2019-7-6 13:00 |

For the last two years, analysts have debated whether the stock market’s performance positively or negatively impacts Bitcoin price action. While this debate is bound to continue, the S&P 500 recently reached a new all-time high and analysts are now wondering whether Bitcoin will follow suit.

Will Bitcoin Price Continue its Parabolic Move?On July 5th crypto analyst Alessio Rastani pointed out that the S&P 500 recently notched a new all-time high and Rastani expects the index will pull back slightly below 2950 before rebounding significantly higher above 3000.

In order for this scenario to play out, the S&P 500 needs to remain above the 2950 – 2930 support.

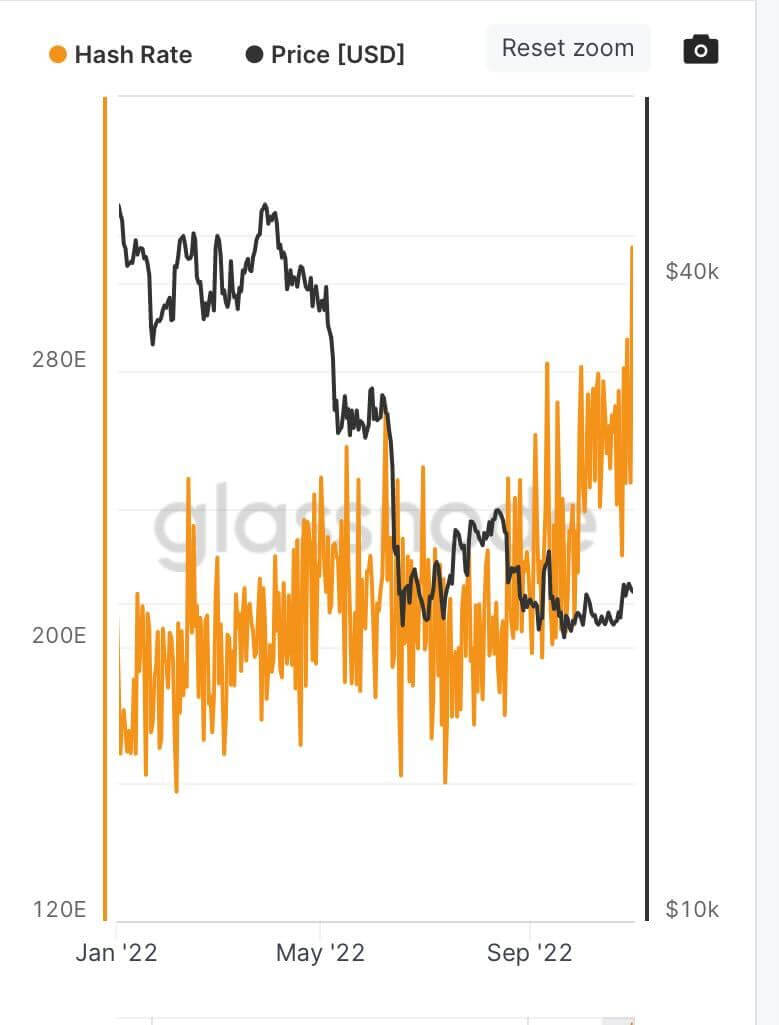

As the stock market rallies to successive all-time highs, Bitcoin price continues to march upward and the digital asset has successfully remained above the 21 daily moving average (DMA). Rastani pointed out that since February 2019, Bitcoin price has bounced off the 21 DMA 7 times.

Bitcoin-USD Daily Chart with 21 DMABitcoin price-USD daily chart from Alessio Rastani’s YouTube channel

This useful tidbit of knowledge will allow more relaxed traders to stay in their long positions by just observing Bitcoin’s price action on the daily chart and over the short-term traders could remain calm until Bitcoin price drops and closes below the 21 DMA which would be a strong bearish signal.

Is it a Bull or a Bear?Popular crypto analyst Josh Rager also makes a similar case in which Bitcoin price could see a bullish continuation on toward the recent 2019 all-time high if it successfully closes above $11,967.

Rager also highlights the potential bearish scenario by pointing out that recently Bitcoin has made lower highs and lower lows and failure to close above $11,967 could lead to a new lower low in the $9,100 region.

Fortunately, Rager is on the side of bulls and believes that the bullish outcome is more likely than the aforementioned bearish scenario.

Rager suggests that the most ideal scenario would be for Bitcoin price to “create a new higher-high and then break the $12,300 daily resistance followed by a retest of the yearly high at $13,800+.”

At the time of writing, Bitcoin has pulled back slightly from $11,640 to trade near $11,400. The MACD on the 4-hour BTC-USD chart is on the verge of a bullish cross and the RSI is slowly climbing above 51. The recent strong 4-hour close also brought BTC above the mid-arm of the Bollinger Band indicator but an increase in buy volume is required in order for Bitcoin to cross above $12,000.

Do you think investors will turn bearish or see a bullish continuation in Bitcoin price? Share your thoughts in the comments below!

Images via Shutterstock, Alessio Rastani, Josh Rager, Coveware.com,

The post Bitcoin Price Could Mirror S&P 500 To Reach New 2019 High appeared first on Bitcoinist.com.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|