2020-9-10 15:30 |

Coinspeaker

Events Show That Bitcoin (BTC), Gold and S&P 500 Are Positively Correlated

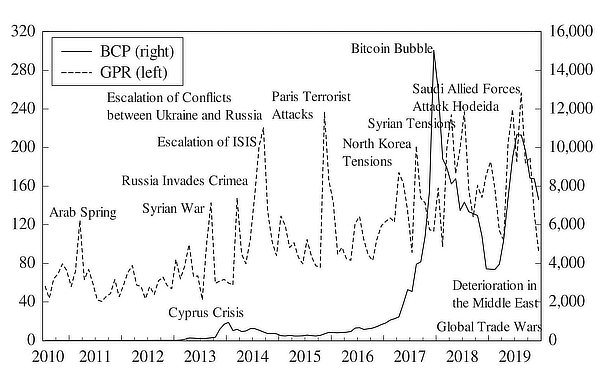

Recent events across markets and among investors have shown that Bitcoin (BTC), gold, and the S&P 500 index have a close correlation. The past months have stirred different events that have tumbled the world of finance and investment, with the coronavirus pandemic serving as the main factor stirring the events.

With the coronavirus pandemic, governments had to step up measures to prevent the spread of the disease. These measures resulted in border lockdowns, straining the global supply chain. Most countries also enacted a stay at home order which led to the lockdown of local businesses. In all, the money supply plunged below sustainable levels and governments had to look for ways to remedy the situation.

One of the ways economic powerhouses like the United States adopted was to print more money to use as a palliative measure for businesses and households. The resultant effect of such measures is in stirring the devaluation of the U.S. dollar.

Consequent to this, the U.S. currency is depreciating, and the Federal Reserve recently made its intention known through Chairman Jerome Powell to let inflation rise above the 2% annual benchmark. The implication of this is that as time passes, people cannot buy the same assets with the same amount of money, a situation that has revealed the potential of bitcoin (BTC) and Gold as a reserve or hedge asset.

Perceived Correlation in BTC, Gold and S&P 500With increasing interest in gold over the past months, the price of the asset has soared, setting a new record above $2,000 in early August. While always being regarded as the perfect hedge against inflation, investors are also beginning to appreciate the potentials of Bitcoin and this has also led to the increase in Bitcoin price in correlation to that of gold.

As noted, the record correlation between Bitcoin and gold indicates investors don’t really see a difference between the two, as they behave the same and serve the same purpose as stores of value. As Coinpeaker reported back in March at the early stages of the coronavirus induced lockdowns, that Bitcoin and the S&P 500 are perfectly correlated probably as a result of what they both have in common-the American retail investors and corporation bosses. The correlation of the Bitcoin with the S&P 500 was also noted in June.

The investors who pump money buying stocks are beginning to see Bitcoin not just as a means to hedge their funds, but as a viable way to grow their funds over time as key crypto figures have consistently projected Bitcoin price surge.

The correlations between BTC, gold, and the stock market have given credence to the actions of investors. The correlation indicates the move investors employ to diversify their investment portfolio.

Events Show That Bitcoin (BTC), Gold and S&P 500 Are Positively Correlated

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|