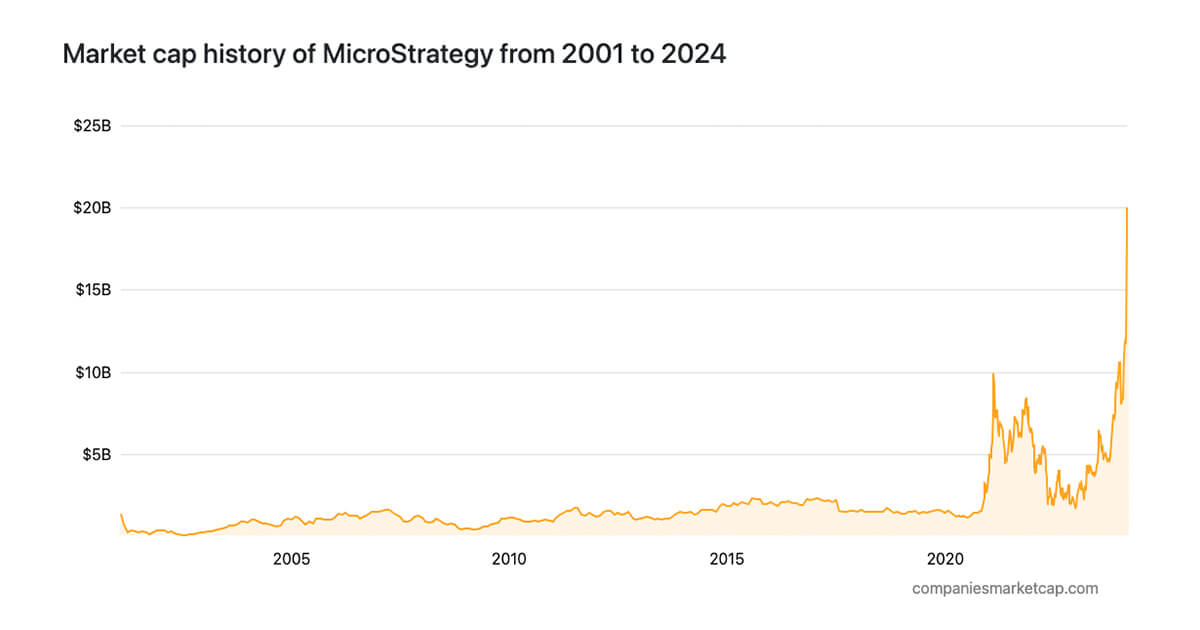

MicroStrategy’s stock outperformed major tech stocks due to its significant Bitcoin holdings, surging 15% recently. Since the start of 2024, MicroStrategy’s stock price has risen by 135%, driven by Bitcoin’s rally. The company announced a 10-for-1 stock split to make shares more accessible, effective August 1. Michael Saylor attributes MicroStrategy’s success to its aggressive Bitcoin acquisition, holding 226,331 Bitcoin worth $7.538 billion.

MicroStrategy, led by Michael Saylor, has recently gained significant attention for its aggressive Bitcoin investment strategy, resulting in remarkable financial returns. As of July 17, 2024, MicroStrategy’s stock has outperformed major tech giants like Tesla, Nvidia, and Microsoft, primarily due to its substantial Bitcoin holdings. As such, its stock price mimics Bitcoin’s movement and has rallied from recent lows of $1,207 to close at $1,794 as of COB today. Its most recent rally is in tandem with Bitcoin’s from $53,500 around the same period to $67,605 as of writing.

MicroStrategy’s strategic Bitcoin accumulation as a core reserve asset has proven exceptionally lucrative. The company holds 226,331 Bitcoin, valued at approximately $7.54 billion. This substantial holding has driven a 1,203% surge in MicroStrategy’s share price since August 10, 2020, outperforming Nvidia’s 1,050% and Tesla’s 167% gains over the same period. The company’s impressive growth trajectory has continued in 2024, with a 135% increase in share price year-to-date, compared to Bitcoin’s 44% rise.

A key aspect of MicroStrategy’s success is its ability to raise funds through debt offerings to purchase more Bitcoin. In June 2024, the company expanded a debt offering from $500 million to $700 million to fuel additional Bitcoin acquisitions. This strategy has paid off, as evidenced by the company’s stock performance and the growing value of its Bitcoin holdings.

Michael Saylor has been vocal about the benefits of adopting a Bitcoin standard. He recently tweeted a chart highlighting MicroStrategy’s 1,203% share price surge since adopting Bitcoin, urging other companies to consider a similar approach. Saylor’s firm belief in Bitcoin’s potential is evident in his continuous advocacy for the cryptocurrency as a superior asset.

MicroStrategy’s recent 10-for-1 stock split, scheduled for August 1, is another strategic move to broaden its investor base. This action aims to make MSTR shares more accessible and affordable, potentially attracting more investors to benefit from the company’s Bitcoin-centric strategy. The company’s performance and Michael Saylor’s strong stance on Bitcoin highlight the transformative potential of integrating cryptocurrency into corporate strategies. Companies like MicroStrategy continue to set a precedent for leveraging digital assets to drive growth and shareholder value as the market evolves.

The post MicroStrategy’s stock performance soars amid Bitcoin rally appeared first on CoinJournal.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|